Higher Ground

Monday 30 November 2020

Global stock markets soared in November as three big themes converged with powerful optimism: vaccine development, a new administration in Washington, and the prospect for climate investment. Notable were the advances in equities that covered new energy and transportation technology. LIT, the GlobalX ETF covering lithium and battery technology rose 26%. TAN, the Invesco ETF covering solar panel and equipment manufacturers rose 24%. ICLN, the iShare ETF that holds a broader basket of solar, wind, battery, and other cleantech names rose 22%. GRID, the First Trust ETF which concentrates on electronic equipment and components, rose 20%. These gains all took place in just one month, through 27 November. In a sign of market breadth, VT, the Vanguard ETF covering every market in the world, rose 13.5%.

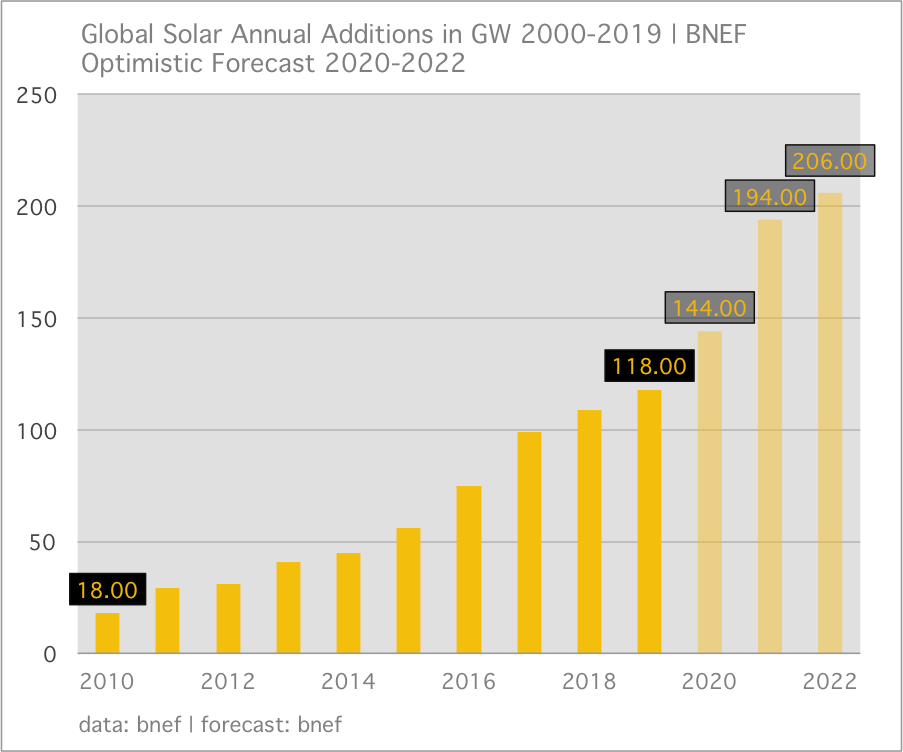

The upward action is not without some volatility, even as technical measures of market volatility and risk, like the VIX, fell. SolarEdge, a US domiciled Israeli provider of utility scale solar equipment for example was trading at $180 in mid-September, rose to $318 in mid-October, fell to $190 in early November and then closed out last week at $288. Like its counterpart Enphase (ENPH), SolarEdge is trying to discount the very difficult math of a world struggling to emerge from pandemic conditions (with all the drag on demand, and poor labor conditions that entails), with a quickly brightening picture not only for 2021 but the next few years as solar growth forecasts are boosted significantly. Bloomberg New Energy Finance analyst Jenny Chase offered a sneak peak of her team’s latest solar growth outlook last week, and the optimistic case she hinted at was nothing less than astounding. Little wonder, therefore, that all the new energy technology names—everything from solar to wind to EV and batteries—are suddenly alert to the possibility of a massive upward growth spike, one that brings the pandemic year to a dramatic resolution.

