EV Fireworks in China

Monday 14 January 2019

Oil Fall has had a very successful launch this past week, with excellent mentions on Twitter, and good mentions in the press. I was interviewed by the CBC in Toronto, and here is a fine write up of Oil Fall from Tim Bray, formerly of Google. Thanks Tim! For those of you who missed it, here is my Oil Fall book launch twitter thread, from Sunday, January 6. Soon, I will publish on Op-Ed that keys off major points in Oil Fall; in particular, the notion that a green energy transition, distributed over twenty years, is no longer a project that will bear inordinately high costs.

If you've not had a chance to read Oil Fall, I hope you will pick up your copy today.

Purchase Oil Fall

Turning our attention to 2019, the final numbers on last year's earthquake in China's vehicle market are now rolling in, and we can make an easy call: the sales growth of ICE vehicles have now permanently peaked in China. Indeed, we now see that ICE vehicle sales peaked in 2017 at 28.10 million sales, and were absolutely slammed last year, falling to 26.82 million sales as EV sales last year took full control of marginal growth, and exceeded full year expectations by selling 1.26 million units. Let's be clear: there is no prospect now that ICE cars in China will ever regain marginal growth from EV from this point forward, as the total market is expected to be flat this year, at best, and the explosion of affordable EV models is now spreading throughout the country.

The chart that appears in Part II of Oil Fall, China Sudden Stop, needs little if any touch up with these final numbers, but let's go ahead with some small fine tuning, especially for those of you who've not yet purchased the book. (hint, hint).

Oil Fall estimated that EV (a category that China refer to as New Energy Vehicles, or NEV, which basically contains EV and PHEV) would hit 4.12% of total market share in 2018. Once again, China exceeded expectations in the final selling month of the year, and now EV have reached 4.49% of the market. Nota Bene: Oil Fall uses the more rigorous total China vehicle market, which includes not just consumer/passenger vehicles against which to run EV sales, but the broader total market which includes commercial vehicles. This is also worth noting because commercial vehicle sales actually rose last year (we don't have data on the EV mix of the commercial sub-category) as consumer vehicles fell pretty hard. The takeaway: EV sales are so strong they are trouncing not only the consumer market, but blunting any ICE growth still taking place in the commercial market.

Let's take a look at a very mildly updated chart for China's total car market, with completed data for 2018, and an outlook for the next two years:

The 2019 forecast changes slightly from EV taking 6.21% market share to 6.61%, and 2020 also changes upward slightly, from 9.06% to 9.79% market share. These small shifts are of course quite subordinate to the central conclusion which should now be obvious: ICE growth is over in China, and accordingly petrol demand growth is essentially over in China. As Oil Fall takes great pains to point out, however, petrol dependency will not enter and is not expected to enter pronounced decline soon. But damage to the oil industry is already underway, and will accelerate the next few years. By the time the outright declines arrive, say as early as 2021 or 2022, the first big wave of damage will be done.

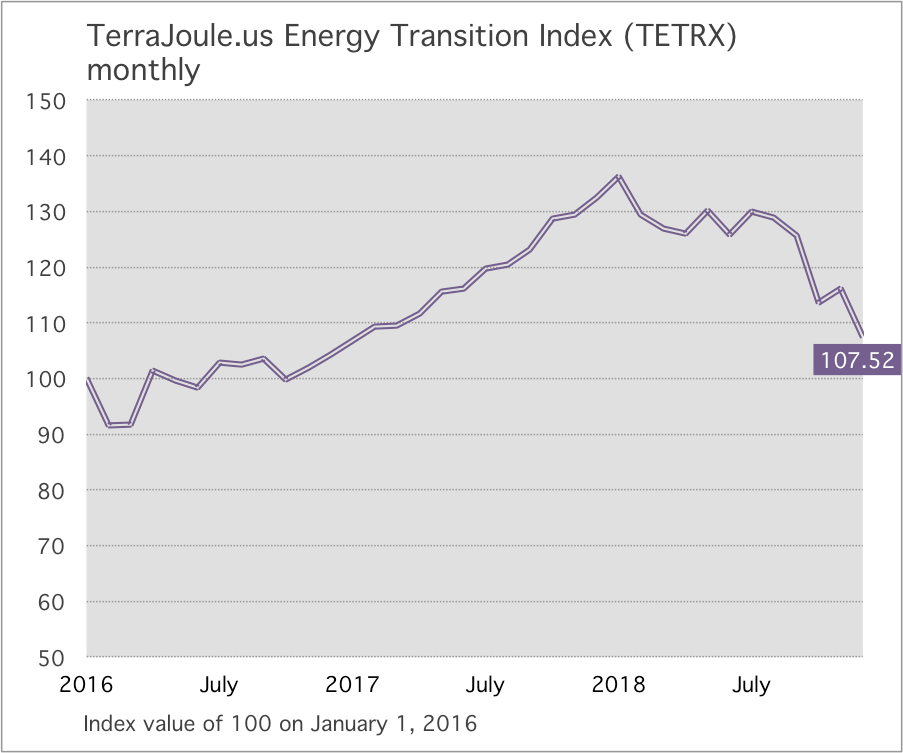

Elsewhere this month, the TerraJoule.us Transition Index (TETRX) fell along with the market in Q4 2018, and finished the year at 107.52, down on the year by 18.85%. TETRX began 2018 at 132.51. To download the (Here is the downloadable Excel spreadsheet).

Going forward, it's not clear there's alot of value in maintaining the TETRX Index. Put another way, the TETRX may now be a distraction from other areas of focus for the TerraJoule.us newsletter. Feedback welcome.

Also in 2019 it also seems natural to drop the PDF format, which TerraJoule.us has used for a number of years. In part, the PDF is an artifact from a time when the letter was much lengthier, and arrived by paid subscription. Now that sales of Oil Fall are doing so well, the optimal mix of content is coming into view: eBooks for sale, and a free newsletter alongside them.

Once again, Happy New Year to all and thanks for your support of Oil Fall.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.