Electric Shock

Monday 13 July 2020

The share price of Tesla Motors rose above $1500, placing its market cap at levels unlikely to be justified even by best-case growth outcomes for electric vehicles and powergrid technology. At $286 billion, Tesla’s market valuation already reflects not only its future opportunity in global EV sales, but its potential to play a key role in the market-based interoperability of the modern powergrid. Compare, for example, the market cap of Tesla to other corporations well positioned to take advantage of an electrified global economy: Honeywell at $100 billion; Siemens at $91 billion; Raytheon at $90 billion; Volkswagen at $73 billion, and Schneider Electric at $51 billion. Perhaps if Tesla were poised to create the key piece of proprietary software licensed to an entire industry (like an early Microsoft), the current market cap could plausibly reflect the significantly higher margins associated with such software, and its systemic importance. And therein lies the problem. The bulk of Tesla’s opportunities lie firstly in consumer goods, and secondly in capital goods; much less so in software. And without a massive edge in software and its significantly higher profit margins, Tesla’s fate is to see its future valuation align with those more typically seen in the manufacturing sector.

But just a word on the passionate following of hate and doubt that has attached itself to Tesla over the past five years: the biggest and most obvious error made by market-shorts was betting on a Tesla bankruptcy. This has always indicated a fundamental misunderstanding, and a failure to appreciate that Elon Musk launched an electric car company at the perfect time to launch an electric car company. The ridiculous spy shots of Tesla inventory in parking lots, the hair-splitting reports on production defects, and the overfocus on Musk’s personal life and twitter account were always and everywhere a sign that short-side analysis had the story wrong. Now, however, there’s a far more conventional reason to speculate on Tesla’s unsustainable market cap: it’s a manufacturer. And, while the total addressable market for EV and powergrid technology is large, Tesla will face very healthy competition in those markets.

There is also clearly a speculative bubble forming presently, in EV market names. One of the surest signs is the flowering of SPACs—special purpose acquisition vehicles that leverage a listing on an exchange to hoover-up recently formed private companies in the EV sector. As Barron’s wrote last week, “this year is becoming the year of the EV-SPAC,” noting that EV truck maker Nikola came to market through this route, and that EV start-up Fisker is now the target of another SPAC, Spartan Energy Acquisition.

One is reminded of the soaring valuations seen in the solar sector between 2006 and 2008, when an emerging energy crisis began to pressure the economy, and markets began to look for growth opportunities. When First Solar, for example, rose from an IPO level near $28 per share in late 2006 to over $280 per share in early 2008, the market got something right: a decade of spectacular growth was about to unfold in solar. But the market also got something wrong—indeed, very wrong: First Solar’s market cap. Today, First Solar is a stellar company that has continued to make clever advances in PV technology and panel optimization. But also today, First Solar trades at $57 per share, less than 1/5th of its all time high.

Small revisions to 2020 oil demand growth estimates continue to roll out from various agencies, but we are settling into a consensus between a -8.00% and -9.00% decline for the year. Both IEA Paris and EIA Washington have very slightly curtailed their 2020 decline estimate, to roughly 8 million barrels a day (mbpd). Generally speaking, this would take 2019’s 100 mbpd of demand down to about 92 mbpd. Notably, however, OPEC—which recently increased their decline estimate—is sticking with a larger decline forecast of 9 mbpd. The Gregor Letter meanwhile, largely due to the catastrophic health policy failure in the US and how it will affect the base case estimate for global growth, continues to stand pat with a full 10 mbpd decline. Simply put, the 2H oil demand recovery will be weaker than is currently expected by IEA, EIA, and OPEC.