Pretty clearly, a key booster rocket to this optimism was the growing acceptance that Biden would not only take office, but would aggressively get to work on climate at the international level. Thus, this week’s Gregor Letter begins where we left off last time, on November 16, 2020, when I addressed the powers Biden could exploit were he restricted to executive action, without senate control. Indeed, the rather important naming of former Massachusetts Senator and Secretary of State John Kerry as Climate Envoy is a major signal that the new administration very much intends to create a path to climate action along the axis of international diplomacy. As someone from Massachusetts originally, I’ve watched Kerry for decades. And I think it bears mentioning that he came of age during the Kennedy era, when Washington not only accepted but embraced its internationalist role in the post-war period.

Surprisingly, markets are treating this development with the same type of reaction one might have been anticipated if, instead, Democrats had gained control of the Senate and with it the expectation of a domestic Green New Deal—a version designed exclusively for the US. One interpretation therefore, when surveying the market gains in November, is that markets very much agree that a global level strategy for climate action matters at least as much, if not moreso. And with regions from Asia to Europe already pledging aggressive decarbonization targets, markets clearly anticipate a tidal wave of fund flows as every participant from large institutions to the individual investor races to get positioned for what’s coming. The share price of Tesla (TSLA) may be instructive in this regard. Already slated to be placed in the SP500 index, the company’s valuation skyrocketed by 44% over the past month, in a strong indication that there are not enough pure play names to sate demand already coming from global investors. And just to say, concerns about Tesla’s valuation were already becoming more frequent, even among those who were never negative on the company’s future. Indeed, just about every security in the EV and automobile space, from SPACs like SBE to the Chinese EV maker NIO, to (even) Ford and GM, was on fire last month. This led to the predictable criticism that a bubble is forming, and perhaps that is true. But bubbles tend to last a while; tend to go further than one thinks possible; and nearly always have fundamental drivers behind them. Bubbles are also an effective phenomenon to get new technology deployed. So, if you have been hoping to see the rollout of clean energy and clean transport and electrification run at a much faster pace, good news: having seen which way the policy winds are blowing the capitalists are stirring, and may soon be stampeding.

Gold fell precipitously, breaking multi-month support, as global capital turned away from an ongoing thesis of slow growth to the prospect for an industrial recovery. Coming into November, gold was already under pressure from rising real interest rates; or to put it more accurately, real interest rates that were becoming less negative. For months, since the all time high, gold suffered multiple failed rallies. And then, rather dramatically, on Monday 9 November when further vaccine development news broke, gold fell by over $100 from $1960 to $1850, and has since been unable to recover. Gold now trades below $1800, around $1770 as we go to press.

But our concerns are not tied to gold, specifically. Rather, what we care about are the direction of interest rates; and the use of gold exclusively as a signal for rates, and hence economic growth. And now we have a fresh signal: the slow growth and plodding recovery thesis is under mounting stress. This is especially true given the renewed weakness in the US Dollar, also a strong indication that markets believe global trade is set to firm, and that risk is falling. Here is what I wrote, the last time I addressed gold as an indicator, in the 7 September issue:

As we head into the election, therefore, a kind of battle is going to intensify in my view between deflationary forces that will continue to pressure interest rates lower, and reflationary forces that begin to prospect for investment returns outside of assets like government bonds, and gold. You can use gold, therefore, as yet another indicator to gauge the road ahead. Contrary to the common view, for example, that gold is a protector against inflation—a thesis that is largely anchored to the 1970s—gold has instead acted in recent decades just as PIMCO describes: a non-yielding long duration asset that is impacted just like a long duration bond, ultra-sensitive to forward looking market views about economic growth.

If gold continues to stall in price over the next few months, I will conclude that we are looking at a standard recession, that will start to lift late next year. If gold goes wild to the upside again, I will conversely conclude that government bond rates are headed back down, that the testing at the long-end will resolve into a much slower recovery.

Gold’s sharp move lower has been accompanied by another technical break: the US Dollar Index moving more decisively below 92.00. Here is typically what happens in the aftermath of economic crises: the US Dollar spikes during the crisis, interest rates fall to zero and often go negative in real terms, measures of risk rise, and all these indicators dig in at those extreme levels to discount a long period of grindingly slow growth. Eventually, one by one, they begin to dislodge themselves from those impacted positions. And here we are. Looking ahead, it might be reasonable to say interest rates have bottomed for this cycle. That’s what gold is starting to tell us. Should we be concerned that interest rates will rise dramatically? Not really. The drag from the pandemic will constrain interest rates for a while yet. And moreover, we have to remember that if this decade is going to be defined by the rapid deployment of new energy technology, then we are potentially looking at a deflationary boom, one reminiscent of the late 1990’s.

