Arbitrage Machines

Monday 25 March 2019

The economics of storage are improving rapidly. A common error when conceptualizing future storage requirements is to imagine we must solve the problem of wind and solar intermittency with a massive woosh! of fixed site storage that fully matches large blocks of demand, over sustained periods of time. This framing is similar to a highway engineering approach to traffic demand, which focuses on peak throughput and accordingly proposes the construction of surplus, redundant capacity. But storage is fated to proceed along a very different, evolutionary pathway. Now appearing at the margin, storage is making its initial entry as a market arbitrage solution, offering owners of storage capacity the option to buy electricity when prices are low, and sell when prices are higher. This is why the largest electricity utility in Arizona, APS, has decided to build storage instead of new power generation, because it’s able to feast on cheap surplus wind and solar generation from neighboring California.

Now comes a different Western utility, Rocky Mountain Power, with a plan to variously incorporate storage and EV charging capabilities into the construction of multi-family housing and intermodal transportation facilities in the state of Utah. You will recall from the last Gregor Letter that Utah is one of 18 US states now deriving at least 10% of its power from some combination of wind and solar. Unsurprisingly, Rocky Mountain Power (RMP) cites the ability to take to take solar supply in Utah and capture it, in battery storage. While we can’t know the internal calculations RMP is using, their initiative is conclusive of a simple idea: storage is increasingly a value-add capability that can be incorporated into myriad settings, that offers a plausible return-on-investment to the owner. Storage is an arbitrage machine.

I would note that a few years ago, when engaged in some consulting to a large, West coast real estate development company, I both speculated and suggested that incorporating storage into new office and residential buildings would create an additional income stream. In the time that’s passed, many analysts have both fretted and over-focused, meanwhile, on the “high cost” of storage not realizing that it would be the falling cost of wind and solar generation itself that would drive the economics of storage. Indeed, I’ve suggested recently that cheap, surplus power from new wind and solar—wreaking temporary havoc on powergrid economics—is not a bad thing but good thing; exactly what you need to drive the development of storage.

Complaining that wind and solar will create problematic, deflationary effects today is not unlike complaining that oil was too cheap, during the 1930’s. This is how adoption happens.

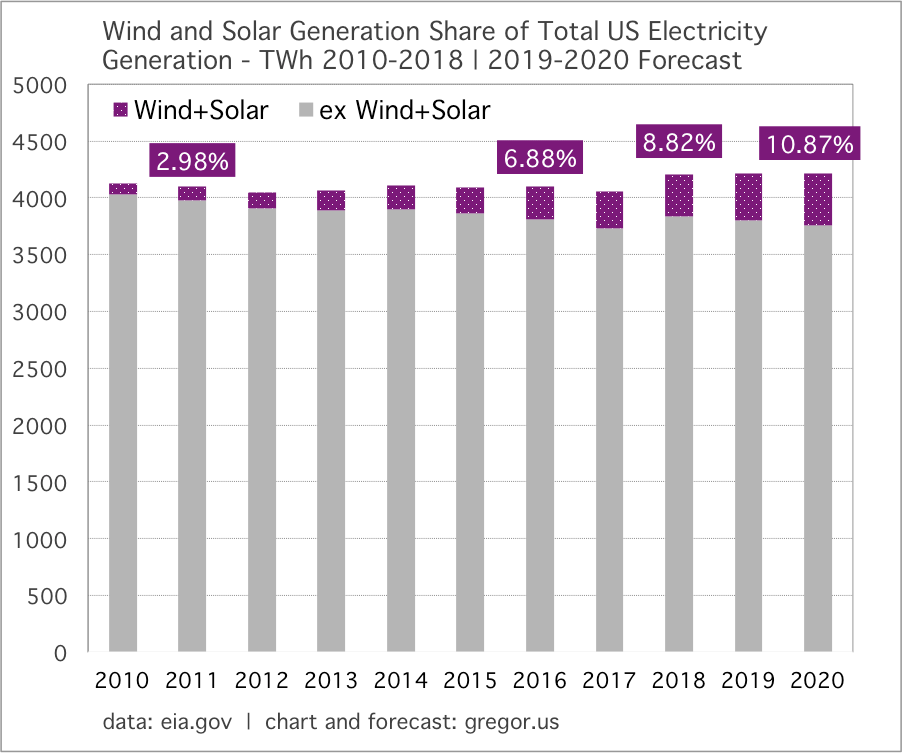

New nuclear might be a good thing too—and we should probably build some—even though wind and solar are now much faster to deploy. During 2018 in the United States enough new wind and solar was constructed to generate 39.5 TWh of electricity. That’s a slowdown from 2017 and 2016, when a fresh 49.7 TWh and 52.1 TWh respectively were created, but these annual additions still represent about 1% of total US electricity demand at roughly 4000 TWh per year. This is fast. Additions of 40-50 new terawatt hours of generation far exceeds deployment rate estimates from just a decade ago.

The prospect of new nuclear therefore now faces not one, but two hurdles. With a negative learning rate, nuclear power—already expensive—never gets cheaper. So nuclear both here and elsewhere in the world has fully lost the cost argument. More challenging is that nuclear has now lost the climate-solution argument. If India can build 0.648 GW utility scale solar plant in less than a year, and if the United Kingdom can transform its power grid in less than a decade, killing coal, and taking combined wind+solar from 2.5% to over 18% of its total electricity, then the longstanding argument that only nuclear can quickly decarbonize power systems has considerably weakened.

