Oil Fall

Monday 9 March 2020

An oversupply problem has been building in oil the past five years, and now the truth is bursting forth, leveling the market’s precarious structure. The last oil cycle roughly ended in 2014, when oil prices permanently lost contact with the $100 dollar era. Since that time, investment by the industry in new supply has been greatly curtailed. Indeed, while oil prices and share prices of producers oscillated, sometimes advancing and other times faltering, the share prices of the oil and gas service sector never recovered—a reliable signal of the future, from the industry’s leading edge.

With the last oil cycle slipping into history, and without enough forward-looking demand growth to drive new investment, the industry then set about managing the only factor it could feasibly control: supply. Both Russia and OPEC therefore proceeded to curtail their own supply growth, which seemed logical at the time, in the hopes that such a strategy would put a floor under prices. More or less, the strategy worked.

Structurally, however, the strategy was accruing a debt. Commodity markets are very much their own type of beast, and no matter how inventive humans become in managing them through futures, swaps, hedges, and other financial innovations there is a physicality to commodities that can never fully be altered. This is neither a bad thing, nor a good thing. Futures markets also are very clearly one of humankind’s greatest inventions, an apparatus to both absorb and display broader informational inputs from participants, across time. Indeed, what futures markets began to display is that the longer-term price of oil was very unlikely to rise again—an echo of the signal coming from the oil and gas services sector. Why might that be?

Well, one must never forget every barrel which OPEC cuts is not erased, but rather, moves from the production side of the ledger to the capacity side of the ledger. Discretionary cuts from OPEC, or even just growth curtailments, are events on an Excel spreadsheet. The futures market is no dummy, and has been aware of this accounting move for several years now. In other words, the futures market kept its eye on the physicality of OPEC’s supply, and was willing to allow near-term oil prices to rise on the back of curtailed supply, but not long-term prices.

To illustrate, OPEC’s share of total global supply began to fall quite notably, starting in 2015, from a 40% share to a 35% share today. That is not a small shift in the share contribution of total supply. As everyone is aware, the annual incremental growth in demand, while weak, was instead sourced largely from the United States, where outright production grew from 9.44 mbpd in 2015 to 12.24 mbpd in 2019.

(nota bene: US production supply growth 2015-2020 was largely the dividend from much larger, previous investment cycle from 2007-2015, during the early and more capital intensive phase of fracking technology’s learning curve).

So, while OPEC and Russian capacity potential was either growing, or at least holding steady behind discretionary cuts, US capacity was also growing strongly. Now you see the problem. The US got itself up to ramming speed for a large volume of demand growth that has never truly materialized, while at the same time OPEC and Russia held supply capability in reserve. Thus, one large block of supply overhang was kept waiting in the wings, as another large block of capability grew unabated. At any point, if by chance, a recession were to enter this picture such structural weakness would be quickly revealed. Worse, if OPEC and Russia were to lose their resolve over supply curbs, then, truly destructive forces would be unleashed on oil prices. And as you know, this is precisely what’s unfolding right now.

But let’s not get ahead of ourselves. We don’t want to mistake the intensity of a shorter-term crisis with the longer term problem of oil growth falling to a flatline. Let’s say, for example, that climate and fossil fuel combustion, not oil markets and share prices, are your primary focus. You would not want to plant a flag right here, and declare that the secular decline in oil consumption (which will indeed come eventually this decade) has now arrived. Equally, if you manage an energy fund, or are thinking the dividend yields in oil and gas sector are attractive, you should not regard the market smash as a buying opportunity.

I discussed this worst-of-both worlds in a previous letter, Plateau Problems. In short, the global oil market is moving more quickly now towards a condition of no growth. This condition will be chronic, best described by the word dependency, and may persist for some years, offering no good outcome to either oil and gas investors, or climate policy aspirations that require meaningful fossil fuel demand declines. As laid out in my book, Oil Fall—serialized throughout 2018, and released as a single title one year ago—oil and gas companies are indeed suffering the first blow, when markets begin to accept that there’s no future growth for their product. Here is what I wrote in 2018:

The pivotal moment for the oil industry—indeed for all capital intensive industry—is not the decline, but rather, the transition from positive annual growth to zero growth, or a flatline. Oil Fall is the story of how near we are to that moment of zero growth…Oil Fall doesn’t attempt to model or forecast global oil demand declines, which may not come until the mid-point of next decade. While analysts waste their time trying to figure out, for example, when EV will ultimately take all market share of new car sales, for example, this series will concentrate on the first blow: when oil demand growth falls to zero. That single change alone will do plenty of damage— not only to oil, but to the oil industry’s influence and power.

Later this week, OPEC, EIA, and IEA will release their latest downward revisions to 2020 oil demand forecasts. But really, with a crisis upon us, those views no longer matter. All three agencies took the axe to the 2020 outlook last month, and will surely do so again this month. In truth, where we finish up the year is fairly unknowable—though certain parameters are coming into view. While the first half of the year is certainly lost, any combination of factors could create a strong rebound in the second half. But I think we can offer a rather simple formulation to the uncertainty: the oil demand decline in 1H 2020 will be so strong, that at best, any 2H demand recovery would take us back to a flatline.