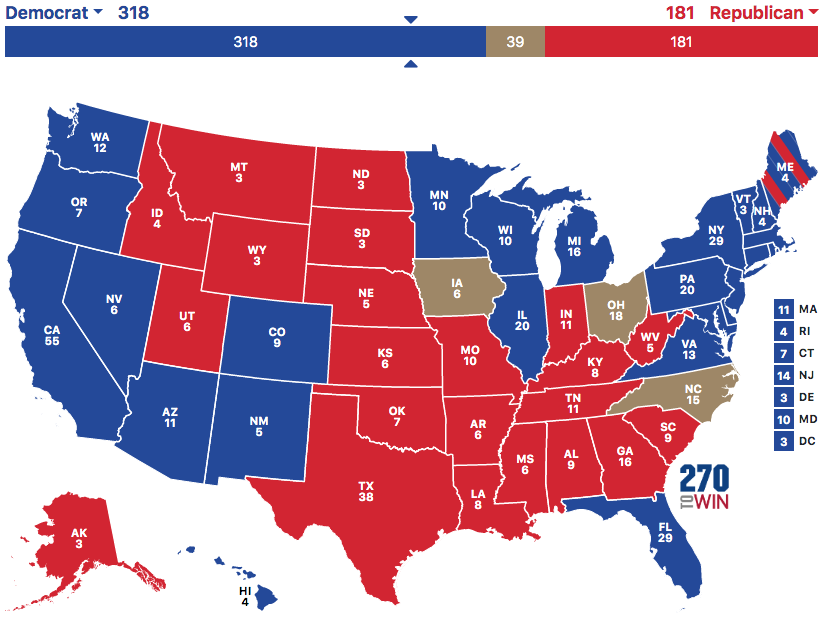

A landslide election is shaping up this November as the GOP now faces tail risk that voting could wipe out its advantage in the Senate, and in state legislatures. Details in recent polling indicate gruesome numbers for the Republicans as seniors and white people—two groups who reliably supported the president and the party in 2016—are starting to sour on this presidency. While Democratic senate pick-ups in Maine, North Carolina, Colorado, and Arizona were already coming into view earlier this year, the out-in-the-open policy failure around the pandemic has now put senate seats at risk in Iowa, Montana, Georgia, and possibly even Texas and South Carolina. Previously unthinkable, John Cornyn may actually have to spend money to hold his seat in Texas, and the same may be true of Lindsey Graham in South Carolina.

One theme showing up in recent polling is not only the unusual Biden strength in red states, but the concurrent Trump weakness in those same states, suggesting risk is rising for the GOP that their voters, while still unlikely to vote for a Democrat, leave the presidential box blank. Or, becoming dispirited, don’t vote at all. The collapse in Trump’s national approval ratings and the opportunity voters see to register that same disapproval at the polls is producing other unthinkable outcomes. Recent polling showed the Texas state legislature could fall into Democratic control, and that Biden is up +5 points on Trump—in Texas. Indeed, Texas is shaping up to be a swing state in the 2020 election—a pivot that had not been expected until 2024. So, why now? Well, the same demographic changes taking place that originally led to the 2024 projection are now combining with passionate, anti-Trump sentiment. Essentially, older white voters are dying in Texas, and being replaced by a far more diverse and younger electorate. This is the story now unfolding across the entire country.

Other states where Biden is polling strongly are Georgia, Alaska, and Kansas. The basic voting analogy to a flood is quite apt, here. As the election is clearly shaping up to be a referendum on Trump, unleashed passions could drive an unusual number of voters to the polls—something we saw last in 2008, when the election also took place in the midst of a crisis. A flood of voters coming to the polls, in the midst of a health and economic crisis, means a historic outcome could be on this way this Autumn.

Readers of The Gregor Letter are advised to start thinking about the following four policy changes that could become a reality should the Democrats gain meaningful control over the Senate:

A significantly expanded Affordable Care Act (ACA), that fixes lingering problems on the level of administered care and costs, and which closes off openings to further judicial challenges. Because ACA was very much part of the previous economic recovery—freeing people to work and liberating discretionary income—future expansion should be regarded as positive for the real economy.

