Plateau Problems

Monday 10 February 2020

A commodity demand shock is spreading out from China. But it’s unclear whether this will be a short lived air-pocket, or a major dent in this year’s global growth. Copper, liquified natural gas, and oil markets have been hit pretty hard. Bond markets too, which had a big run last year, have responded with a second round of price strength taking the yield on the US 10 Year treasury bond from 1.93% around Christmas to 1.57% this week. Thus, one could argue the bulk of the shock has already been discounted.

The risk to this benign view is that China’s economy was already in a weakened state when the virus outbreak began. At present, large portions of China are functionally shut down, and the first reports of demand-gaps are starting to appear. As we were reminded last year, the transmission of fluctuations in China growth show up first in Europe’s economy, with a residual effect on the US economy, especially in commodity producing regions. The Gregor Letter last year took a brief look, for example, at how a second oil crash could affect employment in states like Texas. Were oil to fall further, settling in the $40’s, employment in US oil and gas could wind up joining the manufacturing and farming slump currently spreading throughout the upper midwest. Indeed, now that the US is a price maker rather than a price taker, cheaper oil may still deliver a moderate boost to the consumer, yet a larger hit to all the industries that serve the sector. The 2014 oil crash didn’t just affect Houston.

Perhaps the US economy does indeed have supertanker-like qualities, and must suffer multiple blows and shocks before sustainably reversing course. Though employment growth under the Trump administration has been lower than during the previous administration, the starting point for such growth is quite advanced. Thus, we continue to push deeper into the available workforce, taking the unemployment rate ever lower. And, in an era where workers automatically invest in index funds through retirement plans, broadening employment—regardless of wage levels—acts as constant marginal support for the stock market.

One helpful framing for these questions is to remember that while the short-run oil price is still a proxy for the global economy, the ability of price to suppress or stimulate is more muted, compared to the historical past. Oil demand growth was less than 1.00% last year, for example, and many regions have long since entered a phase of oil dependency, rather than oil growth. Accordingly, the oil price may still act as a barometer of marginal changes in the global economy, but conversely, no longer acts as the kind of powerful stimulant when falling. Here’s why: oil has spent the last twenty years rapidly losing market share to every other energy source. Oil once provided a full half of global energy (and as much as 40% at the end of the century). Today, it provides just a third. Because electrification will be the supertrend of the century, oil’s market share will continue to decline this decade, as we electrify further.

The premature heralding of autonomous vehicles has to stand as one of tech journalism’s most enduring failures. For years we’ve been treated to sweeping claims about AV’s imminent arrival, even as stubborn problems and barriers were evident at every instance. When I covered the rollout of May Mobility’s AV minibus in Detroit, over two years ago, my interviews with engineers in the field indicated something far slower, far more modest would be achieved in the intermediate term. Full autonomy will happen eventually of course, but simple AV vehicles on groomed and predictable routes turns out to describe quite well the more realistic pace of the technology. So I took some notice last week when the US federal government granted its first driverless exemption to an AV delivery vehicle from Nuro. If you seek to locate AV’s true and current position of development, this is it. And there’s plenty of adoption that can occur from this position, at airports, universities, retirement communities, and in certain districts and neighborhoods. Moreover, along with e-bikes, super-mini EV, and other micro-mobility devices, limited-route AV at this stage are ready to become part of the rise of electrics.

The end of growth in gasoline consumption means the end of growth in gasoline tax revenues. As the latest federal budget proposal is released, it appears the US Department of Transportation (USDOT) is projecting a shortfall of over $250 billion in the coming decade due to anticipated declines in gasoline tax revenues. The observation was made by Reuters journalist, David Shepardson. We should not be surprised. California modeled future declines in gas tax revenues over two years ago, when it raised its gasoline taxes and increased incentives for EV adoption. USDOT forecasts are therefore directionally sound: consumption of gasoline just put in a third year of no growth in the US, and is not expected to grow this year or next.

Battery pack prices have fallen 87% the past decade, according to presentations at the BNEF Summit in San Francisco earlier this month. Declining from $1,183 per kWh in 2010 to $156 per kWh in 2019, BNEF, along with other forecasters, sees battery prices falling further, though at a slower rate. Separately, Cairn Energy Research Advisors of Boulder believes Tesla is harvesting learning rate advantages in battery pack production, as it scales up volumes in its various gigafactories.

