Grunty Yank Tank

Monday 20 February 2023

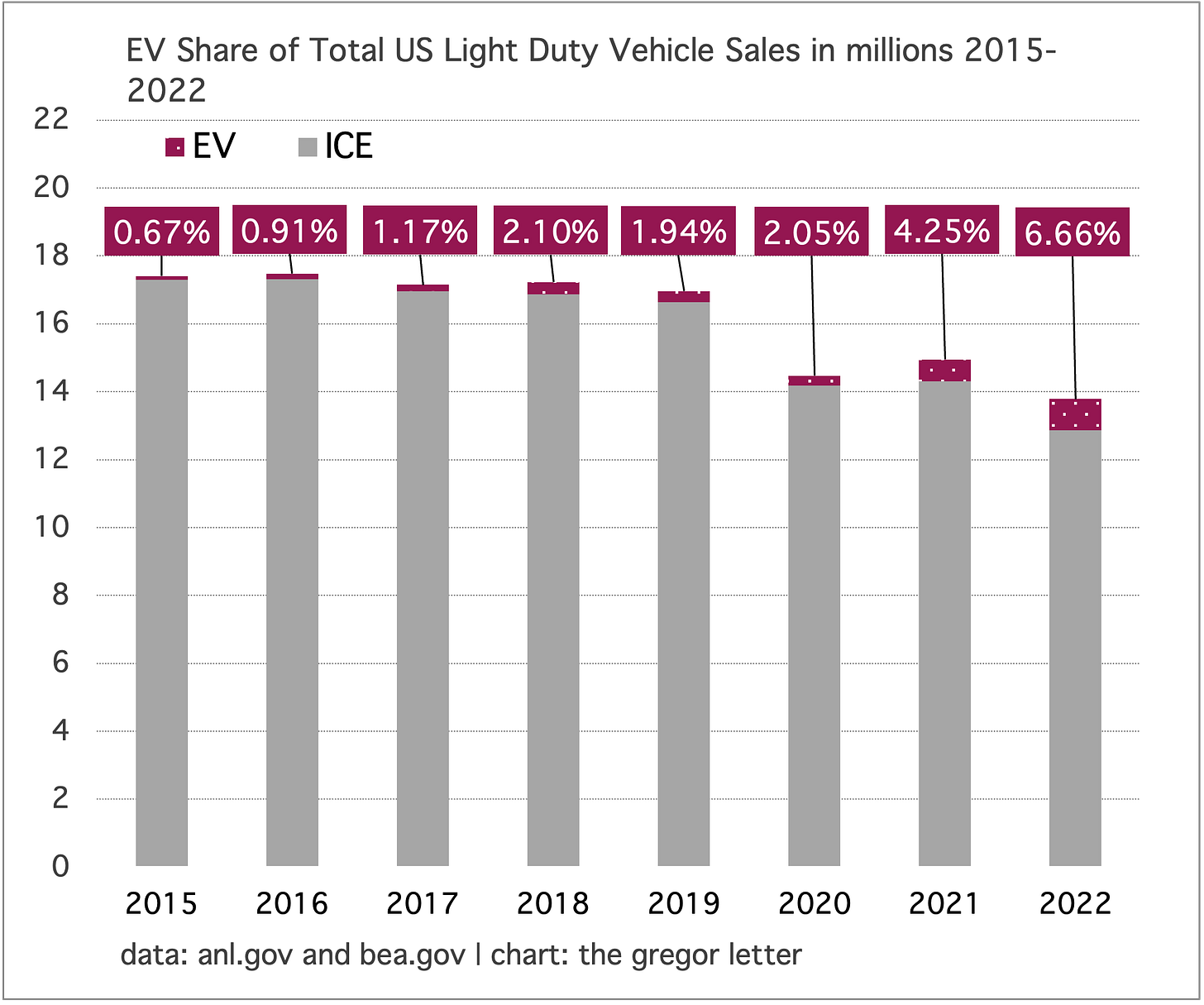

Sales of plug-in electric vehicles have finally crossed above the key 5% market share level, in the United States. In contrast to the other two largest global vehicle markets, China and the EU, model choice and pricing options have historically been poor in the US, making for a long, slow crawl towards EV adoption. The past two years however have seen EV sales skyrocket in California, the largest EV sub-market, and accordingly the old adage applies: as goes the Golden State, so goes the country. Now that EV have crossed this important threshold, you can expect them to grow similarly to other technologies that have reached this same take-off point.

