Material World

Monday 14 December 2020

Solid state battery technology is advancing towards a breakthrough, one likely to become commercially available by 2025. Quantumscape, a ten year old company that emerged originally from Stanford, and whose investor stable is anchored by Volkswagen, released performance data this week in a “battery day” presentation that stirred the animal spirits of stock market investors. QS (the company’s NYSE stock market symbol), revealed that it had landed upon a ceramic separator layer as part of its solution-set to rid traditional lithium-ion battery technology of the liquid layer that constrains energy density, cost declines, and charging times. The dramatic emergence of QS, via the SPAC structure, presents an array of risks for every EV and battery entity without solid-state technology exposure, and also, to investors betting on the company’s singular success. Indeed, the history of technology (re)evolutions indicates that groups working to solve the same problem often arrive with solutions, independently of each other, around the same time. Toyota, for example, has also emitted solid-state signals this year—declaring this past summer they too would harness this technology by mid-decade. And more recently, Nikkei Asia reported Toyota was ready to reveal a solid-state prototype by next year, 2021.

The battery technology sector, as the experts will tell you, has historically been dominated by over-promises and under-deliverance. Solid-state has been a kind of holy grail for decades. In the 8 December QS presentation however, done live-by video, Venkat Viswanathan of Carnegie Mellon, optimistically noted (and I paraphrase) that the QS data promised to solve ‘the and problem; where every attempt at solid-state has been stymied by the challenge to make a battery that charges quickly and can be operated in a range of temperatures and is affordable and can be scaled up into a battery pack.’ At the moment, QS has tested a prototype, a thin packet really (about the size of a playing card) that will need to be scaled up into a full deck of cards, and then replicated into a larger pack. Sober experts seem to agree the road ahead is still fraught, and that scaling up will unleash further challenges. Still, very-online battery experts from Tesla’s Ethan Woodbury to ScaniaGroup’s Matt Lacey weighed in this week with congratulatory, yet justifiably cautious remarks.

QuantumScape is receiving additional buzz because it’s successfully attracted a constellation of well known investors and sovereign wealth funds. In addition to VW’s senior stake, Bill Gates’ Breakthrough Ventures is heavily involved, as is Kleiner Perkins, Vinod Khosla, and the Qatari Investment Authority. Jeremy Grantham, it was also revealed, made a very early personal bet on the company in 2010, and has now enjoyed a $200 million dollar windfall. J.B. Straubel, formerly of Tesla, is also behind the project and his career commitment to solid-state is a nice opportunity to make a salient point: all those battery engineers at Tesla and other companies still working on traditional lithium-ion are not exactly making a career mistake. Why? Because traditional lithium-ion is still powering through the learning rate, getting better, getting cheaper. So if you are adventurous and like risk, it’s easy to understand how persuasive it could be to chase the holy grail. Meanwhile, the traditional battery-pack continues to improve.

But solid-state technology presents an enormous commercial risk for any automaker (and battery maker especially) who, without a hedge, may find themselves naked in the emerging topography of electrified transport, post 2025. Indeed, the risks are very extreme—in both directions. Let’s consider VW. By 2025, VW could emerge with both an equity and commercialization partnership stake in QS that is so singular that the rest of the industry will be caught flat-footed, to say the least. Alternately, Toyota or Tesla or Panasonic might emerge earlier, with a solid-state offering that handily beats the QS-VW venture. Or, perhaps everyone arrives at a solid-state battery pack at roughly the same time, obviating the monopoly risk that the industry could cleave, between the haves, and the have-nots. Regardless of which outcome, we already know who the ultimate winner will be. Electrification (the key to climate action) will only be further boosted and enhanced by the race underway currently in battery technology.

