Lone Star

Monday 2 November 2020

ExxonMobil maintained its dividend after reporting another quarterly loss, strongly suggesting the company has no real plan for the future. The decision came as Exxon announced it would cut 15% of its global workforce. At the current rate, the payout yield is now running at the caveat emptor level of 11%: it’s not clear the obligation to shareholders is even covered by cash flow. A helpful framing to understand Exxon’s lack of strategy here is to consider that $80-$130 trillion will need to be invested between now and the year 2050 in electrification and modernization of the global energy system—that’s according to a newly released report from Bloomberg New Energy Finance (BNEF). But the shortsighted decision to pay out such a large and unsustainable dividend in the face of such a revolutionary change globally indicates Exxon cannot formulate or imagine any way to participate in such growth. Liquidation, it would appear, is the company’s best idea.

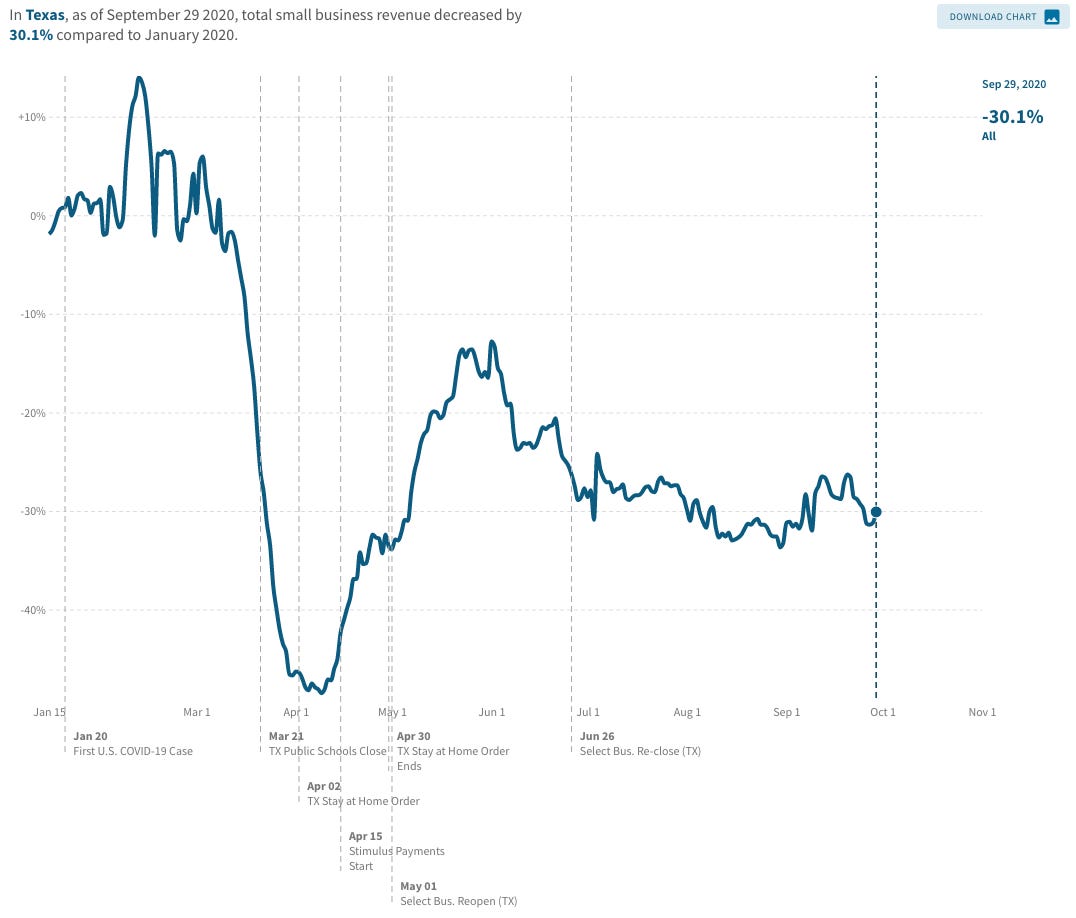

The Texas economy is slowing again, right into election day, as problems in the oil industry mount. The Federal Reserve’s Beige Book report, covering activity through 9 October, indicated that the energy industry in Texas had begun to stabilize. However, later in the month the Dallas Fed reported that retail sales were starting to decelerate, and some of the details in that report looked rather deflationary. The employment picture meanwhile is largely tracking the rest of the country in terms of overall shape (a flattening of the recovery) but compared to January 2020 levels, Texas employment is underperforming, down 7.9%, vs the country as a whole currently down 7.5%, according to data from Track The Recovery, at Harvard University. The same research group also shows that small business revenues in Texas, through the end of September, remain down over 30%.

Voting participation in Texas it entirely off-the-hook, as first time voters and less frequent voters storm the gates to make their voices heard. Through the end of October, early voting and voting-by-mail summed to more votes than were cast in total during the 2016 election—indeed 107.8% of the 2016 total, according to The Election Project. And election day is still to come. The Lone Star State is on course to see its total votes rise by an enormous 30% this year, to as much as 12 million, from 2016’s 8.97 million. Because demographic trends already placed Texas on a course to turn blue starting in 2024, many election observers wonder whether that transformation has been pulled forward to the year 2020, as the same motivation that drove voters to polls nationally in 2018 (to vote against the President) are driving them again this year. If Biden does win Texas this year, it will be a victory entirely unlike Jimmy Carter’s 1976 win, the last time a Democrat won the state. Rather, if Texas turns blue it will be seen as a re-drawing of the US electoral map, as post-industrial states of the northeast (many of them losing population) increasingly turn undependable for Democrats while the southwest from California through Arizona to Texas, with growing and diverse populations, tips further away from Republicans.

