Damaged by the restrictive policies of Premier Xi, China’s economy continues to slow. GDP growth in the second quarter of this year came in at an extremely low 0.8%, extending a multi-year post-pandemic period in which growth never really recovered sustainably despite a one year bounce in 2021. China used to grow at very high rates of 6.0%-8.0% per year. Economists now think China risks failing to achieve 5.0% in 2023. International investment flows also reveal a declining lack of interest in sending capital to work in China. The failure to launch has frustrated macro observers and commodity traders in particular who expected China’s comeback to drive prices of oil and industrial metals much higher.

At the same time, China’s adoption of electric vehicles and clean power is running at the very high rate we more typically associate with China’s historical growth. Forecasters now predict the country’s petrol demand will peak sooner than expected, by next year, as sales of internal-combustion engine (ICE) vehicles continue to be crushed by the EV tidal wave. China’s solar growth, in particular, is completely off the hook and the country is expected in 2023 to deploy more new capacity in one year (157 GW) than the total solar capacity of the US (113 GW at year end 2022).

If you are surprised to learn that China road fuel is near a peak, consider that China’s total mix of new EV, aging ICE, and the year in which ICE sales peaked, is starting to line up with California—the first region in the US to actually experience a decline in gasoline demand after many years stuck on a plateau. California ICE sales peaked in 2015. In China, 2017. California EV sales are on pace to reach 21% market share this year. In China, EV are on pace to reach a 28% market share. Interestingly, as recently as 2019, California’s EV market share was higher, at 6.7% vs China’s 5.4%.

Notice how China’s slowdown has seemingly capped annual vehicle sales on a total basis around the 26 million unit level, again leaving all marginal growth to EV. The effect is amplified however because total sales have actually fallen from the highs last decade, while at the same time EV sales have soared from 1.2 million in 2019 to 7.5 million (expected) this year.

The Gregor Letter frequently points out that declines do not follow peaks as quickly as most assume. But in the case of China, with ICE sales now starting to collapse, it’s actually possible that next year’s peak in petrol demand may indeed convert more quickly to a decline. While it’s certainly not intentional, the contours of China’s economy right now are what you might get under a policy of moderate de-growth: one that suppresses consumption and output, but keeps the pedal to the metal on decarbonization.

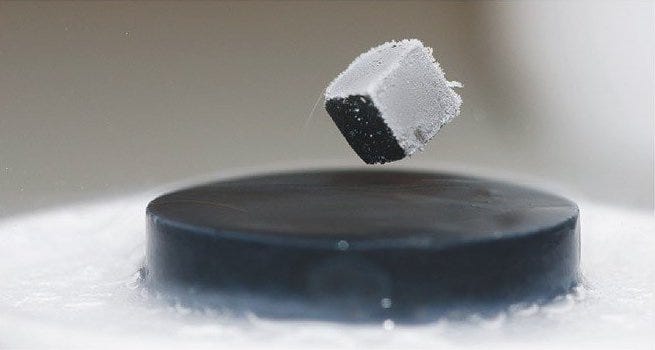

We’re waiting to learn if the recently announced advance in superconductivity, the synthetic substance known as LK-99, is real. Named after Sukbae Lee and Ji-Hoon Kim, LK-99 would be transformational in myriad applications, from transportation to power transmission, if the claim that it’s operational at room temperature can be proven. Presently, superconductivity can only be achieved at extreme low temperatures, making broad deployment basically impossible. A breakthrough would also have positive implications for the development of quantum computing.

Most tech and business publications are covering the story, from The Verge to Scientific American. Unsurprisingly, the US Department of Energy also maintains a superconductivity explainer page. Teams around the world are understandably busy, racing even, as they try to replicate the findings. Results so far are mixed, at best.

Inflation is falling and the US economy is booming as the nation embarks on a course correction to an ongoing, forty year error. Because tax cuts and deregulation were so successful in the early 1980’s, it set up an expectation this formula could be called upon repeatedly in the future, to goose the economy. The thesis was partly right: tax cuts did continue to goose the economy, but with increasingly diminishing returns. By the time we got into the current century, the US needed an entirely different set of policies: mainly, detaching healthcare from employment (partly accomplished during the Obama administration) and now the domestic investment boom that’s drawing in foreign money too, in a kind of multiplier effect. When President Biden remarked on Twitter last week that CEO’s told him that “for them to invest, they needed to see the US government invest,” he was exactly right. Foreign and domestic investors have been waiting decades for the US government to kick start long overdue investment, especially in infrastructure, to which they could join. This is clearly part of the reason why a year’s worth of rate hikes from the Federal Reserve, which have started to suppress housing and consumption, have had less of an effect on employment in the aggregate. The recession everyone expected never arrived, and perhaps it won’t—anytime soon. With several lines of investment, each stretching out for a decade or more, it’s possible the US has engineered for itself an ongoing, countercyclical growth component that will press onward, recession or not. I don’t know about you, but if the US government is going to “spend money” it seems better to use that money to build useful things, keeping unemployment low, especially if it attracts other capital. We are not repeating the mistake, therefore, of the aftermath of the great recession, when we slumped for too long, nearly entered another recession in 2011, and spent alot of money on social safety net programs. This time around, we’re getting right back on the long term growth path. What’s not to like?