Is an arms race now unfolding in battery technology? Bring it on. Batteries large and small, paired with software, are the pathway by which intermittent renewable energy not only trounces other forms of power generation, but, unleashes a digital marketplace for electricity. Take, for example, the first dedicated EV charging station which opened this month in the UK. Deployed by GridServe at a location in Essex, the station draws renewable power from both the grid and an overhead array of solar panels. But the most important feature of the station is the onsite 6 MWh battery that will grab cheap power whenever it’s available (say, overnight, when the UK’s vast and growing supply of wind power is in surplus). The station is just the first of 100 to be deployed by GridServe.

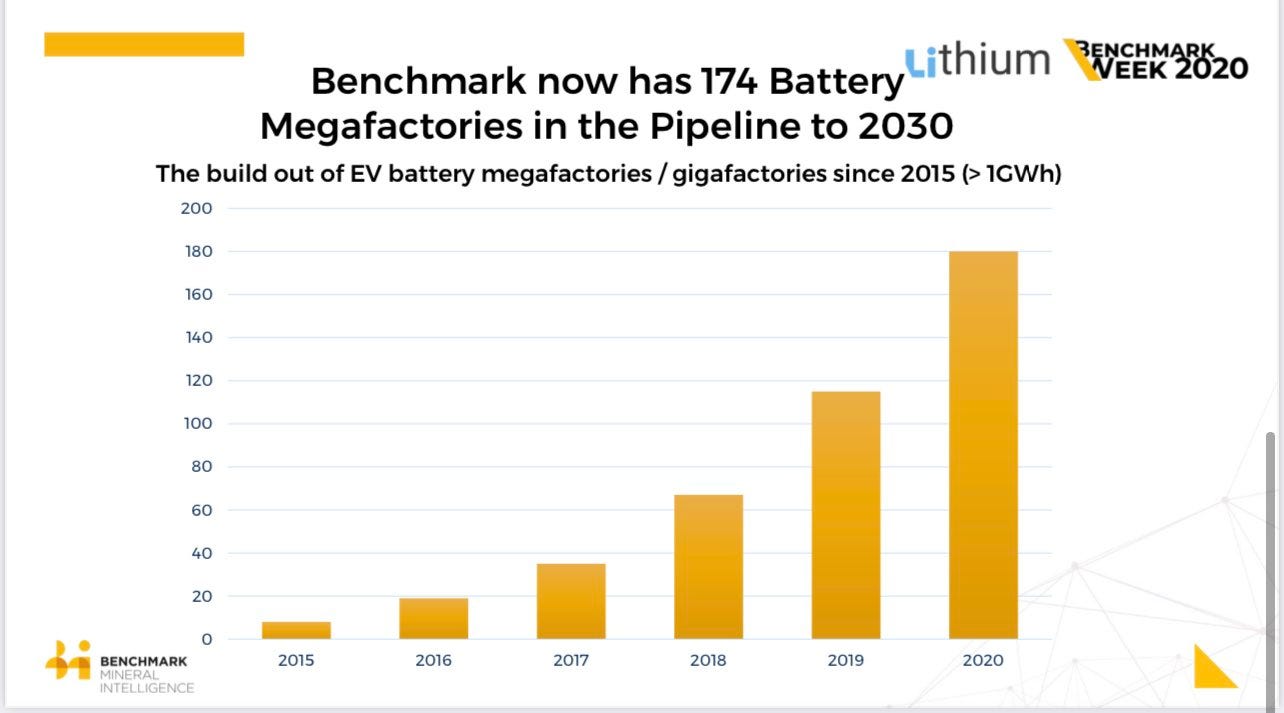

Needless to say, battery demand is going to go through the roof in the years ahead. According to Benchmark Mineral Intelligence, the buildout of battery megafactories is about to go supernova.

The burgeoning need for batteries is increasingly obvious: corporations, schools, governments, and any institution with a portfolio of real estate will eventually consider batteries as a standard feature either to be installed in new construction, or to be retrofitted into existing RE portfolios. Doing so will unlock an array of advantages: everything from daily arbitrage of power supply prices, to offering charging services to employees. So, it’s not just the vehicle market that will drive demand. The future condominium buyer, for example, will expect their building to be fitted with charging services, and the building’s owner will understand the way to offer those services, while taking a piece of the profitability, will be through an onsite battery. Eventually, it might be the case that new home construction too will come with a battery rather than rooftop solar, because the former will add so much value and the latter (at small scale) will no longer be efficient compared to grid supplied solar. The next question becomes, where will we source all the required lithium?