In the same way California increasingly runs on solar, Texas continues its steady march towards higher penetrations of wind power. In 2019, wind capacity grew by an enormous 17%, from 24.1 to 28.1 GW, and took wind power up to 18% of total electricity generated in the state, according to the EIA in Washington. If Texas were its own country, it would rank 5th globally for installed wind power. And there’s much more to come. According to the EIA, Texas will have deployed another 5GW of wind capacity by the time 2020 concludes, and is currently slated to add 3.6 GW in 2021. That would mean the estimated 25,000 wind related jobs in Texas will grow further. And from a top-down view, once Texas moves through the demand-shifting curve—in which incentive programs shift as much demand as possible to high wind/low demand hours overnight—Texas will then become a prime candidate for storage deployment

Texas should now be regarded as the crossroads of America’s future. While popular views of Texas still anchor to its historical identity as a land of cowboys and oil rigs, the Lone Star State has decidedly taken on California-like qualities in the past two decades as an international center for health care, technology, and global immigration. Indeed, many Californians continue to move to Texas (especially to Austin) which has only pushed the state further towards its electoral tipping point. Harris County, which covers most of Houston, is also analogous to Los Angeles County in that it’s the third most populous county and now regarded as the most ethnically diverse county in the United States, with a population greater than 24 US states. And, as the state with the second highest population overall in the country, Texas offers the richest electoral prize outside of California at 38 electoral votes. But that total is going higher after the results of the next census. California may lose a vote, moving from 55 to 54, but Texas is expected to advance from 38 to 41 votes. Needless to say, but it has long been predicted that once Texas becomes a tipping point or toss-up state in presidential elections, the Republican strength in the electoral college will vanish. Reliably taking Ohio and Pennsylvania, for example (at a projected 36 electoral votes after the census) simply can’t make up for the loss of the Lone Star State.

But it’s the transformation of Texas’ energy industry and broader economy that makes the state a fertile bellwether to America’s future. Austin has become a second Silicon Valley. Houston a center of biotechnology and healthcare. Economic reports from the past decade, especially from the Federal Reserve, indicate that the state economy while still tilted towards the oil and gas industry has accordingly diversified enough that oil price crashes can still dent Texas, but don’t destroy it. Indeed, it was ten years ago that famed oil man Boone Pickens began to declare that using natural gas to create electricity was crazy and wasteful, and began to promote the growth of wind power. Now, international renewable and renewable-focused utility companies like Germany’s E.ON, France’s EDF, and America’s new giant NextEra, all have a presence in the state. Despite the likelihood that chemicals and plastics still have some moderate growth ahead, it now seems possible to forecast that job growth in Texas within the oil and gas industry is going to flatten, and eventually decline. And renewable jobs will grow strongly. Soon, the wind turbine will share a spot with the oil rig as a symbol of state industry. But not too long from now, the oil rig will fade from such scenes.

