Ebb Tide

Monday 9 September 2019

The growth rate of EV sales is slowing. Light duty vehicle markets from India to China to Europe are falling hard, and that is finally starting to pull down the growth rate of EV sales. This is also happening in the US (where total LDV sales are falling more gently) and in the key EV market of California. Systemically, while this will extend downward pressure on global gasoline demand, the next rebound in global growth will now wash over a smaller-than-potential fleet of EV.

(UPS electric delivery truck on Parry Street, Vauxhall, Borough of Lambeth, London. March 2019, via Google Earth)

In India, a decline in vehicle sales is reminiscent of the sharp break which began last summer in China. India’s LDV sales through July fell by 12% year-over-year, and are forecast to finish 2019 down 10%. In Europe, where government bond yields have gone deeply negative as the continent tips into recession, LDV sales fell 8% in 1H 2019. On a country-by-country basis, however, some of the declines were far steeper—in France and Spain especially. From a market perspective, the STOXX Europe 600 Automobiles and Parts Index is trying to bounce, as it fishes around for a bottom. But again, all signs point to a lower low before the next recovery.

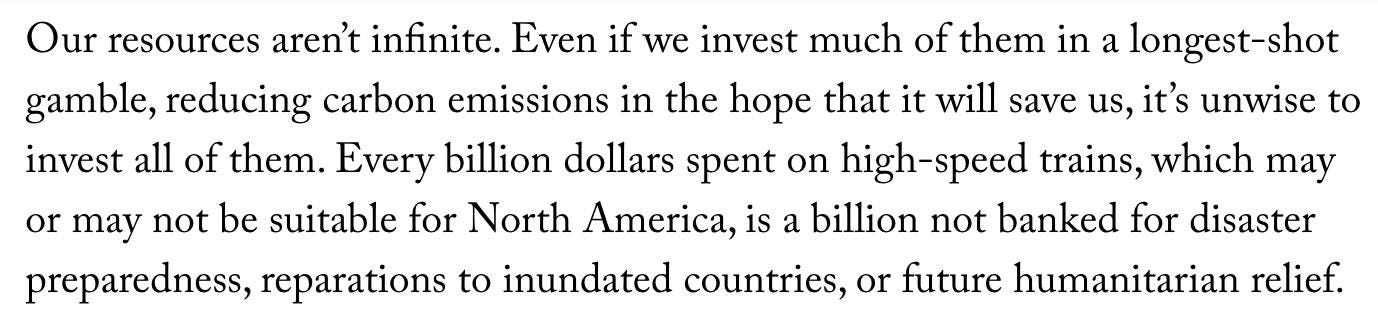

How are these declines impacting plug-ins? In the UK, sales of EV+PHEV are up just 4.6% through August. In the United States, where plug-in sales rose a whopping 80% last year, 2019 sales are up, at best, 7% through August and even with expected seasonal strength in Q4 may reach only reach 15% growth this year. China EV sales are still looking pretty strong, however, decelerating from 62% growth in 2018 to 40% growth in 2019. Given that it’s the most important EV market in the world, that is surely good news. However, in California, EV sales are set to advance just 20% this year after 60% growth last year. California’s total LDV market is on pace to fall by 5.25% this year, and its gasoline consumption is falling notably, now down 2.6% through May, after a decline of 1.5% for all of 2018.

This dynamic once again answers a long-standing question: does a lowering of the economic growth rate suppress fossil fuel demand, while at the same time taking a bite out of clean energy deployment? Yes, absolutely. Eventually, however, there is an offset: lower interest rates, typically seen around the trough of global GDP growth and which tend to linger, are an elixir to clean energy. The rebound in global energy consumption, when it comes, will therefore initially disappoint as existing vehicle fleets, and power generation, take new growth as currently configured. However, as seen in the 2010-2018 period, low interest rates and even cheaper clean energy technology will make for a heady, if not frothy landscape for EV once we get past the year 2020. Until then, the first wave of EV is about to ebb.