Batteries are the wall that locks into place surging new generation from wind and solar. The Gregor Letter has previously made the point that sometime around 2018-2019, high growth domains for wind and solar (like Europe and California, and the UK especially) really needed to shift their focus to storage, having already built a ton of new wind and solar. Well, we’re finally starting to make some headway.

CAISO, the California grid operator, reports that at the half-year mark the state was sitting on 5,240 MW of storage (opens to PDF), and of course this continues to grow.

Separately, we’ve got some frontline indicators from the market itself that rooftop solar installations are increasingly paired with batteries. This mirrors trend spotting already done by the EIA, as they noted starting several years ago that utility scale wind and solar projects were also starting to trend in the same direction.

We should also acknowledge in this discussion that natural gas—though it is a problem on the macro level—is in fact an assistant to the buildout of wind and solar when new natural-gas power capacity is built or utilized as a gap-fill solution around intermittency. Yes, this means that some moderate share of global power in the future will be met by natural gas. But, it should be pointed out that on-call natgas power helps enable wind and solar to get to very high levels of penetration.

If we skate to where the hockey-puck is going, however, it’s probably the case that battery storage technology will deliver the following: 1. lower and lower cost per MW. 2. longer and longer duration. The sightlines don’t have to be stretched out too far on storage’s future capabilities to see, therefore, that batteries will also eventually shut-down natural gas growth. If iron-air technology for example, which will be deployed first in Minnesota and Colorado, does live up to its 100 hour promise, then the opportunities for a natgas power installation that also acts like a battery (comes online for short bursts, an hour or two, then goes back to sleep) will narrow quickly.

The astonishing growth rates still being achieved in wind and solar should also help us understand that both clean sources are really just commodities. Blades will get bigger, panels will capture more sunlight, and their costs will fall. It’s storage where all the value is going to stack up, especially since it’s storage that can benefit most from algorithmic, software-led optimization.

