Tail of the Pipe

Monday 19 February 2024

The Biden administration is about to climb down from its previously aggressive EV targets for US automakers—an admission the policy was bound to fail. Using the EPA as an enforcement mechanism, the administration last year proposed a fast-paced schedule for US automakers to lower emissions by introducing production targets for both EV and ICE, to start in 2027. The problem: US automakers are simply not on track, even a little, to produce EV in such volumes by that time. The policy proposal held that if EV targets were not met, then curbs would kick in on ICE production. The industry was unhappy about the proposition at the time of course, but a year later it’s capacity, not attitude, that’s guiding the outcome. The New York Times has the story.

The failure of the US legacy automakers to meet even their own EV production targets has, at the same time, been misunderstood as a slowdown in the EV market. But outside of normal year-to-year fluctuations, no such slowdown is yet established. Here in the US, plug-in sales reached 1.43 million units out of 15.49 million total vehicle sales last year, for a market share of 9.25%. That is a rapid advance for plug-in share compared to 2020, just three years prior, at 2.00%. Globally meanwhile, EV are literally storming the ramparts. Last year, roughly 17% of global car sales had a plug, according to BNEF which expects market share to advance again this year, to 21%.

The Biden-EPA plan was not particularly well designed in the first place, and, would not have resulted in much of a hit to US transport emissions, until later next decade. As Cold Eye Earth relentlessly points out, other than EV adoption the US really has no policy to tackle emissions in transport, and this results from a longstanding but informal bipartisan agreement to never touch the existing cars. As we are now learning in the global power sector, you can adopt all the new, clean technology you desire. But, unless you retire existing, incumbent capacity, emissions declines will be very hard to realize.

Last year’s global oil demand reached a level about 1.2% higher than the peak year of 2019, well within the Cold Eye Earth forecast. Readers will recall the longstanding outlook offered here: oil demand will fluctuate 1.00% - 1.50% from the 2019 level, never reaching actual decline, until much later this decade. In its latest Oil Market Report, the IEA pays considerable attention to the global slowdown in demand, especially emanating from China. Yet, the IEA still sees the world tacking on an extra 1 million barrels a day in 2024. We shall see. (This is also a good time to recall British Petroleum’s longer term forecast, first released in 2019, that saw virtually no demand growth at all after 2025). The global oil market has pretty much run out of time to mount a new oil cycle of higher prices, and higher demand.