Investment is quickly coalescing around the entire lithium-to-battery supply chain. The state of California, seeing the opportunity for lithium extraction in Imperial County, has moved in a very business friendly direction of late, and is now referring to the region as a potential Lithium Valley. According to Bloomberg, California officials would like to see an integrated industry arise in the region, in everything from lithium production to battery output. To the north, in Kern County, the Anglo-Australian mining group Rio Tinto discovered in 2019 that tailings from previous mining waste contained enough lithium to make reprocessing and extraction of that above-ground resource economic. And a newly launched public company (via SPAC), MP Materials has also brought legacy mining assets back into production—this time, in San Bernardino County, California—with a concentration in rare earth elements. In a sign however, of how the past decade was a preview of the next, a dedicated lithium+battery ETF—which seems like it would be a creation of the last year or two—actually started in 2010. LIT, from the Global X family of ETFs, reveals something however in a comparison of performance timelines: up only +2.28% the past ten years, but, up +65.68% in just the past year. Finally, as we go to press, Tesla has indicated that it will start having trouble keeping up with demand for its cars, and is exploring ways to increase production.

Readers looking to understand the industrial, agricultural and social history of Imperial County might consider reading Imperial, by William T. Vollmann. One of the more challenging issues energy transition is going to encounter soon, despite all the fossil fuel extraction that is going to go away as a result, is the new call on natural resources as copper, silver, iron ore, and yes, lithium, are required in increasing volumes. A single wind turbine requires at least a half a ton of copper (if not more) and energy transition will require lots of steel—and that means iron ore. Imperial Valley, along with other southern California counties, could produce hundreds of thousands of tons of lithium per year. But that would come on top of a century of environmental degradation that has left alot of destruction in its wake. (The county was named after The Imperial Land Company, which diverted water to the region at the start of the 20th century. Fancy that; an entire county named after a company.) If you do decide to take on Vollmann’s book just know it’s a monster, at over 1200 pages. (You could also try the NYT book review, from 2009). For a briefer look at some of the environmental challenges ahead for this region, please see this excellent piece by Justin Gerdes at Energy Monitor which covers approaches less impactful to recover the region’s lithium, while also ensuring the local economy fully participates, with far better equity.

Could Jevons’ Paradox make a comeback, during the coming decade of energy transition? William Stanley Jevons observed that as we use a particular energy source more efficiently, that same energy source becomes far more cost effective as an input cost to the production of goods and services. The result is an increase in the energy source’s economic proposition, as it becomes even more competitive, and propagates across the economy, leading “paradoxically” to an overall increase in demand for the energy source. Many fear we will repeat this experience in an age of electrification driven by renewables, and, wind up with a far bigger call on natural resources, and higher global emissions.

Generally speaking, this is unlikely to happen. If we apply Jevons’ observation to renewables, you can pretty quickly see that…we will simply get more renewables. In other words, in an age of plummeting prices for wind, solar, and batteries, the Jevons effect becomes your ally. Adoption of wind and solar is already generating benefits just on costs alone, due to the learning rate, in which costs per unit drop as more units are produced. So we are already winning victories through adoption of wind and solar. Domains from China to the UK, from Europe to California are seeing rapid displacement of previously expected fossil fuel growth, with clean energy growth. As I have written extensively, this is likely to trigger a deflationary boom (Schumpeter) because electrification driven by wind and solar is eating into the enormous waste of the fossil fuel system. Again, more victories. And if you’d like to pause here, and educate yourself more fully on the Jevons’ effect (the rebound effect), Noah Smith put up an excellent primer this week, one that takes you clearly from knowing nothing about Jevons to this same understanding: why renewables are not likely to lead to a damaging rebound effect.

