Chartfest

Monday 30 December 2019

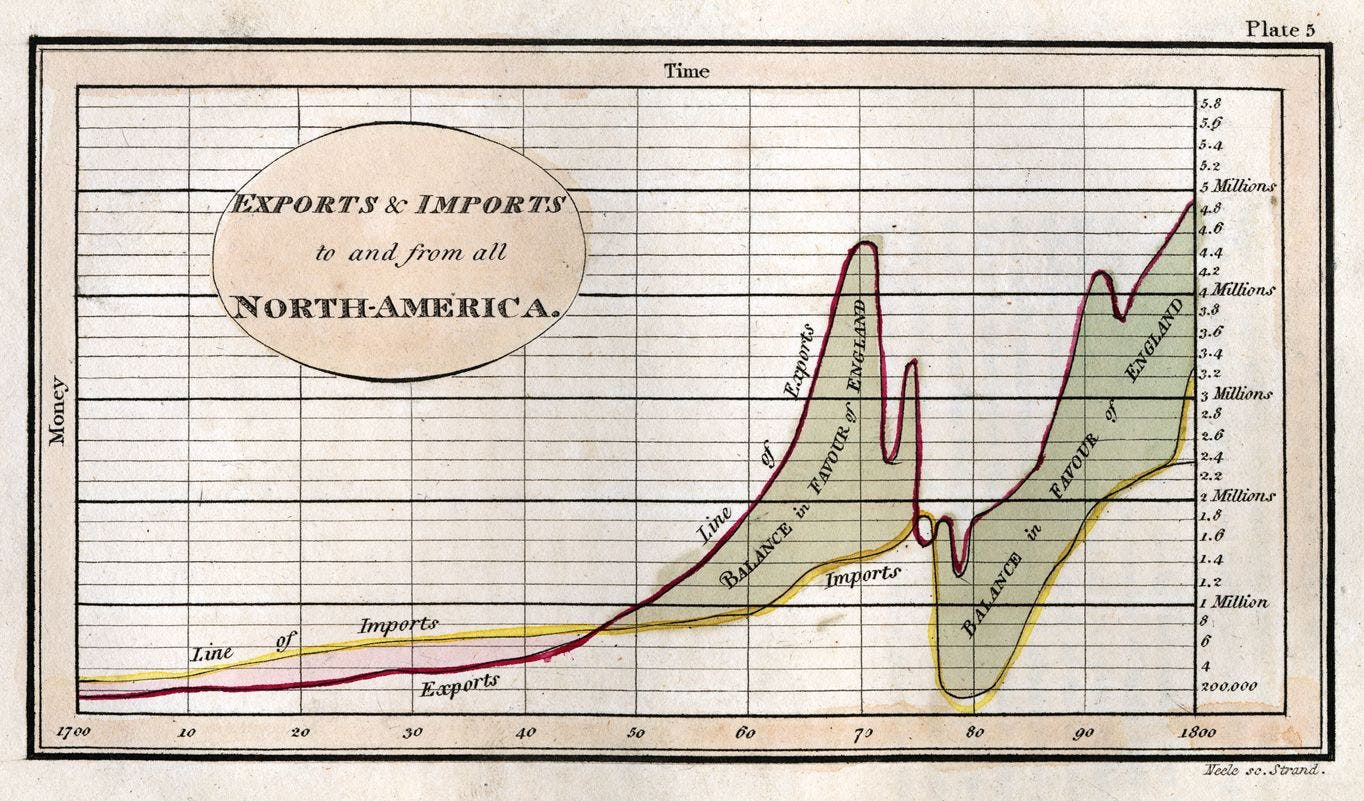

(18th C. chart of trade between the US and England, in millions, 1700 - 1800)

Combined wind and solar will nearly reach a 10% share of US electricity production in 2019. While the rate of growth has slowed in the last two years, commercial rooftop solar, utility scale solar, and a new growth spurt in wind power will see total deployment accelerate again in the new decade. | data current through October 2019.