Greatly stepped-up corporate taxation and the closing of corporate tax loopholes. Democrats have already signaled that the GOP corporate tax cut is going to be hit with a clawback. But more significant is that expertise will be brought to bear in the coming legislative session that will likely curtail the power of large corporations to avoid taxes, and, which will likely put small business on a better footing. SP500 earnings are going to be impacted.

Major public investment in US infrastructure with an emphasis on efficiency, low emissions, and clean energy. Fossil fuels are already in trouble both globally and in the US, so a better way to think about the next policy initiative is one that accelerates trends already in place. Democrats don’t need to “ban coal” for example as coal’s future is already bleak. Rather, the next round of public investment will use market-based incentives to seed green-infrastructure deployment along new pathways, with further support for EV, powergrid technology, and efficiency in buildings and transit fleets.

The biggest push in half a century to make the District of Columbia its own state. The idea took hold in the late 1960’s, and by 1970 Washington D.C. was granted a non-voting member to the House of Representatives. With momentum from the upcoming election, the successful transition to statehood for D.C. would of course add two Democrats to the Senate—not a small change.

Just to remind: for the purposes of winning the White House, it doesn’t matter if Biden wins the minimum 270 electoral votes, or a more substantial count above 300 electoral votes. Rather, the difference between a tight win and a blowout win directly impacts all the down-ballot races, and in particular the US Senate. Per recent polling, the electoral college map (below) has been updated to reflect that Biden will 1. win all the states Hillary Clinton won in 2016; 2. take back Wisconsin and Pennsylvania; 3. win Florida and Arizona. While Iowa and North Carolina may see two GOP senators fall to Democratic challengers, it’s still not clear those states will be lost by Trump.

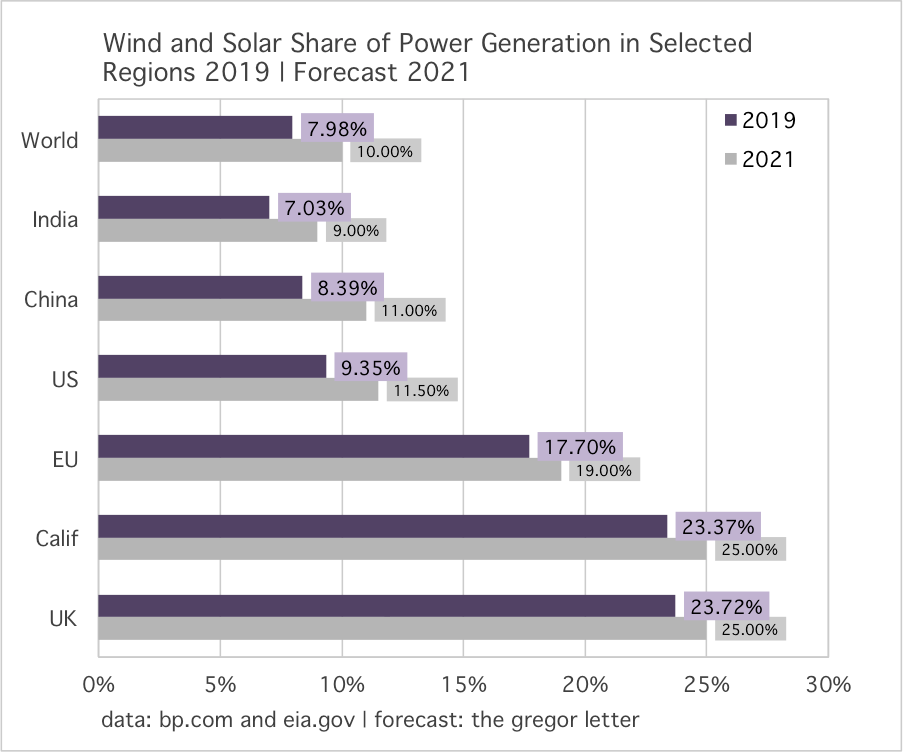

Combined wind and solar hit 8% of total global power generation last year. Important sub-domains of California and the United Kingdom are even further ahead, and on their way to see a 25% share. The results now foreclose upon arguments that wind and solar can’t scale. The next big bang will see grid storage solutions rapidly fall in price, and a consensus that embraces wind+solar+storage as the top power solution.