But my concerns are not at zero, on this issue. While I totally agree that any rebound effects from rapid renewable adoption will redound to even more adoption of renewables (and that’s awesome) I also believe this will create consumer and commercial surpluses in the form of purchasing power, and extra capital, that can be devoted to more consumption of everything. Not just energy, per se. We know the fossil fuel system loses at least half of combusted energy to the atmosphere in the form of waste, and renewable driven electrification steadily eat in to that waste. Colloquially, we might say renewables will incrementally undertake the project of reducing every two dollars spent on fossil fuel energy down towards one dollar. The result will be an ongoing efficiency dividend. What will the global economy do with that dividend? Perhaps it will take more trips on airplanes powered by solid-state batteries! You can easily think of myriad demands that might arise if global populations are richer through renewables, with more purchasing power. So yes, I do think there’s a real risk that renewables will trigger very strong economic growth, and the consumption increases that nearly always show up with such growth.

Still, it’s hard to get too concerned about demand unleashed in the future from cheap, clean electricity when the other side of the energy balance sheet, one dominated by fossil fuels, enters steady decline. This is just the kind of high-class problem one dreams of having, frankly. To be sure, along the way, we will be treated to warnings about the very increased calls on materials I’ve discussed already, in today’s letter. But again, context: rising demand for copper, iron ore, lithium, silver, rare earth, glass, lumber, and even cement in the service of long-life energy infrastructure looks like a winning deal as shipping volumes of coal, oil, and natural gas stagnate, and enter decline. It must always be remembered too that the fossil fuel system requires, and has always required, that extraction and combustion occur 24/7/365.

Not so with renewable infrastructure. Once erected, renewables act just as you would expect collection devices to behave: they sit there, with fewer moving parts, and do not require mile-long freight trains to deliver their inputs. Renewables are a long-term investment. Fossil fuels are chronic; and that’s an important feature to their declining competitiveness against renewables. Indeed, renewables are so cheap now, and deploy so rapidly, that the cost of fossil fuel energy units themselves, like a ton of coal, is no longer the intractable problem fossil fuels now face. Rather, it’s all the enormously expensive supply chain infrastructure and chronic maintenance costs fossil fuels require. Let me be bold: I don’t think a new coal plant would pencil out now over a 25 year time frame against wind, solar and storage even if you locked in coal supply at zero. The price of coal is not coal’s problem.

For those of you who want to dig even deeper, I still regard this 2012 four-part post by Dave Roberts at Grist (later of Vox, and now on Substack) to be masterful.

The Gregor Letter base case for economy recovery remains unchanged. While the US remains an outlier in its lack of social safety-net support, most other developed economies have continued to trot out such policies as we get nearer now to an organic recovery. Commodity and materials prices are soaring as production and consumption starts to return, with likely more price advances on the way as various vaccines begin to roll out. We are moving therefore into the standard recession portion of the post-crisis period: very importantly the US Dollar index continues to fall, confirming that transition. Still, the path to a future labor recovery here in the US, while visible, is certainly more problematic to the extent household balance sheets are being impaired now, here in the later stages of the pandemic. As I mentioned in the last letter, therefore, a double-dip or something that feels like a down move in the economy is a real risk. This opens up the possibility that the Federal Reserve could be more dovish than expected, and may be inclined—in the meeting coming up this week—to make at least one new gesture (further bond purchases, expanded asset purchases, renewed commitment to not raise interest rates) that would create, at least, a sentiment bridge to 2021.

In the near term, we are sort of in a holding period as we await the formation of the new administration. And really, after the result of the two senate elections in Georgia on January 5, 2021 we will then be able to say something more specific about the outlook for next year. Those two elections will determine whether the Biden Presidency has control of the senate, or, whether it will have to proceed using only executive power. As Robert Frost might say, those are two very different paths, ones that will make all the difference.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.