Electrified

Monday 13 January 2020

E-bikes threaten to replace trips by cars, and are spreading so quickly they may impact oil demand growth. Over the past decade the spread of cycling more generally—in combination with fuel efficiency, the resurrection of transit, and now the rise of EV—has certainly impacted road fuel demand. 2019 for example will see a third straight year in which motor gasoline demand failed to make any progress in the US. But e-bikes are a new threat, a direct assault on a large, unexploited tranche of the market. Roughy 60% of the population has not yet hopped on a bike to run errands, or commute to work. The simple technology of an e-bike however, which smoothly maintains your cadence (think of an invisible hand firming its support as you head up inclines) may now persuade these potential buyers to come off the sidelines. Shock statistic: in 2018, European e-bikes sales were 10X EV sales.

For Atlantic Media’s Route Fifty, I reported on the e-bike story in late December. Here’s what you should know. A full half of all car trips are quite short, less than 15 miles. As it happens, your average e-bike easily covers that distance on one charge. If you are a fit rider already, your light-call on the e-bike battery will further extend the range. More important is the value proposition of an e-bike, that for $1500 to $3500 a single e-bike could replace many car trips. The longer term investment is worth considering also: according to my industry sources, most e-bike motors are designed to achieve 10,000 maintenance free miles. Finally, e-bikes require no license or registration. Anecdotally, here in Portland, we increasingly see parents putting teenagers on e-bikes to help them swiftly complete their rounds of after-school sports and other activities. Of course, Portland has very good safety infrastructure for bikes—and that’s a crucial issue for broader adoption.

The e-bike story has recently burst onto the scene for two reasons. First, sales are taking off. In my Route Fifty story a key retailer here in Portland explains why: the market, in his view, just exited from the early-adopter phase as technology, price, and choice are all aligned now to push into the fatter part of market diffusion. Second, Deloitte published a blockbuster report saying that global e-bike sales could reach 40 million units per year by 2023. Andy Hawkins over at The Verge found that prospect gobsmacking, and rightfully so. As I noted in my own piece, 40 million e-bikes sales per year would put them at nearly 1 e-bike for every 2 cars sold (of any type) globally. Meanwhile, the CBC in Toronto caught up with me last week, and you can read that interview here on the CBC’s What On Earth. Finally, while my piece was the usual macro view, I highly recommend Rachel Swan’s piece at the San Francisco Chronicle. Swan really captures the details of what it’s like for a family to load up an e-bike, like you would a pack-horse, and head up into the hills.

Siemens announced through a twitter message from the CEO that it would go forth with the Adani coal mine development, in Australia. In my opinion, and regardless of the terms, that’s going to be a mistake. Global coal consumption peaked in 2013, and has been on a bumpy plateau ever since. The decline therefore is ever nearer in time, and, when it arrives, could be rather steep. The underpinnings to the current condition of flat demand are eroding steadily too, pillar after pillar falling in domains from Europe to the US and, yes, even China. Perhaps Siemens will be paid up front as a supplier of services and equipment, but the damage to the brand could be substantial. For a preview of how corporate parsing often hurts more than it helps, do read the Siemens press release.

Sales growth of EV in China slumped hard in the second half of 2019, partly due to broad based subsidy cuts that came into effect last July. The results appear to have unsettled policy-makers, however. Over the weekend of January 11-12, the Ministry for Industry and Information Technology announced that no similar subsidy cuts will occur this year. The announcement appears to be a genuine surprise, and, will probably boost market performance of EV manufacturers, at least in the near term. There are more details to come on the Chinese market, further down in this letter, as a disappointing year for EV everywhere now comes to a close.

Sales of ICE vehicles fell again in the UK last year, as EV once again took market share. Following the global trend, the UK’s entire car market has been falling since a 2016 peak, in which 2.692 million units were sold, to a total of 2.311 million last year. That alone represents a decline of over 14%. But it’s ICE vehicles that are shouldering the losses. Combining regular petrol-engine sales with diesel-engine sales, ICE vehicles fell by 85,000 units, from 2.225 million to 2.140 million last year—a gentler decline than seen in 2018 and 2017. That said, since the 2016 peak, UK sales of ICE vehicles have fallen more steeply than the total market by 463,000 units, or 17.8%.