What if quantitative easing and other stimulus measures undertaken by central banks were more directly tied to climate action? Sweden’s Riksbank continued to offer forward looking commentary in its latest minutes that suggested sustainability and carbon risk would play an increasingly important role in its asset purchases. From the 25 November Annex to the minutes:

In addition to applying the norm-based negative screening when purchasing corporate bonds, the Riksbank also intends to measure and report carbon footprint in its corporate bond portfolio. This will enable the Riksbank to promote the reporting of climate pollutant factors in general and to create incentives for companies and other organisations to measure and report their greenhouse gas emissions.

A number of economists have, for years, suggested the ECB should underwrite a green oriented stimulus package, and the folks at analytical shops like Bank Nordea have been forecasting since summer that “Climate QE” was inevitable. That the ECB’s Lagarde has also given voice to the idea is also driving investment in climate-aligned investment flows. Again, this is all part of the current convergence, in which global capital senses an imminent recovery that is both organic, but which will also be directed by policy towards new energy technology.

Union Square Ventures, a New York based venture capital firm, is reportedly raising its first climate-tech focused fund. Reported in the WSJ, the plans now afoot at USV follow a summer announcement in the same vein from Chris Sacca, most recently of Lowercase Capital. As you might have guessed, Chris has named his new venture Lowercarbon Capital. Elsewhere, Chamath Palihapitiya has also announced his intent to become active in the space, and has provocatively said that the world’s first trillionaire will be made in climate change.

Let me offer a some brief comments about the contours of the opportunity ahead, for venture. First, the currency of this decade, or perhaps the platform of this decade, will be the cheap and clean electricity that’s already competing against and winning against every other energy source. This electricity is already coursing through the veins of high penetration domains like the UK, California, Texas, and Europe. There’s more to come of course, and it will sweep the world. This is foundational to everything that happens next, and whether you are in venture or at a central bank, you need to understand this global rollout of cheaper, faster, cleaner electricity is unstoppable. What we want is for clean power to become a commodity. And that’s exactly what it will become. And there’s no investment opportunity for venture in a commodity. Best leave that to First Solar and Vestas, with their I.P. and their expertise as they roar through the learning curve.

As a currency, the commodification of clean electricity will essentially produce a deflationary boom, spreading cheap energy throughout the global economy. But clean electricity will also become the platform, on top of which all the good things can happen. Software, for example, will optimize not just the grid, but all the devices that derive their power from the grid. Together, solar farms, offshore wind arrays, EV, and buildings fitted with storage will create a kind of market for electricity, and software will always be the layer that enables and enhances interoperability. This is already underway in charging companies, big box storage, and elsewhere along the grid but there will be much more to come.

What greatly interests me is software that would enable every participant in the electricity chain to make better purchasing and investment decisions. We already know that the total lifetime cost to own an EV is now competitive, if not flat out lower than the cost of ICE ownership. It would be helpful if consumers had an app that made that calculation clearer, for them. This will also eventually apply to home batteries that can take surplus electricity off the grid at opportune times. At the other end of the spectrum, utilities are already running Monte Carlo simulations to help them make better investment decisions. Last year, I sat through a two day seminar hosted by PacificCorp as they explained how they came to the conclusion they should shut most of their coal assets down as soon as possible, and build wind, solar and storage. How? Software. So a progression towards off the shelf software that would help not just consumers or utility companies but towns, cities, universities and other institutions make these investment decisions strikes me as a latent, pent-up need. You see, we have the fact of clean electricity as being cheaper and faster, but we don’t have the knowledge of it yet, distributed throughout society.

