Pricing Traffic

Monday 8 April 2019

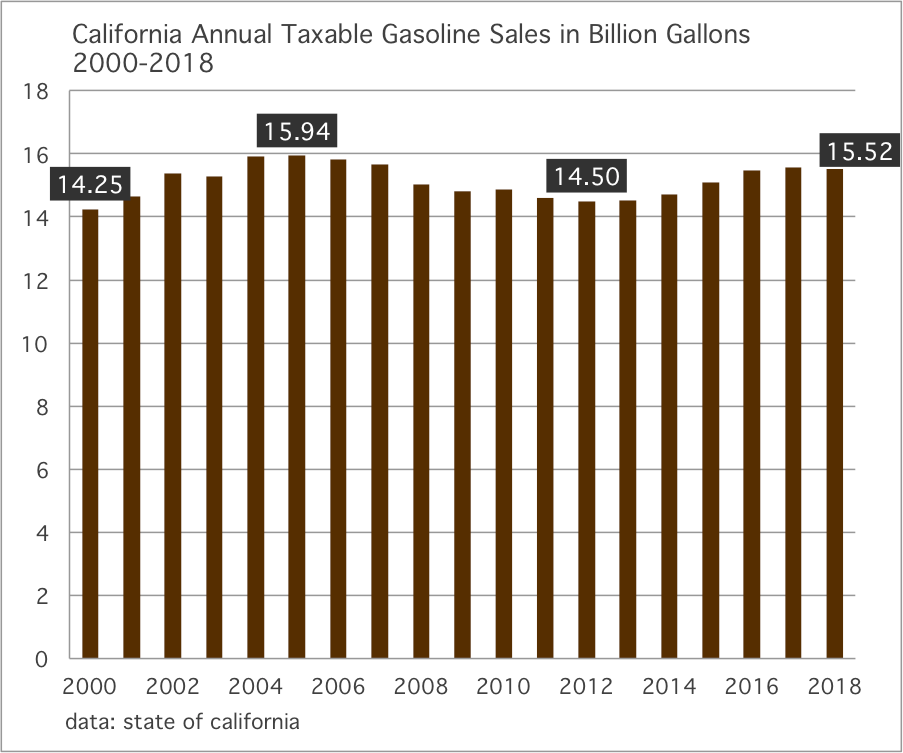

California gasoline consumption eased in 2018, falling 0.4% from the previous year. Tracking the state’s fuel consumption is crucial not only to gauge the national trend, but is also part of the update to the Oil Fall series, which relies heavily on the Golden State as a leading-edge domain of fuel efficiency standards, petrol taxes, ICE vehicle disincentives, and EV adoption. Like the United States as a whole, the recovery in California’s gasoline demand, sustained over four years from 2012 to 2016, began to stall out in 2017. And, as also seen in the national profile, California demand still sits slightly below the all time highs, set in the 2005-2006 period. The prospect that gasoline demand could stitch together new growth from this point forward is remote. Below are two views, therefore, of California gasoline demand (in gallons), and, the US picture (in quadrillion btu) as both data series have now completed, for 2018.

New York City will introduce a long-overdue congestion charge covering a large tract of Manhattan. Passed in a midnight-special budget session before the end of March, the New York state legislature will make it possible for the City of New York to introduce a $10 daily charge for cars entering a zone that roughly runs south of 60th Street, to the Battery. This is the nation’s first congestion pricing program and is quite similar to the same program which began 16 years ago, in London. Like a damn-break, the news has electrified transport planners and urban theorists who’ve long made the quite reasonable case that much of the automobile complex has, unlike other sectors of the economy, been allowed to run for a century without pricing. Indeed, much of the world has now given up on building new road capacity as a way to solve a demand side problem, given the serial failure of that approach.

For Atlantic Media’s Route Fifty I happened to cover this issue just last week, as the prospect of an interstate widening project in Portland comes up against the wishes of the community to try congestion pricing instead. One point I make is that tolling and other road pricing is not as historically common in the West, as it is on the East Coast. And yet, now that New York is going ahead with a scheme, that’s likely to offer the go-signal to many other American cities.

Coda: London is now adding an emissions overlay to its London congestion pricing program. Unless your particular vehicle model complies with a new, more restrictive emissions standard, you will pay not one but two charges now to enter London. The second charge goes into effect today, April 8, at midnight.

When urban freeways are removed it can ignite a fresh wave of economic development in cities and downtowns. From San Francisco to Boston, and Madrid to Seattle, cities are increasingly experimenting with placing offending freeways underground, or removing them altogether. In all cases, neighborhoods long cut off by these large, infrastructural divides tend to rebound, amplifying the trend towards pedestrianism and beautification.

To this point, the Congress for a New Urbanism has published for a number of years its “Freeways That Deserve to Die” report and this year added I-275 in Tampa and (in a stroke of timing and newsworthiness) the portion of I-5 that runs through downtown Portland. After reviewing all their picks, however, I must say the most compelling choice remains I-980 in Oakland—which has been on the CNU list for a while. There can be no question that a number of factors have prevented Oakland from partaking in several economic expansions the past 40 years, but the brutal carving-up of the city by freeways is an overwhelming depressant to its prospects. Oakland has the same climate, topography, architecture, and access enjoyed by other population centers in the Bay Area. (Actually, it has better weather than San Francisco). And yet, Oakland remains unhelpfully splayed between one trend in favor of pedestrians, and the sad legacy of 20th century road-building.