And yet. Ironically, it may be the very real success of wind and solar deployment that opens up a better argument for nuclear: as marginal amplifier, to make current progress move even faster. Here, we see that the cost argument has two sides. Yes, nuclear is now the most expensive new generation out there, and its ROI is second-rate, given its long construction timelines. But so what? As estimates of future climate-change damage ratchet upward, we should care less about up front price tags and more about outcomes that bear heavy losses. Moreover, although combined wind and solar are now moving very rapidly, and even with storage solutions also now emerging, in many domains the gaps in needed supply are being furnished by new natural gas. And natural gas, while far better than coal, will stand as a new emissions barrier in the years ahead.

Accordingly, I now believe we should build some new nuclear. Not alot, but some. It doesn’t matter how much it costs, and it doesn’t matter that it may take ten years to build. If so many climate analysts are now in agreement we’ve got about 10-12 years to substantially re-direct the current growth path of emissions, then having a new population of nuclear capacity arriving at the margin, next decade, would be greatly supportive of the much larger wave of new wind and solar and storage.

The largest nuclear power station in the United States, Palo Verde in Arizona, produces about 32 TWh of electricity each year. Combined wind and solar in the whole of the United States produced 371 TWh of electricity last year, after a fresh 39.5 TWh addition. So nuclear isn’t going to win any races. But in population dense regions, like the US East Coast where an offshore wind industry is now just getting underway, natural gas continues to provide not only the bulk of new supply but also enjoys an embedded dependency. As the Americas editor of PV magazine points out, it may now make sense to build some new nuclear in such regions. Here, decarbonization is simply not moving fast enough, and there is simply too much density and surety of future demand to not consider a different approach. In short, a number of regions around the world need to make a choice: if you are serious about climate change, either step aside quickly and let the rapid scaling of wind and solar work its magic, or, do the same for nuclear. But at least recognize that advocating for wind and solar (and storage) simply doesn’t work, operationally, if its merely a way to signal preferences.

When the EIA publishes long-term projections it confuses both the lay public, and also energy professionals. This was especially true last week, when the EIA projected that recent reductions in US emissions were about to convert to a sustained, long-term flatline. For the public, such a press release amounts to a prediction. Energy professionals, meanwhile, assume the EIA is attempting to produce instead a projection—one that proceeds from time-present, based on current trends, technologies, and costs. After all, that’s the claim EIA makes.

But it’s simply no longer true. There is nothing in current trends, technologies, or costs that would support a sudden end to the very real 13% emissions decline which has already occurred in the US, since the peak in 2007. Close examination of the constituent parts of the EIA projection also reveal its implausibility. The US coal fleet, for example, was largely built after WW2 and, now at the end of its lifecycle, is rapidly being retired. Coal-share of US electricity has fallen from 50% towards 25% in ten years. And yet, in the EIA projection, that trend now halts, and does not move forward. (The explanation is almost too strange to believe: The EIA agrees coal retirements will continue, but coal’s share of electricity is stable because capacity at existing plants is increased.)

The EIA’s conclusion therefore, that US emissions in the year 2050 will be just 4% below 2018 levels, does not in any way follow from its claim that this projection “reflects no changes to current laws and regulations and extends current trends in technology…” Declining emissions in the whole of the OECD have been going on for a decade, or more, and began even before the ascent of decarbonization in powergrids, as regulations on vehicle emissions, and the economics of efficiency programs across industrial and residential sectors, have accelerated. To claim this progress now enters a 30 year hiatus simply doesn’t match the claim of the projection, that it “extends current trends in technology.”

The EIA has understandably been taken to task for such projections. In an early 2018 PV Magazine story, Rice University’s Daniel Cohan began to notice the EIA was not even incorporating realistic present day prices for wind and solar. More recently, other analysts see in the most recent 2019 outlook that EIA has made an effort to improve. But anomalies—again, which couldn’t possibly proceed from present trends—are still legion. Wind power deployment essentially halts after 2020, for example, because of the expiration of subsidies? What nonsense. Wind power is in the midst of a second great run, which has now seen costs fall and efficiencies soar as larger turbines are deployed and construction techniques for offshore wind are further optimized.

At turning points, even the best analysts can get caught out. It’s obvious the EIA, more than most, is crippled by today’s rapid change. Because these EIA “projections” are no longer plausible, and no longer useful, to continue releasing them simply pollutes the conversation.

Wind and solar reached 8.8% of US electricity generation last year. In a system that used a total of 4207 TWh, combined wind and solar contributed 371 TWh. In the next two years, I’m forecasting that wind and solar’s share will reach 9.8% this year, and 10.9% by the end of 2020.

For those of you who’ve read Oil Fall, you will know that most of the world’s major regions, from the US to Europe to China, are all on course to see combined wind and solar cross the 10% mark by next year—if they haven’t crossed that mark already. The two technologies represent, therefore, the marginal electricity supply that will power the newly emerging fleet of electric vehicles.

The EV epiphany appears to have landed in the German auto industry. When Volkswagen, deeply shaken by its emissions scandal, announced last year it would proceed with a fully committed EV program, it apparently made investors nervous that VW was undertaking such a large shift in corporate strategy. But that was last year, before it was clear the EV takeoff moment had fully arrived. Now, in 2019, the same change in perspective has taken hold more broadly, in the German car industry. As reported by Auke Hoekstra, a researcher at the Eindhoven Institute of Technology in the Hague, the league of carmakers now agrees that EV must now be the central, corporate strategy of the industry.

Accordingly, this now leaves the US auto industry as the odd man out, as China and Europe see just one path forward. This is sad, and frustrating. Current US industrial policy is already in a shambles, as the government pursues 18th century tariff schemes, while the President harangues GM for closing a plant that produced gasoline power sedans nobody wants to buy. Indeed, the US auto industry has already ceded nearly the entirety of the domestic EV market to Tesla. Now, as we prepare to head past 2020, it’s inevitable the US industry will be playing defense and catch-up, as wave after wave of foreign-designed EV arrive.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.