(Electric black cab from LEVC, the London EV Company)

UK sales of plug-ins however, while encouraging, are not exactly spectacular. If you include, for example, non plug-in hybrids to the plug-in pure electrics and plug-in hybrids, that all-in group took an impressive 7.37% share of the total market last year. That share level is important because, across various domains, reaching a 5% share tends to mark a tipping point for faster adoption of new technologies. But when we take the non plug-in hybrids out, all plug-ins—the category we really care about—tumbles back to 3.14%. Observers could console themselves with the fact that pure 100% electrics had a great growth year in 2019, advancing 144%. But, until plug-ins cross the key 5% level, the UK car market like the US car market is a story of declining sales overall with the stronger phase of EV adoption yet to come.

New York State lifted its 2035 target for offshore wind by another 1000 MW, to 9000 MW. The ramp is an indication that other states along the Eastern Seaboard will continually increase their offshore capacity targets as the supply chain forms, and costs drop. Last year, I reported on the early preparations to scout for and invest in ports in Long Island Sound. With the recent announcement from New York State, the total target for states from Virginia to Massachusetts now stands at roughly 27,500 MW. If you would like to keep up with the running tally, please follow the twitter account of the Special Initiative on Offshore Wind, at the University of Delaware.

The largest utility scale solar plant in the United States has just been approved for construction. The 690 MW behemoth, which is to be paired with storage capacity, will arise in the Nevada Desert. Trend to watch: now that storage is coming down in price, look for nearly all new solar projects to include this capability.

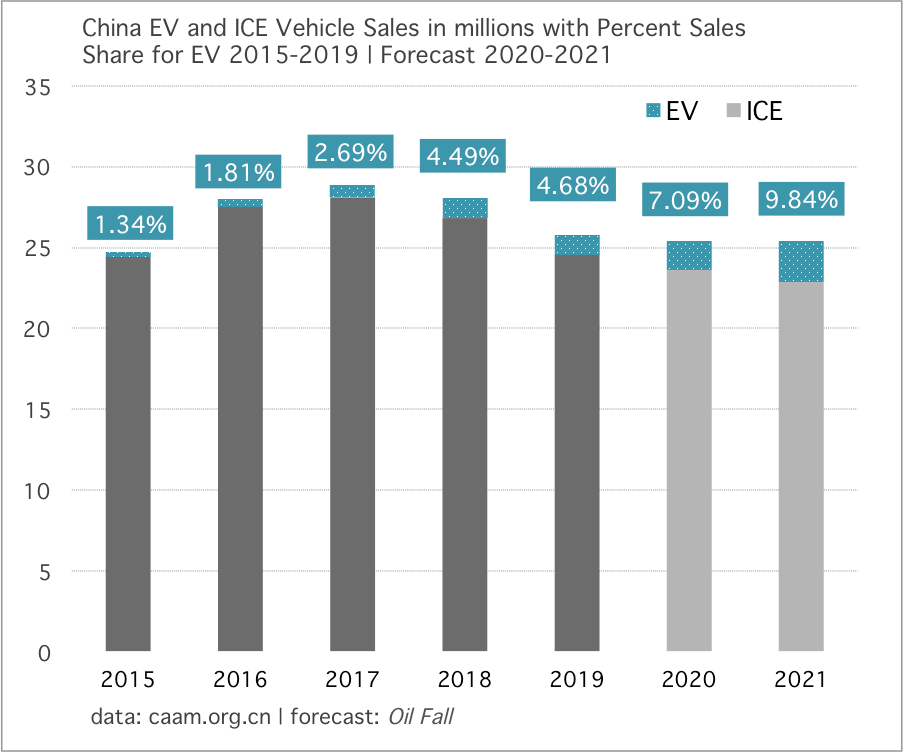

China’s vehicle market plummeted in 2019, falling by 8.13% and managed to take down EV sales also, to a negative number. The damage done to EV sales both in the passenger vehicle segment and especially in the commercial segment was so rapid that a favorable EV outlook at both mid-year and after the third quarter was transformed into a 4.29% decline, compared to 2018. The main culprit: subsidy cutbacks which took effect in July. Policy makers won’t make this mistake again.

Crucially, this also took the overall EV share of the market from an anticipated 6% at mid-year down to 5% during Q4, and now to a final 4.68% share as the year completes. There is a silver lining here, however. Across a number of technologies, substitution curves tend to get going around the 4-6% market share level, which often acts as a take-off point. While 2019 is without question a setback for EV growth, as a 4.68% market share for EV sales is only a smidge above 2018’s 4.49% share, China’s EV market has clearly entered the zone, so to speak. Below is a plausible forecast for the next two years:

China automotive industry forecasts indicate another down year in 2020, though, at a far milder pace. The chart here sets a decline of about 1.5% next year for the total market, and an increase from 1.206 million to 1.8 million EV sales. Accordingly, the EV market share will surely get beyond 5% this year, even if the 7% mark is not reached. So, despite the turn for the worse in 2H 2019, the shape of China’s car market trajectory has not meaningfully changed.