But it’s also the case that EV market share in the US has feasted, in part, on a slumping overall market, where total light-duty vehicle sales continue to decline from a high of 17.47 million in 2016, to just 13.79 million last year. Accuracy demands, therefore, we acknowledge how a shrinking base makes for a lower hurdle to achieve the 5% market share level. That said, readers of The Gregor Letter will recognize an additional dynamic here. As we’ve seen in wind, solar, and now battery storage, weakness in overall market conditions only lightly affect (if at all) the deployment of new energy technologies. The cleaner solutions simply press onward.

Just to add some absolute numbers to the picture, the US put a fresh 918,464 plug-ins on the road last year, according to Argonne National Laboratory which now helpfully tracks the sales data. Meanwhile, California accounted for a chunky third of those sales at 345,818 units, according to state data. Back to the market share figures: while plug-ins have now reached 6.66% of US light-duty sales, they have reached a whopping 18.8% of California vehicle sales. That places California, unsurprisingly, in the same league as China and the EU, where EV market share reached 25% and 22% respectively in 2022.

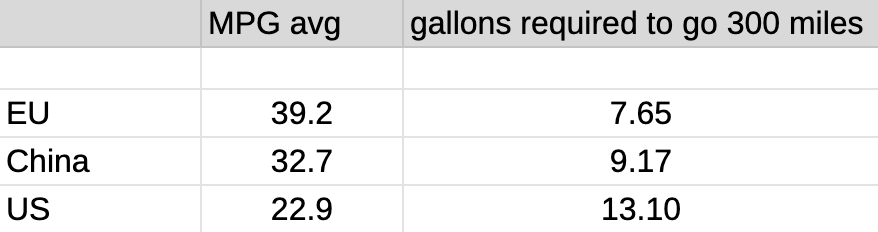

There’s another, less discussed metric that needs to be considered as EV finally get going in the US, however, and that’s the stark difference in the fuel-efficiency of the existing US fleet compared to China, and the EU. You see, while it’s amazing how fast EV adoption is taking place in China and the EU, those existing ICE fleets have significantly higher average fuel efficiency. Accordingly, the volume of future road-fuel demand that’s being snuffed out with every EV sale in the EU (39.2 MPG fleet average) and in China (32.7 MPG fleet average) is not as large, as it will be in the US (22.9 MPG fleet average). This may feel like a topsy-turvy inversion to some readers, but this adheres to a phenomenon seen everywhere along the journey to decarbonization: the biggest emissions reductions are to be found where combustion and emissions are the worst! Want to hit power sector emissions hard? Hit coal power hard. Want to hit ICE emissions hard? Hit American gas-guzzlers hard!

I was once told a hilarious story by a group of New Zealanders who, in their younger days, took a summer-long trip to the US and bought a used American station wagon at the outset, which they sold three months later at the end of their holiday. Their term for the wagon, which insatiably consumed gallons and gallons of gasoline: a grunty Yank Tank. The implications for road fuel demand are far more profound if the US is now indeed on the verge of more rapid EV adoption.

Let’s make up a simple table therefore, showing the volume of gasoline consumed across the three major car markets, to drive a standard 300 miles between fill-ups. (data on average fleet MPG comes via IEA.org and the US Dept. of Transportation). As you can see, if every million new EV in Europe will dent future petrol demand in the EU, then every million new EV in the United States will rip a hole in future demand.