The 1989 Loma Prieta earthquake helped elucidate the problem, and the opportunity. After the quake, San Francisco took down the Embarcadero freeway, thus opening up its waterfront. Today that spine—instead of serving cars on a large, elevated structure which darkened the area in shadow—now hosts cobblestones, a green market, a bikeway, and a streetcar extension down to the ballpark. The same earthquake also took down a portion of I-880 in Oakland, which began to open up portions of West Oakland (despite the subsequent re-routing of its replacement). But CNU’s targeting of I-980, which negatively impacts downtown, is spot on. Already served by BART, Oakland’s downtown remains an underutilized asset among the collection of urban centers in the Bay Area. Indeed, for all the attention given to the bad side effects of nimby-ism in the City of San Francisco proper, a similar and concurrent problem affects much of region as a whole.

While China’s EV market is supplied by a kaleidoscope of manufacturers, the US market is exceedingly dependent on a single name, Tesla. Accordingly, now that Tesla’s sales growth has slowed, it has meaningfully shifted the path of 2019 EV sales for the whole of the country. Last year, US EV sales of all plug-ins grew by 81% to reach 361,000. But this year, first quarter sales have barely grown, notching 27,587 units as compared to 26,443 units in the first quarter of 2018. Unless Tesla deliveries of rise substantially—or other manufacturers like Kia and Hyundai pivot quickly and start to actually serve pent-up demand for crossover 100% EV models like the Niro and the Kona—then US sales of plug-ins will fall far short of the 500,000 units one might have expected, coming into the new year.

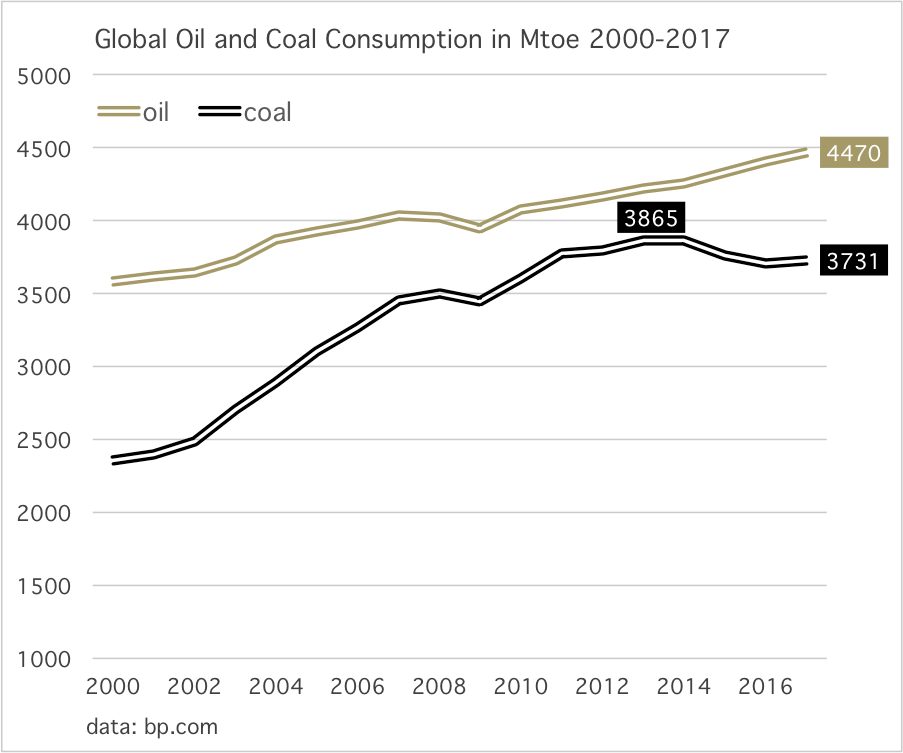

Finally, a word about US coal production which, having stabilized at lower levels since 2016, has once again started to fall rather precipitously, a sign of what’s to come in global consumption. Recent data on the first quarter of 2019 indicates that compared to the same quarter in 2018, US coal production is down 9.2%. To review: the global coal sector was hammered hard in 2014, with many listed names eventually declaring bankruptcy, when the long growth path of coal demand converted to a flatline. This predictably led to a brief period of crimped supply and, because coal dependency globally was not meaningfully disrupted, an eventual price recovery. The stabilization in US coal production therefore was mostly due to this price recovery, and the export market, even as aging US coal plants—very much at the end of their lifecycle—shut down. But now one has to ask the question: with US coal production so dependent now on exports, have the recent shifts in both China and India outlooks determined the next phase of US supply? Most certainly, yes. Each country came into the 2017-2018 period with plans for future coal capacity growth and each country since has had to conduct various and ongoing cancellations of those plans. The culprits? Wind and solar, of course, and their rapidly declining costs. Indeed, for the past few years, the oscillations in both India and China coal consumption has not flowed from new capacity, but rather, calls upon existing capacity.

Just to remind: global coal demand peaked in 2013 and only the most unusual, black-swan outcome could get the world back to those levels. Most foreboding now is that costs for wind and solar have fallen so far, so quickly, that they will soon start to pressure existing coal capacity. The coal story of the past five years is highly instructive to what’s coming for oil, and illustrates the outsized damage which occurs when demand growth goes flat for any commodity.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.