Supremely important in this regard is the decline in ICE vehicles. From a high of 28.102 million in 2017, ICE sales fell to 24.563 million this year. According to the forecast, they will fall by another million next year to 23.6 million and by 700,000 next year to 22.9 million as I expect the market to stabilize in 2021 and attempt its first rebound from the current multi-year decline. But, regardless of how the final market share percentages work out, what’s now clear is that ICE sales have peaked for good in China. That’s why a year ago I kicked off this twitter thread with the assertion that China just killed the future of the internal combustion engine. Note the wording. China didn’t kill ICE. It killed the future of ICE. Like coal and oil, ICE will be with us for many decades to come. But, without any growth. And eventual declines.

Forecasts are hard (and long term forecasts are harder) but some forecasts are just plain bad on the day they’re made. Currently, the worst-in-class projections seem to coalesce around global growth in primary energy demand. The latest example comes from the EIA, offering up the view that over the next 30 years, world energy demand will rise by 50%. For that projection to come true, the growth would have to be almost entirely driven by fossil fuels. The EIA’s model therefore couldn’t possibly reflect the massive deflation in front-end demand that naturally occurs as we move away from combustion. The majority of growth in energy supply over the next 30 years will come not from combustion, with its extraordinary waste-heat, but from efficient renewables.

Apparently, there is still insufficient understanding that at least 30% of the energy the world consumes is lost to the atmosphere, if not more. Much more. Last year, the world consumed 13,865 million tonnes oil equivalent of energy. (the Mtoe is a unit of heat, not volume or weight). According to a range of studies and analysis, however, at least 30% and as much as 60% of that energy never made it to the user. That is the nature of combustion, in everything from thousands of power plants to billions of engines. Steadily remove combustion, and you will steadily remove the excess consumption of energy required to run the world.

In Part III of Oil Fall, Waste Crash, I conducted a quick review of various agencies and the percentage share they place on lost energy in the global system. Here’s that particular table:

Without duplicating the longer discussion contained in Oil Fall—which goes into detail on some of the methodologies across these various results—I would advise paying most attention to world estimates from the Lawrence Livermore National Laboratory (LLNL) for 2011 and the International Institute of Applied System Analysis (IIASA) for 2014. Importantly, while the entirety of the waste gap is not ultimately harvestable—owing to things like line losses in electricity transmission, and that many processes will continue to require combustion—the lesson here is rather forceful.

To illustrate how waste will be steadily removed from the system, please consider the following progression.

• California’s 35 million registered vehicles running exclusively on petroleum, asking nothing from the powergrid, and consuming 15.5 billion gallons of road fuel each year.

• California’s 35 million registered vehicles no longer running on petroleum, but rather entirely on the electric motor platform, and relying wholly on the electric grid for power. But, a grid powered entirely by natural gas.

• California’s 35 million registered vehicles running exclusively on the electric motor platform, and relying entirely on a grid that is powered only by wind, solar, and storage.

In the first step, 35 million California ICE vehicles transition to 35 million EV, thus steadily giving up 9.3 billion gallons of petrol that was wasted, lost to the atmosphere. Surprising, to be sure. But, once again we are reminded that the internal combustion engine is powerful, but wasteful, losing at least 60% of its energy. In this first step, we have wiped out the waste heat from 35 million individual engines, but, we still have the waste heat from natural gas power plants. Far, far less waste heat systemically—but, with another step to go.

In the second step, we then remove the waste heat from the natural gas power plants, and now we are left with the line losses only, in electricity transmission.

Repeat this progressive removal of waste heat across a number of domains, and you begin to see how energy transmission partly pays for itself. Will we be able to transform all processes, services, engines, machine operations, and so forth from combustion to non-combustion sourced electricity? No. Or, at least not easily or quickly.

But everyone should understand this transformation is already underway. The energy savings are already appearing, already measurable in California and the UK where the greater systemic energy efficiency of running an EV is now being disseminated as combined wind+solar go past 20% of electricity supply in those two domains.

Will Australia’s ongoing catastrophe show up, thousands of years from now, in the geologic record? That was my thought when reading this moving account, from Sydney based writer James Bradley. A vast layer of carbon dumped and fixed into the soil; sustained temperatures marking their impression across land and sea; and most of all, the carcasses and bones of a billion newly dead animals. Were we to find such a notable striation today, one might conclude a sudden methane release or some other similar event had occurred, appearing in the record as a sudden die off.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.