US oil consumption peaked 18 years ago, in 2005. Since that time consumption has fallen some, but has mostly oscillated. So, we cannot yet expect that US EV adoption, at just over 6% of market share, is going to move the needle enough to trigger a broader decline in US oil consumption. The legacy ICE fleet is vast. And the lifespan of ICE vehicles is lengthening. However, in California, where road fuel demand has also been on a plateau for many years, gasoline consumption probably has entered decline. Not a steep or rapid decline, but a decline nevertheless. (see: the 12 December 2022 issue of The Gregor Letter, End of the Road.)

Once the US gets to higher levels of EV adoption, we should be prepared for a more rapid hit to US gasoline consumption trends. That it takes 13 gallons of petrol to go 300 miles in the US is a ripe, juicy target for transport electrification.

Grunty Yank Tank: we salute you.

Trading a coal problem for a natural gas problem seemed like a good deal a decade ago. But now we see that both the United States, and the rest of the world, are building up a very substantial new path dependency on natural gas. The Gregor Letter took a first look at this problem in the previous issue, Bad Natty Emissions. Overall, three main themes are at play:

• Natural gas has now been fully globalized through a titanic rise in LNG export capacity, which smooths the path to even higher levels of adoption, and subsequent dependency.

• The extraordinary success in killing coal in the US and Europe has smothered policy makers with a sense of progress, while distracting attention from the relentless embedding of natural gas not only into powergrids, but myriad other industrial applications. Notably, the global stagnation of nuclear power growth also goes unmentioned but is a critical piece to understanding how natural gas has feasted on coal’s carcass.

• There remains a persistent belief and expectation that the rapid growth of wind, solar, and batteries will blunt natural gas growth when such an outcome has not happened, is not happening, and the sightlines to the belief this will eventually happen are murky at best.

Let’s begin with a portrait of how the US electricity system has evolved over the past decade. In the US, coal’s decline, wind+solar’s advance, and nuclear’s stagnation is a pretty good proxy to the portrait of natural gas and its robust growth globally.

As you can see above, wind and solar growth is super impressive, and we should be excited that wind and solar are able to keep pressing forward at such a strong rate, and now, from a higher base. But coal’s dramatic decline creates a gap simply too hard to fill by wind and solar. And, with zero help from nuclear, that means natural gas growth is going from strength to strength. What people need to understand far better, when looking at a chart like this, is that all that trailing growth in natural gas is an investment in future natural gas dependency. As The Gregor Letter has tirelessly pointed out—whether in global coal or global oil—it takes one herculean step to halt further growth, and perhaps an even bigger herculean step to trigger actual declines. Dependency is powerful: incumbency, path dependency, whatever term you prefer. Once you embed an energy source in a large system, a whole array of ancillary support gathers around that energy source. Roots get put down.

Now, the natural gas problem extends well beyond the power sector. So we neither want to restrict the analysis to electricity, nor do we want to entirely lay the problem on that sector either. But for now, let’s keep going with the natural gas question in power specifically, because there continues to be an ongoing misunderstanding about how the US and global power sectors are actually evolving. (In a subsequent issue of the letter, we will finish up the coverage of natural gas to include all sectors).

Take this chart, for example, recently posted by the US EIA on 7 February, 2022, showing the total capacity of coal and natural gas power that would be retired this year:

This chart got many people excited, understandably. Coal continues to collapse in the US, and that 8.9 GW of coal capacity will absolutely not be replaced with more coal. New coal is dead. But the 6.2 GW of natural gas capacity also got people excited. This at first glance seemed to confirm that longstanding wish that combined wind and solar would eventually kill natgas growth, and 100% dominate marginal growth of generation in the US power sector. Unfortunately, many may not have seen the chart posted the day before on 6 February, also by the EIA, showing that 7.5 GW of new natural gas capacity would be deployed this year.

A fun little test you can run with yourself: if you quickly sum solar at 54% of expected new capacity this year, with wind at 11% of expected new capacity this year, does your brain take a shortcut, and tell you something like “Oh wow, wind and solar are going to make up 65% of all new capacity this year, which confirms that the two technologies are finally coming to dominate marginal growth in the power sector.” If your brain does that, there are two explanations: one, you are human and vulnerable to shortcuts; or two, you are not aware that you have to massively deflate any measure of new wind and solar capacity to arrive at the only figure that matters: generation.