Should Texas turn blue this week, its transformation will follow the pathway seen in most large systems which undergo long timeline change: slowly, then all at once. If a Blue Wave takes Democrats not only to the White House, but also to control of the Senate—and Texas plays a key role in that wave—then future government investment plans and incentive structures that emphasize new energy infrastructure will appropriately benefit Texas enormously. As most investors already understand, oil in the ground is now unlikely to ever appreciate again in value. And even if oil has a long tail of global dependency, it’s no longer an energy source that will require much growth of new investment. Should Texas, already at an industrial tipping point, vote for a new policy direction in the US, one that’s aligned with climate goals, then it will only be helping itself. While ExxonMobil is unlikely to spot the opportunity, the state in which Exxon maintains its corporate headquarters is very close to understanding that vision, and making sure it happens.

Joe Biden is on course to win the presidency, and the Democrats are equally on course to take the Senate to a 50-50 configuration. The final national lead for Biden in the 538 average stands at 8.6 points: 52% to 43.4%. As the New York Times points out, even if the polls this year are as wrong as they were in 2016, Biden still wins the election, but of course by a smaller margin. The public remains emotionally anchored however to the 2016 polling error, in which movement towards Trump in key battlegrounds was overlooked. As a result, the public keeps forgetting a key truth from 2016: Trump’s victory was such an extreme edge-case that only the slightest shift towards Biden—even from just, say, voters who chose neither Clinton nor Trump in 2016—is enough to break Trump’s competitiveness in the year 2020.

Many election forecasters are also projecting that voting turnout will leap, from 2016’s 136.67 million votes to 160 million votes this year. Moreover, polling shows that the very high level of votes that went to neither main candidate in 2016—which took 5.7% of vote share away from both Clinton and Trump—is likely to decline greatly this year, down to 4%, or lower. What might be a reasonable projection, therefore, of this year’s outcome in terms of the popular vote?

Well, one useful concept that might be employed as a guide is Trump’s popularity or approval level which has hovered persistently around the 42-44% level for several years. Sometimes this approval level dips quite low, towards 41% and sometimes it crests around 45%—but each time reverting to 42-44%. What was Trump’s vote share in the 2016 election? 46.1%, just above the approval levels that would dominate much of his presidency. Amazingly, Trump’s national polling in 2020 also consistently centers on this very same level, and, the 42-44% level appears over and over again in many state polls.

Using Biden’s average 8-9 point lead, and projecting 160 million total votes, what might the popular vote breakdown look like? Sure enough, Trump would take about 70.4 million votes at his habitual 44% share; Biden would take 83.2 million votes for a 52% share; and the rest going to candidates other than Biden or Trump would account for 4%. In such an outcome, the narrative might be the following: Americans surged to the polls and gave Trump more total votes than in 2016, though his share fell from 46% to 44%. In Biden’s case, he was able to advance above Clinton’s 48.2% share in 2016 by bringing many older voters, new voters, and exiled Republican voters to his cause, while also benefiting from a 2020 phenomenon: 2016 Other voters realizing once and for all that a vote for someone other than the two main candidates is a wasted vote. While such an outcome would be a strong repudiation of Trump—not dissimilar to the rejection of Jimmy Carter’s single term—it would remain to be seen whether the election would “feel” as revolutionary. But if Democrats took enough senate seats to get beyond 50-50, that might begin to feel more like 1980. (N.B. Reagan beat Carter by 9.7 points, 50.7% to 41.0%, as the third party candidate John Anderson took a large 6.6% share of the vote.)

