Road Fuel?

Monday 12 January 2026

An emerging bright spot in our current energy transition is that global road fuel demand appears to be peaking. Here at Cold Eye Earth we maintain a healthy skepticism towards any claim of a peak in fossil fuel demand or emissions globally, and equally assert that these declarations can neither be reliably “called” in real time. Peak declarations have scurried about for nearly twenty years now, nearly all of them wrong. But at least in the past, the “peak game” in energy demand forecasting paid respect to a time-window, in a nod to uncertainty. Today’s peak callers rush to the stage after quarterly data to yell “peak” only to throw themselves against this wall repeatedly as the years pass by.

The prospect that global road fuel is currently in the midst of peaking is composed of a number of data points, but owes most of its viability to long-run trends that began a decade or more ago. Put another way, the very same trajectories that got people excited about a peak in oil demand were overly embraced when they first appeared. Those trends needed time—and lots of it— to broaden and deepen. Let’s take a look at them.

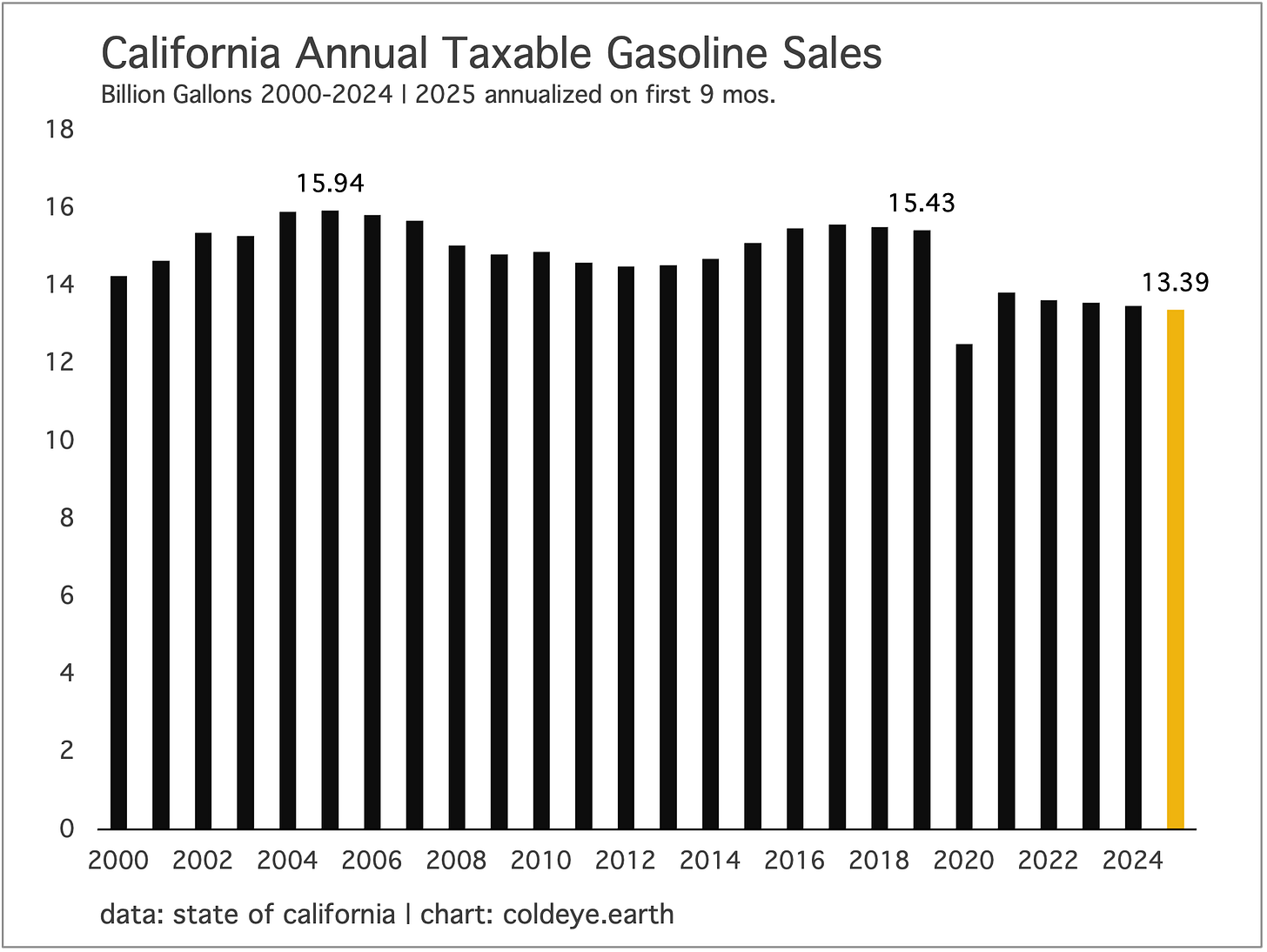

• The arrival of the first EVs, and the array of incentives to buy them, 2005-2015. We can think of this period as the early investment phase, the start of a long journey that would eventually curb sales of internal combustion engine (ICE) vehicles. Europe and the U.S. were the first participants in this stage which had no effect at all on oil demand but prepared the ground for an eventual shift. A great example of how this lengthy return on investment played out in a specific domain is California, which remains the leading edge market for EV sales in the U.S. The seeds were sown. And eventually, they bloomed.