While no energy source in the power sector runs 24/7/365, nuclear gets pretty close at around 92%. That’s known as a capacity factor. So, we have to deflate the 2.2 GW of new nuclear about to come online (Vogtle) by 8% against a theoretical 100%. But when you see 29.1 GW of solar capacity is going to be added this year, you have to deflate that by 75%, again, against a theoretical 100% to reflect that solar’s capacity factor sits at 25%. Remember, the only value capacity measurements have is they enable us to project generation. Late in each calendar year, for example, we begin to get estimates of how much solar the world deployed as measured by capacity, which enables us to project that year’s generation growth from solar. But ultimately we don’t care about capacity. Generation is the only thing that matters.

The chart from the EIA is rather unhelpful, to be honest. The inclusion of storage in the pie chart is also confusing, or at least can lead to mental shortcuts, because 9.4 GW of storage doesn’t tell us enough about that particular capacity’s duration—which again, is another way of making the same point:

Capacity is not generation, in power sources.

Capacity is not duration, in battery storage.

The capacity factor for US natural gas power is not that great either. And comes in at around 57%. But the reason you see, in the first chart of this essay, such robust growth of power generation from natural gas is that not only does the US continue to deploy substantial new capacity, but natural gas’s lower capacity factor gives the fleet room to boost power during summer heat waves and winter freezes. We see a similar dynamic in China’s coal fleet which is overbuilt and runs at a low capacity factor—until you get a year like 2021 with its global coal and natural gas crunch, when China’s slumbering coal capacity roared to life and crushed a seven year decline in global coal consumption, spiking coal back to the global highs of 2014.

Now let’s turn our attention to the global picture. From 2010 through 2021, combined wind and solar was the undisputed leader of generation growth, having advanced by an incredible 662%. Nuclear globally, just as in the US, stagnated the entire period, with growth statistically insignificant. Coal, which very much remains a problem outside the OECD, grew by 18.6%. But note that the 2021 spike, if removed, means coal grew by 9.3% from 2010-2020. (That is the track we thought we were pursuing, until China’s dormant coal capacity was put into action).

And now, the new problem: natural gas, growing by a heady 33% during the period.

Question: what do you suppose is going to happen to global natural gas growth in power generation when global coal really starts to decline? Wind and solar growth is in rude health right now, and can be expected to keep growing at very high rates—maybe even rates that many think implausible. But this may ironically only serve to support the same, wishful belief that wind and solar globally can steal all the growth from natural gas, as the gap opens in global coal generation.

This is another way of stating that, without nuclear as a teammate, combined wind and solar—which are indeed cheaper, faster, and better than nuclear—will not be able to counter natural gas growth. By the time China’s coal generation finally goes into decline, ample piped natural gas from Russia will be available to fill the gap. And yes, China will by that time have even more wind and solar up to exceedingly high levels, if not higher! And it still won’t be enough.

Energy transition will become increasingly bifurcated. The decarbonization of global powergrids will press onward, but this progress will be hounded by a lagging, stubborn dependency on oil, metallurgical coal, and natural gas. This week, I was a guest on Markham Hislop’s Energi Talks podcast. You can listen for free, here.

Saudi Aramco is not investing in future oil supply growth. And we know why. An excellent thread here by Bloomberg’s David Fickling:

The DOE’s Loan Program Office has made a conditional funding commitment to Redwood Materials. To spur the development of battery material recycling, the DOE has earmarked a potential $2 billion loan to the Nevada-based company, headed up by former Tesla executive J.B. Straubel. It was Straubel who very early on understood that material needs for the energy transition would intensify, especially in the battery sector. The DOE’s conditional funding agreement also reminds that the US has very clearly embarked on a new industrial policy, designed to return supply-chain capabilities back to the US.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the 2018 single title is newly packaged and now arrives with a final installment: the 2023 update, Electric Candyland. Just hit the picture below to be taken to Dropbox Shop.