The Gregor Letter election map, last published in late September, has therefore not changed. Despite the last minute fretting over Pennsylvania, Biden very likely starts out with 291 electoral votes (21 more than needed to win the presidency). He does so by winning all the states Hillary won, and taking back the three key states Trump one by a sliver: PA, MI, and WI. It’s just that simple. Biden also likely gets Maine’s second district and also Nebraska’s, for another two votes that Hillary missed. From there, it’s just a question of bonus states, and, nearly-as-crucial senate control.

Bloomberg New Energy Finance released its New Energy Outlook 2020, with projections to the year 2050. BNEF agrees that global coal demand has now peaked for good, that global emissions from energy combustion have peaked for good, but interestingly, does not agree that oil demand has peaked for good…not yet. Just on the emissions front, BNEF projects that global emissions peaked last year at 31.9 Gt CO2, and will rise again after the pandemic driven decline into 2027, a second peak that never matches 2019’s. Thereafter, emissions fall steadily.

Looking more closely at the BNEF oil forecast however reveals that, while there’s a difference between a flatline and their own growth outlook, it’s not a large one. Slow growth describes the BNEF oil consumption pathway to a peak in 2035. In their projection, global oil demand moves from 189 exajoules (EJ) in 2018 to 211 EJ in 2035, then back to 189 EJ in 2050. That progression, from 189 EJ and back again, moves at just a touch more than a half a percentage point each year. Not much, but it does add up and it’s indeed a surprise to see BNEF leaning on such a long-tail of oil dependency—with an upward drift.

For what it’s worth, The Gregor Letter also sees a long-tail of oil dependency, but one with a declining drift that sets in sometime later this decade. In other words, hope for an imminent decline in oil consumption is likely to be premature. But the notion that oil consumption can rise nearly 10% from 2018 to 2035 seems aggressive. One phenomenon that supports the view of a 2019 peak is the pandemic itself: it arrives at the exact moment global transport is electrifying, at the start of the key decade when the EV adoption curve is set to soar. The pandemic is therefore holding demand in check, and may do so for a full two years. Accordingly, global oil demand that oscillates, without sustainably rising or falling, is the likely outcome for another several years—at which time the accumulation of on-road EV starts to become a real force. | To obtain the executive summary of NEO 2020, you will need to supply your email to BNEF at this page, after which they will send you a link to download the PDF.

The Gregor Letter base case for economic recovery remains unchanged. The likelihood of a Biden win and control of the senate is strengthened by the final round of polling. While the lame-duck period will be difficult, markets will find it hard to resist the beginning of the discounting process in which domestic investment, stimulus, and far better pandemic management are plugged in to growth and earnings models for 2021.

Yes, it is extremely discouraging that the pandemic has returned both here, and in Europe. But a very bad 2020 was already in most models, and, in The Gregor Letter base case. As readers know, this is why I have not wavered from my view that global oil demand would fall by a full 10 mbpd this year, the high side case which other forecasters edged away from in summer, and to which some forecasts (like OPEC) are now converging.

Interestingly, the one source of minor trouble that could complicate 2021 and the recovery into 2022 would come as a result of global markets genuinely believing that much higher growth was on the way: rising interest rates. As some may recall, when reflationary policy was eventually accepted during the great recession, around late Q1 of 2009, interest rates rose steadily for about 12 months. Yes, they were coming from very low levels. And if rates start rising now, they too would be starting at very low levels. But when interests rates start to trend, levels are important but so are the changes. For example, if the yield on the 10 Year Treasury were to double, from 0.86% to 1.72%, the higher level would still meet the definition of a low rate. But the doubling would begin to impact risk assessment of many investments, including renewable energy. For example, if an institution is bundling up cash flows from utility-derived earnings and offers, say, a 5% yield return to investors—that looks extremely attractive when the yield on the 10 Year Treasury is below 1.00%. But the equations does start to change if the treasury yield is sitting 100 basis points higher.

All this said, the global economy would be delighted to get back to growth, and would be happy to pay higher interest rates as the price of admission to a far better growth domain. But it’s something readers should ponder.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

Photos: 1. Map of Texas rivers and tributaries. 2. James Dean on the set of Giant, Frank Worth, 1955.

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.