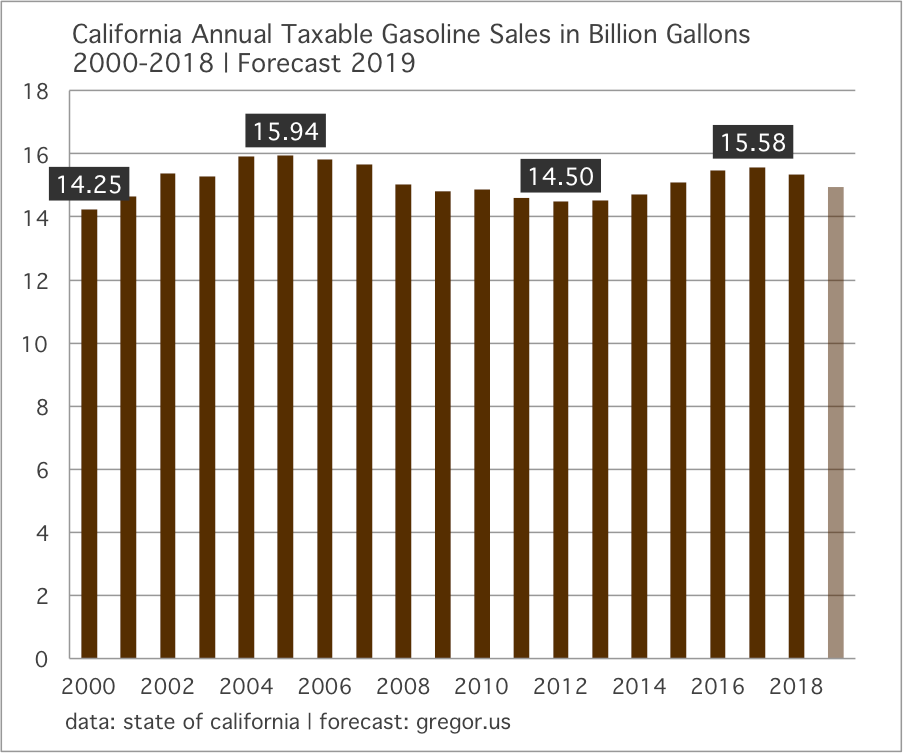

A not-very-good essay on the cost of energy transition was unwisely published by The New Yorker this week. In the course of its argument, the author, Jonathan Franzen, revealed he understands neither growth rates nor investment returns. Accordingly, while Franzen may be an accomplished novelist, he is not the right candidate to address the costs and benefits of a Green New Deal. In this one paragraph, Franzen sums up the breadth of his ignorance—and joins the rest of the culture in being unable to distinguish between a trillion dollar program to buy everyone, say, a lifetime supply of chocolate and the same trillion dollars spent on useful infrastructure that both enhances GDP, and creates energy efficiencies.

Here is my question: how is it possible that in a society which places notable emphasis on undergraduate education in economics, and which also sends thousands of candidates each year to business school, we cannot have a rational, adult conversation about investment returns? Franzen’s zero-sum analysis is deeply embarrassing, but it is often the same ruse deployed elsewhere by educated professionals who should know better. Every claim I make, by contrast, in this January Op-Ed on the cost of energy transition gets truer by the day, for example, as wind, solar, and storage prices continue to fall past key thresholds. I must emphasize: these are not even my ideas. I am not the author or creator of the fact that old infrastructure, and old fossil fuel systems, now increasingly run at an economic loss. These are now just facts. Facts that drive the investment decisions of asset owners, many of whom who care not one whit about climate, or green new deals, but are interested only in the bottom line.

The largest dam removal project in US history, along the Klamath River, will begin in early 2022. The asset owner, utility company PacifiCorp, was facing an uneconomic re-licensure to keep the current hydro assets running and made the decision to create that generation through other means. My coverage of the project, and the national trend toward dam removal and related ecosystem revivals, has just published in Atlantic Media’s Route Fifty.