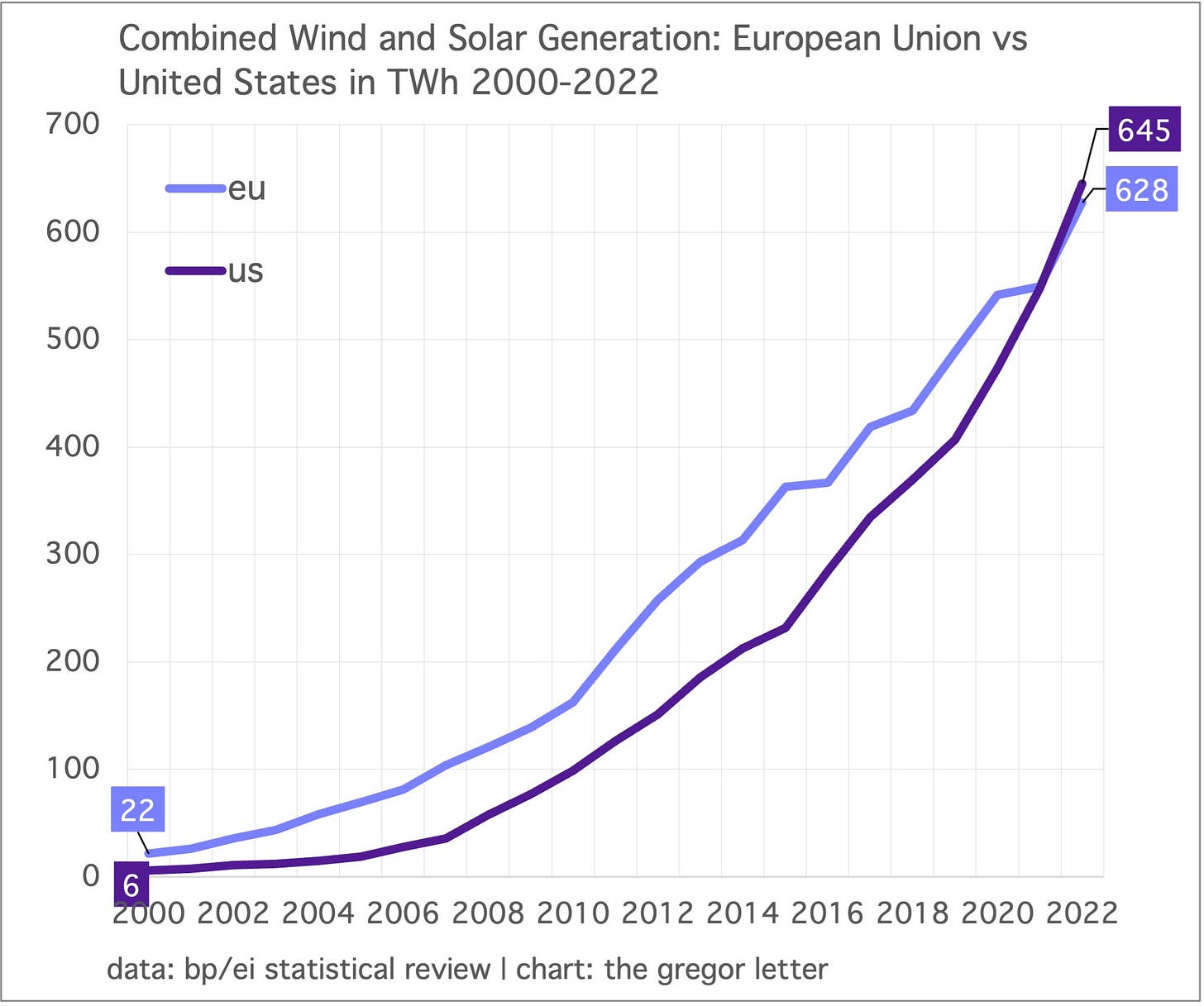

For most of the past twenty years Europe led the US in the buildout of wind and solar. But the US has now caught up. California led the first big-bang of utility grade solar in the US; but after that giant leap forward growth actually slowed—understandably. Wind growth on the Great Plains followed. Recently however, the US is getting growth from the rapid expansion of wind and solar into Texas, a national explosion of rooftop solar, and soon enough, offshore wind on the east coast. Because Europe is heavily involved in demand reduction, and the US favors supply side solutions, it’s a good bet that wind and solar generation in the US is going to move steadily ahead now, of the EU.

Global growth prospects for nuclear power continue to improve. While announcements are not equal to actual MW deployed, both Canada and China have recently unveiled plans to add capacity. The province of Ontario, for example, where a single SMR is already under construction, now intends to add three more SMRs which will total 1200 MW of nameplate power. China has raised funding to build six new reactors and this follows a similar plan from last year, to build ten new reactors. More broadly, the World Nuclear Association tracks activity and reports that there are currently sixty new reactors under construction.

Now, in previous accountings of nuclear power’s future expansion prospects, all new plants under construction needed to be deflated by the number of retirements. Because the late 1960’s and 1970’s saw such a large cohort of new reactors come to the scene, this has meant that new reactors planned 50-60 years later looked vulnerable to being drowned by a wave of elderly reactor’s going offline. That’s much less the case now, because life extension in recent years became a new trend. Especially here in the US. The World Nuclear Association helpfully acknowledges that gauging and forecasting retirements is difficult. However, the WNA does have a current base case scenario to the year 2040, which sees 308 reactors coming online against 123 going offline. That is a far, far better ratio than was seen just 5-8 years ago. A final thought: while readers may have their own projections of future capacity, the overwhelming dominance of China and India in capacity declarations strongly suggests that one should not take the under, on global capacity expansion. China and India will indeed start, complete, and put into service their intended projects.

We have probably entered the period when boosts to global GDP from human advances will be eroded by losses from climate change. In other words, it’s time to deflate future prospects for growth; but modeling such an ongoing erosion is nigh impossible. Sometimes, being less precise can be helpful. We might begin to think therefore of climate change as a kind of tax imposed on our future output. To be sure, climate change will spark ingenuity, as is always the case with a crisis. But mostly, climate change looks ready to apply a sustained and rather brutish tax taking. That particular term comes from property law, and the mechanism by which municipalities eventually seize lots of land which are far in arrears on their tax payments. That’s perfect too: because if we don’t pay our climate tax, then climate will impose a larger penalty.

We are already paying the tax. The new energy infrastructure we are deploying is far more efficient, and may have eventually emerged as a solution to the less efficient process of combustion. But, we certainly wouldn’t be building out a new system (next to the old one) with the same vigor and rapidity as we are now. Equally, while new energy infrastructure will require fewer natural resources than the current system, it’s true that mining and natural resource extraction will be a significant feature of energy transition.

In Nature’s Wealth, the work of Joseph Tainter was briefly mentioned, and it’s time to come back to Tainter’s concepts, at least briefly, in this quote:

Eventually, the point is reached when all the energy and resources available to a society are required just to maintain its existing level of complexity.

Tainter was not thinking of climate change per se in this quote, but we can add climate change to the overall complexity that grows as societies and economies reach very advanced stages of development. Examples of complexity: pears are harvested in South America, packed in Southeast Asia, and then sold in North America. The materials needed to make a single AA battery (or even a simple pencil) must be sourced from all over the world, but it seems easy because supply chain pipelines just send those materials along with everything else being sourced already to places of manufacturing. This is all well and good, and we could even say these systems adhere to Ricardo’s view of global trade. But the downsides to complexity are seen in such events as the 2010 BP oil spill (pictured above). Here, we see what happens when highly complex fossil fuel extraction taking place offshore suddenly collapses into an accident so costly and transformative that it questions the value of the entire undertaking. In other words, advanced economies engage in high-risk activities to maintain their complexity, but this complexity carries a unique kind of risk known as tail risk, which typically creates losses so large that they wipe out years of trailing gains.

What can we do? Here is one thought: when climate-driven storms, flooding, fire, and heat really begin to bear down on us—right as we’re still pursuing emissions reductions through decarbonization—it will be important to not lose heart, and even if it seems fruitless, to keep pursuing the path.

—Gregor Macdonald