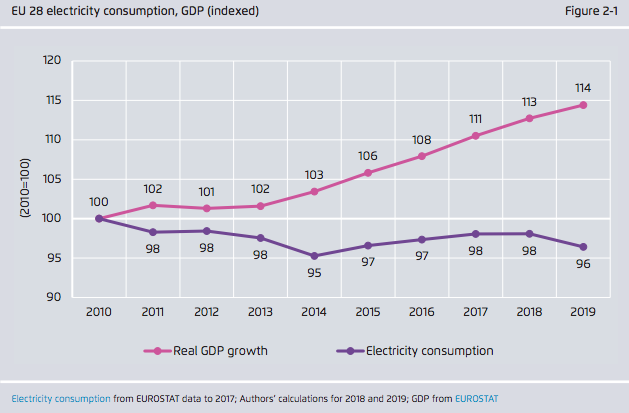

The efficiency of electricity will be a key factor in safeguarding economic growth, as we migrate away from combustion. In a just released report on the European power sector from Sandbag.org, GDP was shown to grow steadily this decade while electricity consumption was flat, to down. The harvesting of efficiency occurs in one step as work and services are electrified. But the second step of efficiency gains occurs when the powergrid itself is cleaned up, as it too sheds combustion. Wind and solar account for roughly 16% of EU electricity, and this should rise to 17% this year. While there is surely some sluggish EU28 economic growth more generally captured in the chart below, the thesis stands.

The ETF covering independent oil and gas producers here in the United States fell to another lifetime low this week. XOP, the ETF from State Street Advisors, is now down 80% from its high of $80.30 in 2014, to $18.73 on February 10, 2020. Meanwhile, the ETF covering oil and gas services, OIH from Van Eck, is also skimming along near lifetime lows. The price lows come as wider recognition takes hold that the oil industry has few if any growth prospects. The central thesis of Oil Fall, that the oil industry will be damaged early—when oil demand growth falls to zero, long before outright declines set in—has started to come true.

But Oil Fall also contains a warning. While halting the growth of coal consumption, and soon enough, oil consumption, is encouraging it is another task entirely to push fossil fuel demand into steady decline. In domain after domain we have seen over the past twenty years various forms of oil consumption peak, only to then oscillate along a plateau. And those plateaus are still very much intact. As Oil Fall explains, near term developments in the world of fossil fuels could create a worst-of-both-worlds outcome: falling employment in fossil fuel companies and fresh rounds of bankruptcies, while at the same time a pace of decarbonization that is far too slow.

Indeed, one argument from energy and climate observers asserts that even as we grant that wind, solar, storage, and electrification is moving along beautifully, these are still largely (though not entirely) additions to the existing system rather than forceful replacements. This argument has weak spots: decarbonization in the UK grid has essentially eliminated coal; EV adoption in northern Europe really has begun to displace ICE vehicles; and coal is collapsing in many other domains too, replaced by wind, solar, and (oops) natural gas. But the argument finds its strength on the global level. We are still growing emissions globally. Even as we add titanic volumes of renewables—which do of course pinch off growth opportunities for fossil fuels—industrialization, urbanization, and consumption of resources continue to expand.

The plateau problem, therefore, is going to confound analysis for some time to come. The pictures which emanate from that problem will seemingly change too, depending on the observer. If you take the view as I do, however, that we now have both the technology and the affordability required to go faster, then there are indeed areas where we could go faster. In my January podcast with Bloomberg I did point out that cities need to immediately embrace congestion pricing, something which London adopted two decades ago. The tipping points for cars are so near, in fact, it would be a shame not to give them a solid push, a well deserved kick, if you will. ICE sales have peaked globally. Road fuel demand growth is over in some domains, and going soft in others. Electrics are storming the market. And, getting cars out of cities more generally is now a trend. Politically unpopular as they are, more petrol taxes, but in particular road-demand pricing schemes, would take cars—especially in the OECD—over the edge and with them, oil demand.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.