Just as in our last deflationary boom, the blossoming of systemic efficiency will create consumer surpluses and as I said, that becomes a kind of currency which economies can spend on other things. This is a harder phenomenon to capture or predict, but I have likened the decarbonization trend to something like the peace dividend from the dissolution of the Soviet bloc, or the initial rollout of the internet. Generally speaking, venture will want to pursue opportunities that follow this optimization trend. Any device or software that repairs, maintains, or enhances water, electricity, construction, transport and other similar systems will thrive. Readers know I have written about London quite alot and was on a trip there just this late Winter to discuss my ebook Oil Fall (I barely got out before the lockdown). But just to say, London is so much closer now to the tipping point where EV cars, EV buses, EV taxis, e-bikes, regular bikes, and interoperable information systems and apps all work together in a seamless way. If you are in venture, you might want to study and talk to professionals in the e-bike industry because in a single e-bike one almost has the universe-writ-small: what was at one time a simple device of metal has now been hoisted into a network of electricity charging, safety and information monitoring. My own discussions with people in the industry indicate that e-bikes will eventually be fitted with simple radar, will have sensors to know if you have crashed, will send and receive internet information, will charge wirelessly, and will record your movements if you get lost, or go missing. Again, this is all made possible through the learning rate at which batteries are progressing. There are high end e-road bikes now with batteries so small in the downtube you would never know either by looking, or especially, by feeling their weight.

To sum up, clean electricity is coming to everyone but it must be made intelligent. That is venture’s opportunity, to tinker at the edge of this burgeoning ecosystem, wringing out further efficiencies and embedding extra value. Hope this helps!

Here comes the next wave of cheap, clean electricity as global solar growth is set to explode higher. As referenced above, BNEF is out with their forecast to 2022, and I grabbed their optimistic case, and wrangled it into a spreadsheet. Despite the pandemic year, BNEF sees at least 120 GW of new solar added this year in their conservative forecast (not shown). But in their optimistic case, we go as high as 144 new GW this year. While we can’t back out these global figures easily from industry reports, I would point out that First Solar’s last earnings report beat revenue expectations handily, and in reference to my last letter, glass shortages are now appearing in China.

A bit more on that: while I have not seen the full BNEF report, its author Jenny Chase did additionally remark that solar demand could pace significant pressure on global glass supply. This opens up the possibility that panel manufacturers, who typically operate in a tougher, tighter margin reality may actually get some pricing power over the next several years. We should be happy to see it. A company like First Solar, which has worked tirelessly to optimize every aspect of panel production, from basic energy efficiency to panel sizing that ingeniously aligns best with shipping and site construction, deserves a break from the ruthless deflation that stalks the sector.

Needless to say, a world which builds 200 GW of fresh solar capacity in a single year is a world few, even the optimists, saw coming just a few years ago. In such a world natural gas becomes, after coal, solar’s next victim. In such a world, a kind of recognition will set in that decarbonization is inevitable. Capitulation, if you will.

General Electric’s new offshore wind giant, the 13 MW Halilade-X, will be deployed at the latest, biggest offshore wind farm in the world. Dogger Bank in the North Sea will host 190 of the GE wind turbines to form a a 2.5 GW power array. That is incomprehensibly large. According to CleanTechnica, a single rotation of the turbine’s blades would produce enough energy to power a UK home for two days. It must be said: the ability of the wind industry to continue ploughing through the learning rate, uncovering more savings, more efficiency, more power, is almost shocking.

The Gregor Letter base case for economic recovery is pretty simple now to understand. And frankly, there’s not as much to say as we head into the end of an awful year. Stock markets are going to continue running well ahead of any labor recovery, which will continue to be slow until we get past a very tough winter. Central banks will probably have to build another bridge, at least a short one, to get us to Spring. My hunch would be they openly embrace climate focused infrastructure investment, and get on board (in some way) to be supportive. I am reminded of the moment we reached in late 2011, when many understandably felt the economy was double-dipping. Then, like now, gold peaked and started to fall, and by the following year, enough people agreed things were getting better to secure Obama’s reelection. I think 2021 could play out in similar fashion. Stocks will be firm or going up, and that will strike many as crazy (as it has already). But it will still take at least another 18 months if not 24 months before we get back to pre-pandemic employment levels. And for many workers, that will be tough—just like it was in the last recession.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.