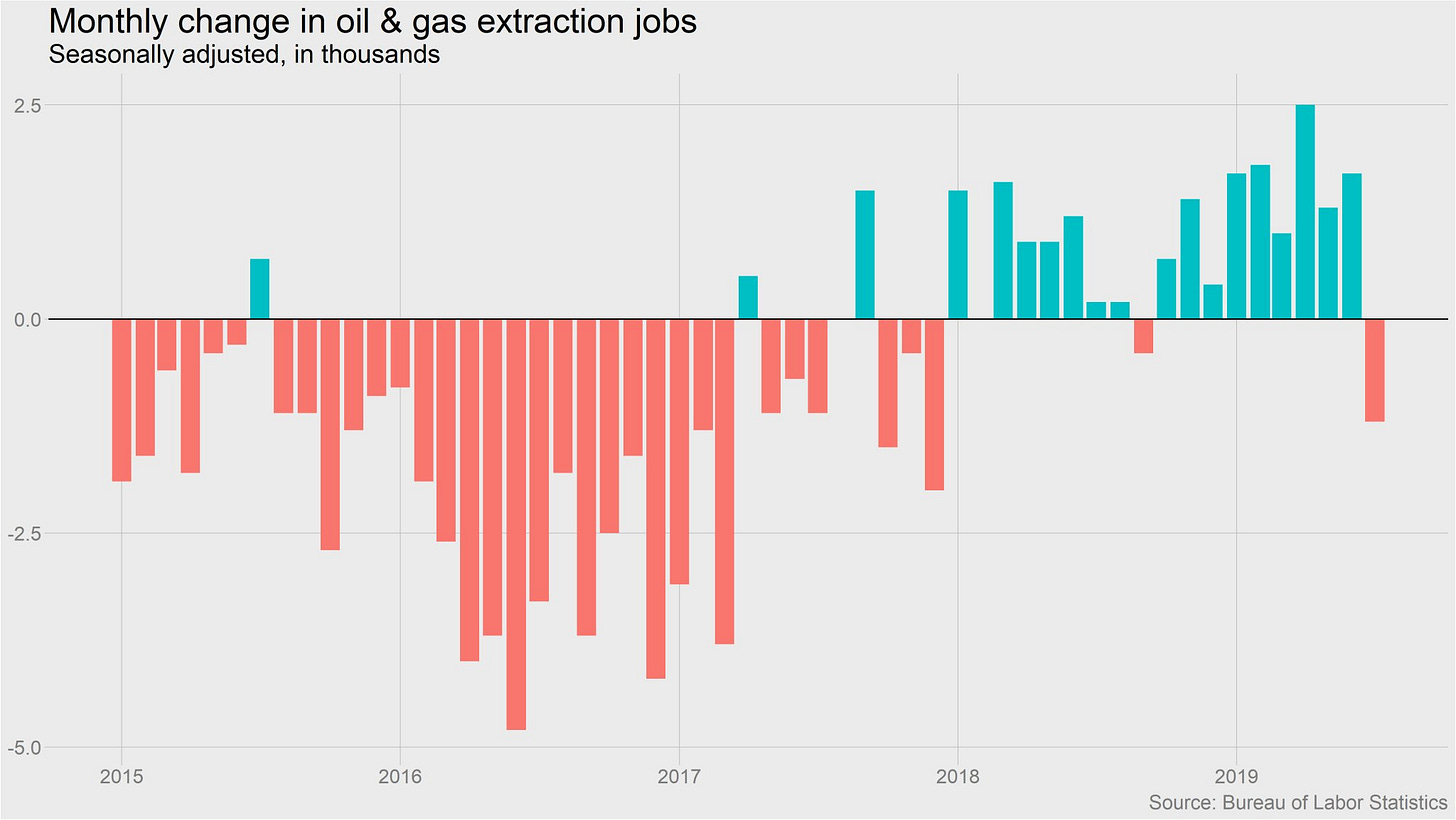

The downturn in US oil and gas sector employment has begun. Picking up on the theme discussed last month in The Gregor Letter, the outlook for fossil fuels continues to dim, especially as the final engines of growth for oil demand are China and India. The chart below comes from Ben Casselman of the New York Times.

A shorthand way to think about the future sensitivity of the US oil and gas sector to price is to simply accept that marginal changes in demand now come entirely from outside the US. Fluctuations in LNG exports, petroleum product exports, and domestic oil and gas production are no longer tied at all to domestic consumption—because US oil consumption is basically flat. When the US coal industry lost China, starting in 2014, there was no prospect of domestic growth to save it. That’s basically where the US oil and gas sector sits today.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.