Green Light

Monday 11 February 2019

Few public initiatives are successful without a marketing plan and that’s no less true for the Green New Deal, unveiled last week. The proposal appears to have made two missteps; but those are likely to be subsumed over time by a fine stroke of persuasion. First, the bad. By loading up the resolution with a Christmas tree of promises—everything from healthcare to hints of a full-employment scheme (not that those are bad things)—Markey and Ocasio-Cortez, the co-sponsors, have opened themselves up to charges the Green New Deal is just a stalking horse for a bunch of long-standing progressive initiatives. Second, the resolution (remember, it’s not yet a bill) was short on detail overall, and, notably missed the opportunity to freeride on all the various state-level initiatives in wind, solar, and EVs that have been so successful the past decade. Vague, where it could have easily been specific, and overbroad, where it should have been less ambitious, the Green New Deal has made a wobbly debut.

And yet. For the first time, against a backdrop of the Trump administration’s ill-conceived aggression towards the environment, the United States has sent a signal that a more robust confrontation with fossil fuel combustion is about to take place. If you have any corporate or financial sector experience you’ll immediately understand that’s a signal you must hear. Lofty, aspirational goals nearly always appear to be just that—at first sight. But when cities from Paris to London start signaling they want cars completely gone from their centers, and countries like China warn that sales of ICE cars will eventually cease altogether, corporate planning and investment strategies start to shift—long before these aspirational policy goals, even if pegged to far-off years like 2030, or 2040, are set to occur.

Strategically, therefore, the Green New Deal has dislodged a very large stone. This will productively set the world to thinking about what’s to come from the United States. Better still is that the proposal—to my delight—has wisely avoided the issue of cost, foregrounding instead the yield of positive outcomes. Of course I would think so, because this aligns with my advice offered in my Op-Ed last week, A Green New Deal is Already Happening, published at BuzzFeed News. As you will see, I both argue and explain that plunging costs for new wind, solar, and EV combined with the massive losses we already endure from combustion strongly argue that a Green New Deal—run over 20 years—will have a positive return-on-investment. And let’s not forget the broad economic hits to GDP that are stacking up in the pipeline, if we do nothing. Can’t be emphasized enough: we already have more than enough data to know climate change will distribute punishing damage to property, agriculture, growth, and many of the efficiencies we’ve come to enjoy.

While you’ve probably read a number of reaction pieces to the Green New Deal, let me offer this excellent short thread on Twitter from UC Santa Barbara professor Leah Stokes. Note Leah’s thoughtful attention to persuasion, and, her own academic work which centers on public reactions to policy proposals that focus not on costs, but jobs. Finally, please read this companion thread from author and investor Ramez Naam, whose tendency to be positive, constructive—and rigorous—is just what we need right now.

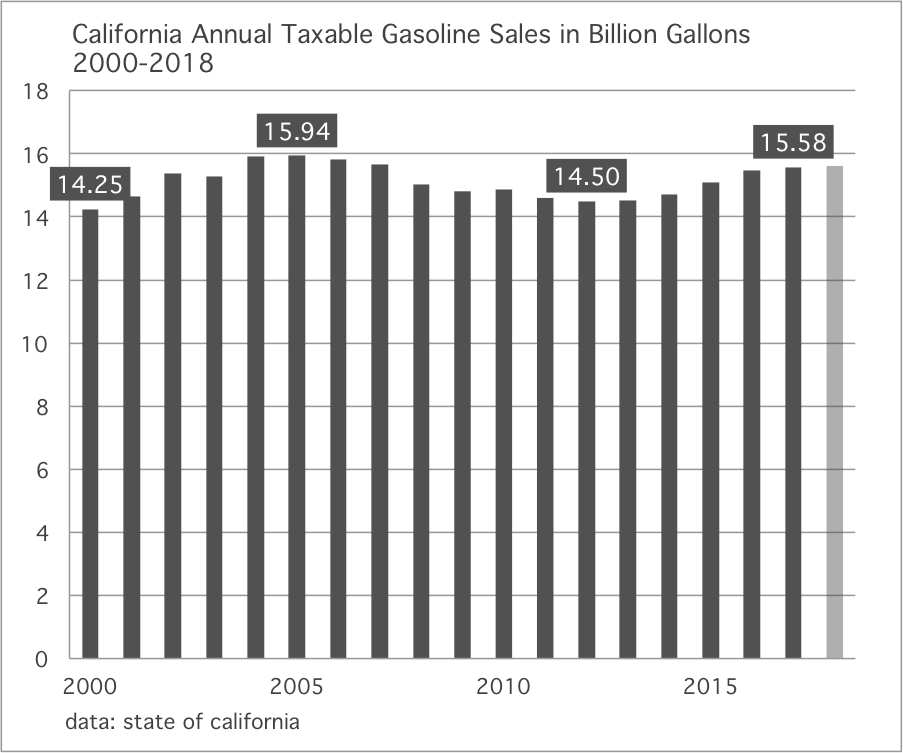

Meanwhile in California. Because Los Angeles, and California more generally, feature prominently in the Oil Fall series it’s important to continuously update you on the rollout of electric vehicles, and gasoline consumption, in the Golden State. Just to re-cap: the sales growth of ICE cars is now over, in California. Last year, combined EV and PHEV reached 9% of new vehicle sales, or roughly 180 thousand units in a total market of 1.99 million. Final data on these figures will arrive next month, but will only impact the decimal points. The implications are obvious: EV have now taken full control of marginal vehicles sales growth.

California’s population has grown by 17% since the year 2000, from 34 million to 40 million. But a trailing set of policies, that already suppressed the growth of gasoline consumption, are now bearing down more concertedly. In the same way that US gasoline consumption failed to make any progress (again) last year, California too is set to record another flat year of growth. Data is now available for the first 10 months of 2018, and is shown above. As you’ve heard me suggest previously, US road fuel consumption is very close now to entering a new decline. I expect this to begin later in 2019.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.