US power generation from coal is on track to fall to levels last seen 50 years ago, in 1978. The US is now tracing out the super-decline of coal seen in the UK, in which coal for electricity eventually falls to zero. Policy is no longer the main driver of the retirements. Utilities are instead running sophisticated modeling programs which are spitting out the same answer: shutter all the coal, and replace capacity with an array of natural gas, wind, solar, storage, and demand-side management. In a total system that produces more than 4000 TWh, coal’s share will likely dip just below 1000 TWh, having been cut in half in just a decade. | data current through October 2019.

Global power generation from coal is expected to fall rather hard, by over 3% in 2019. While total global coal consumption for all applications peaked back in 2013, coal-burn for electricity has kept growing. That’s expected to come to an abrupt halt in 2019, and frankly it’s not clear where we go from here. Does spare capacity in China continue to rear its head in the next few years, or, does wind, solar, and natural gas finally arrest the growth? It’s impressive already that combined wind and solar globally will reach above 2100 TWh this year. | data current through December 2018

California gasoline consumption is on track to fall by 1.8% in 2019, after a statistically insignificant decline of 0.3% last year. At the state level, we operate without current census data on population or vehicle-miles-travelled data. That said, factors in the decline of petrol consumption range from adoption of EV to the unbundling of transportation more generally in short-trips, now taken up by everything from public rail transit to micro-mobility electrics. It is expected that California will lose a single congressional seat after the 2020 census, as the population growth rate in other large states outpaces its slowdown. Moreover, it should be mentioned that gasoline tax increases continue in the Golden State, and all incentives are tipping away from ICE vehicles towards EV. It’s a safe bet that gasoline consumption in California has peaked for good—but, as in other domains, this does not mean a rapid decline is imminent. | data current through September 2019.

US gasoline consumption failed to make progress for third year. US auto sales and sales of ICE vehicles peaked in 2016—as did US gasoline consumption. The declines since then are exceedingly small. But like California, US gasoline consumption has now likely peaked for the last time. It’s not just the advent of EV capping petrol consumption growth. The rise of electrics are chewing their way through the rich underbelly of short-trips in suburban areas across the country. All this said, beware forecasts of any rapid decline in gasoline consumption. We are on a plateau for now; though admittedly when the break finally comes it could be pronounced. | data current through November 2019.

Global motor gasoline is expected to rise by just 1.1% in 2019, according to the IEA. Closer examination of the IEA’s forecast however indicates anomalously high estimates of China road fuel consumption, so as with most IEA forecasts one should favor downward revisions in the months ahead. To the IEA’s credit, they are forecasting a year of near no-growth next year in gasoline use, with a projected increase of just 0.2%. The driver of these trends globally is similar to the same array of factors seen here, in the US. But most notably is the meaningful decline in the sales of ICE vehicles in China, the world’s largest vehicle market. Mind you, sales growth of EV this year is super slow—barely positive in most markets. This has taken a tiny amount of pressure off ICE sales. But the picture is still bleak for ICE, with sales falling into outright decline in most markets. In China, ICE sales are falling particularly hard, from a peak over 28 million to around 24 million this year. (The data is currently quite volatile month to month as sales of ICE and EV reflect rapid changes in China’s car market, and economy.) Needless to say, ICE sales in China—as in other markets like Europe, and California—have now peaked. | data current through November 2019.

The US has become energy independent, on a net basis. The United States in recent years has seen its consumption of energy flatten, even as population and GDP grows. At the same time, domestic production of oil, associated petroleum products, natural gas, wind, and solar has grown so quickly that after tallying up imports, exports, and consumption, the US energy balance sheet has now tipped into surplus. The structural trend change became obvious years ago. Still, it’s amazing to witness. While the US is still an importer of crude oil, the balance sheet is going to move further into surplus as we move through the next decade. That is, of course, until foreign demand for exported fossil fuels begins to wane. In the chart below, you could say, the red has turned to black. | data current through September 2019.

Total public construction spending per capita stopped growing a decade ago. Intuitively, it may strike some as normal that spending would level off—if one assumed the US merely had to maintain a large inventory of functional infrastructure. Alas, that is not the case. The US remains in a severe, ahistorical infrastructure deficit with schools, subways, water systems, port and intermodal arrays, and powergrid(s) in need of full replacement. It has been 70 years since the last big round of public investment—and it shows. | data current through December 2018.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.