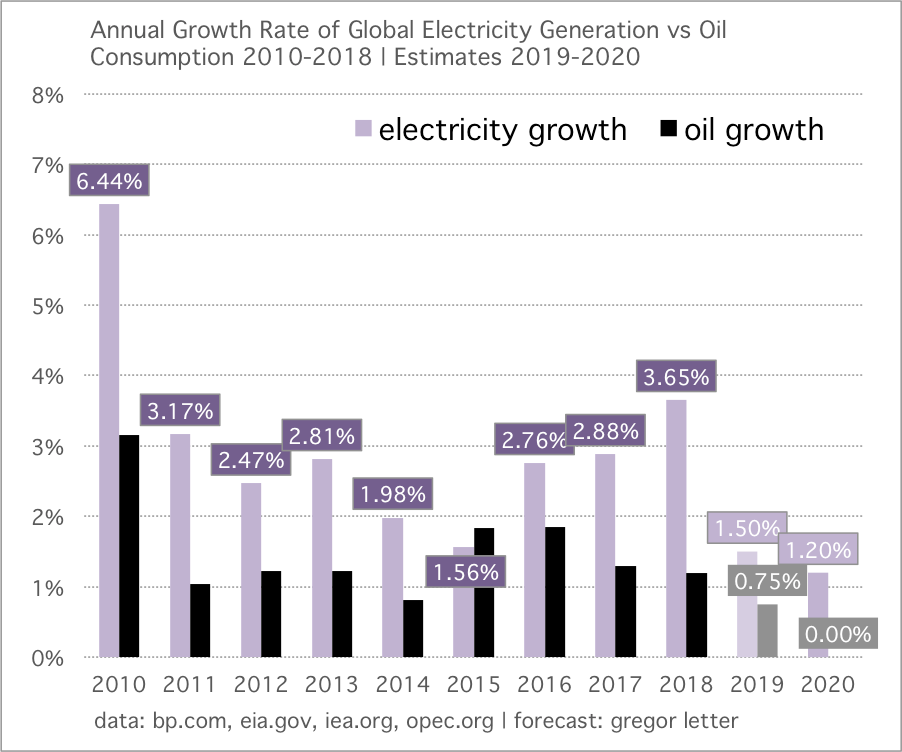

Accordingly, I’ve now downgraded my own forecast to zero growth for the year, from an already weak forecast of just 0.64 mbpd. When you look at the chart below, this would suggest the agencies have more catching up to do. Also note that last year’s growth is also still in the process of being estimated. This week’s reports from the agencies will deliver fresh 2019 revisions as well.

Deceleration in global oil demand growth is now an established trend. This will only increase the intensity of this year’s market smash, and re-rating of everything connected to the oil industry. Oil Fall speculated, and in my other writings I have repeated, that the time period to watch for oil’s growth rate to begin a plateau at zero is 2021-2022. If that prospect comes true, then this year’s risk of zero growth is not so much a preview but just an extra, crisis induced blow that brings the pain forward in time.

Electricity growth powers onward globally, but probably grew at a slower rate last year. That’s according to a recent report from UK based Ember, a London based research outfit. Readers may recall a rather grim factor in 2018’s very strong global electricity growth came directly from higher global temperatures, which boosted air conditioning consumption (and which also boosted emissions). Last year, however, coal consumption in particular fell hard, and the global emissions picture, as estimated by the IEA, improved greatly. According to the IEA, 2019 emissions were likely flat—a confirmation of oil’s poor year of growth, and weaker electricity growth with an emphasis on lower consumption of coal. But Ember, which has cleverly pieced together estimates of last year’s electricity consumption using a bottom up approach, suggested in its report that milder temperatures—and thus lower air conditioning use—was a key feature of 2019’s lower power growth. You can read Ember’s report here.

Just to say: despite the fact that a transition from oil to electricity offers the best pathway to decarbonize transport, we will probably be vexed and plagued in the years ahead by oscillations in global air conditioning use. It’s an emerging problem, and one requiring more attention.

Human lifespans are short, and were even shorter during the majority of our evolutionary history. We are wired therefore to care greatly about near-term threats while caring little, if even understanding, long-term threats. This intertemporal mismatch explains why we can very easily panic right now about a pandemic, while musing leisurely about the dislocation we may suffer from climate change, as the century wears on. So I thought the headline of this piece, Climate crisis on back-burner as pandemic threat looms, was just perfect. The author is Marlowe Hood.

Assuming the crisis converts to a recession, global emissions will surely fall this year. The earth observatory at NASA has produced some terrific images, showing the collapse of air pollution in China as the pandemic took hold. We cannot of course either hope or expect that such anomalous conditions will continue. But perhaps, just perhaps, an industrial slowdown globally this year will prod reflection, and open up pathways to moving the energy transition much faster.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.