The Atlantic Coast Pipeline, a project that would have delivered natural gas across West Virginia, Virginia, and North Carolina, was cancelled. Duke Energy and Dominion Energy cited rising costs as the central reason, even after the Supreme Court ruled in their favor over permitting just last month. One factor that may have partly influenced the decision is the planned deployment of offshore wind along the Eastern Seaboard. Over the next decade at least 20 GW and as much as 30 GW of offshore capacity will be deployed (at varying rates of construction). The Financial Times covered the story this week. Given that backdrop, it’s reasonable to speculate the future return-on-investment of new natural gas pipelines could be poor. And it’s not like pipelines are that compelling on a political level, either. The offshore wind industry offers the prospect of considerable regional investment on an ongoing basis. For Atlantic Media, I covered that aspect of the story last year. A final consideration: given cost curves, it’s likely new East Coast offshore wind could understandably wind up backloaded, with steady deployment to 2030, and then a large tranche of capacity arriving in a woosh! over just five years, from 2030-2035.

EV sales continue to bolt ahead in Europe, and the UK especially. While BNEF projects global EV sales will drop this year to 1.7 million from last year’s 2 million units, that’s a far better performance during the present crisis compared to the industry as a whole. Europe auto sales are expected to decline 24% this year, and the US is on course to decline 22%. While it’s now clear that internal combustion engine sales have peaked in both Europe and China, we will still have to wait on the United States. Simply put, when the US emerges from recession, there will have to be a far wider range of consumer choices on the market for EV sales in the US to begin to match what’s already unfolding in other developed regions.

Although The Gregor Letter base case for economic recovery remains unchanged, the chance of any upside surprise is now diminished. The severity of the current wave in the pandemic and its damage to longer-term growth is quite real. The wave extends the risk of deflationary pressure farther into the future, because it grants enough time inside the crisis to permanently break relationships between employers and workers. Worse, state finances are crumbling also and rounds of furloughs are likely to continue, also breaking the relationship between cities, states, and public employees.

One of the persistent beliefs about the current situation, which will eventually come under pressure, is the entire notion of the recovery itself. The sudden stop in economic activity in March and April was of course followed by a partial resumption of consumer activity. But this brief, 12-16 week event is largely running on the terms set by depth of the initial decline. In other words, this is more like an opening chapter. What matters to interest rates, earnings, housing and car markets, and the job market, are the next 104 weeks. And in canvassing most of the forecasts from CBO, IMF, and various financial institutions, one finds that unemployment will remain at recessionary -like levels for at least another two years. You can see the potential for longer-term impacts of the crisis laid out in this New York Times piece on California, where consumer spending remains down over 15%. Indeed, that is a pretty good proxy for the longer-term impact on consumption and jobs now facing the US.

There is no question however that, assuming the Republicans lose the White House and the Senate, far better policymaking will begin to roll out early next year. But again, all one needed to know generally about the pandemic in 2020 is that 1. pandemics typically come in multiple waves and 2. the US government is being run by a uniquely incompetent group of people who’ve literally done nothing about the pandemic, who would then proceed to make it worse, and, would lie about it. Accordingly, any forecast of the pandemic’s longer term impact must face up to and incorporate another six months of grotesque mismanagement in the United States. Those additional six months will negatively impact universities, professional sports, commercial real estate, travel, tourism, small business formation, and of course jobs.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

Photos: 1. BMW i8 series, Portland, Oregon, August 2019, Gregor Macdonald. 2. Boatyard and railroad line, Portland, Oregon, June 2020, Gregor Macdonald.

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.