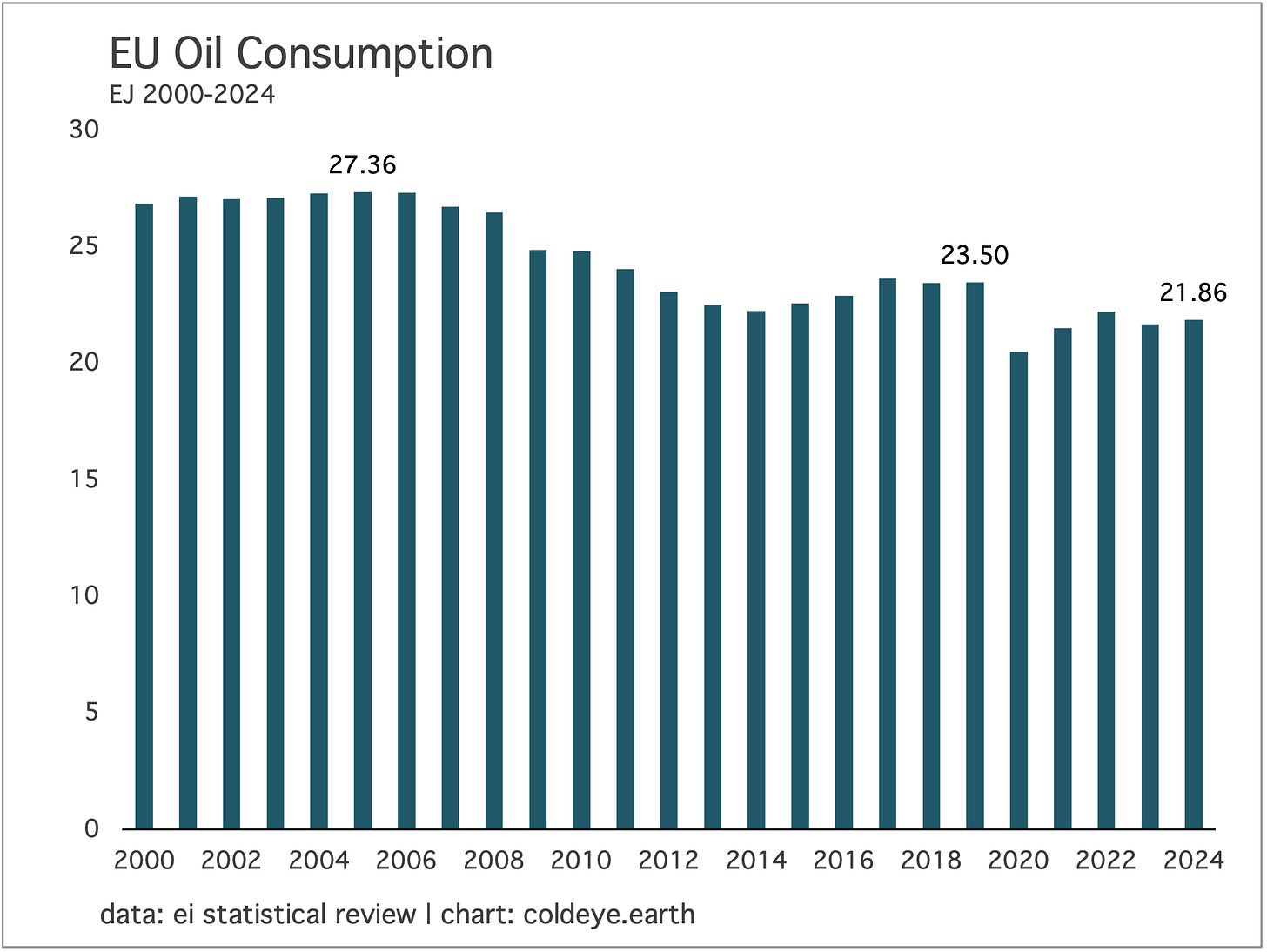

• Disincentives to ICE vehicle ownership in the form of fees, higher petrol taxation; the rise of the walkable city and the flowering of emissions zoning and congestion pricing; and the exploding popularity of EVs, 2010-2020. Although adoption of EV in the U.S. during this period was sluggish, (and remains so) globally the car itself became an increasingly powerful symbol of the problem of climate change. Europe, for example, had long been a leader in ICE disincentives—mostly through stiff petrol taxes—but then cities from Paris to London to Barcelona began a second initiative to attack ICE vehicles through travel fees, and car zoning. Just as in California, those initiatives accumulated over time and then broke through.

• The juggernaut of China’s EV-forward transportation policy, and the peaking of global ICE vehicle sales, 2015-2025. In the year or two after 2018 we began to safely conclude that global ICE sales had peaked, as they were unlikely to turn around or recover again given global sales growth of EV, especially in China. What we did not know is how rapid and aggressive (see the chart below) the ensuing 5-7 years would become for EV sales in China, as they stormed both passenger and commercial markets. The best estimate for EV sales last year (based on 11 months of data) is that they got close to reaching 50% of China’s total market. This means it’s an easy layup to project that EVs will push past 50% of the market this year. Put another way, the ICE vehicle, in China at least, just became the rotary phone.

Keep reading with a 7-day free trial

Subscribe to Cold Eye Earth to keep reading this post and get 7 days of free access to the full post archives.