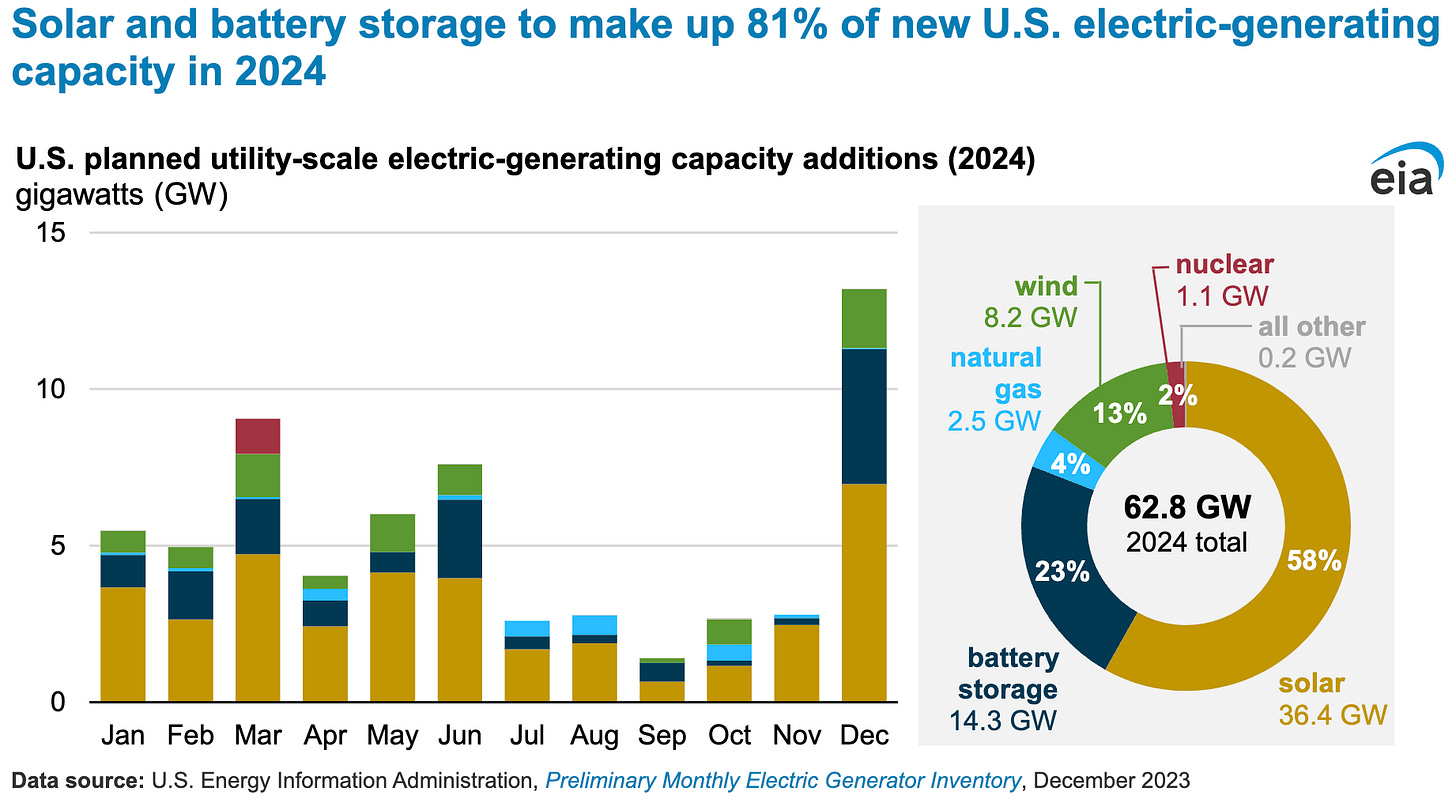

A stellar year for wind, solar, and storage is on the way here in the United States. While we must adjust capacity measures for the respective capacity-factor of each energy source, the EIA growth forecast is so dominated by clean energy that we can confidently write off the small contribution coming from one fossil fuel, natural gas.

On the topic of natural gas, this is probably a good time to reflect (again) on the evolution of power sector emissions in the US. We have done a great job killing coal, and that has produced enormous declines in coal emissions. However, the bargain we made with natural gas has its own implications.

As you can see in the chart below, power sector emissions from natural gas are now crossing above coal emissions. That’s a good-news—but not such great-news—story. And, it’s one that hand-waving advocates of global natural gas growth should ponder.

Natural gas prices have fallen to historically low levels, as a mild winter in the US has made for a very light call on reserves. As Cold Eye Earth goes to press, natural gas for March delivery has fallen to $1.56 per million btu. According to Reuters coverage of the story, that’s the lowest inflation-adjusted price in thirty years. This will likely produce a short-term windfall for LNG exporters, who generally sell supply under contract but can of course buy at spot, anytime. It’s also a reminder that North America has vast reserves of economically recoverable natural gas; and even over the longer term, US natural gas prices have not moved much on the back of relentlessly higher demand. When you begin to absorb the idea, therefore, that the tendency of natural gas prices is to be weak in North America, it makes the problem of natgas path dependency easier to understand.

Cold Eye Earth pays close attention to the US presidential race, because a change in administration would surely bring a profound change to the regulatory state. For readers outside the US, you can ignore the rumblings and threats from the Republican Party about the three, big domestic investment programs enacted under Biden. The CHIPS Act, the IRA, and the IIJA are responsible in part for the country’s strong economy. And the tentacles of those programs have already reached deeply into Republican states.

What a Republican administration would do, however, is gut federal agencies, starting with the EPA. For example, the federal guidance on EV production that Biden has just walked back? Well, there would be no new EPA restrictions under the GOP, and many current regulations—from gas flaring to regular tailpipe emissions, to standards for new federal buildings—would be either erased or dialed back into obscurity. There is no question, other things being equal, that US emissions would either stop falling or actually rise during a four year GOP administration. While President Trump failed to brake the decline of coal during his four year term, he was able to essentially halt the forward progress of tailpipe emissions standards, for example. And overall emissions not only halted their decline, but rose under his administration—a trend broken only by the pandemic year.

Unfortunately, risk is rising that Biden will lose this year’s election. Yes, we have started to break the deadlock on poor consumer sentiment, and inflation expectations. But that may not be enough. In a recent op-ed by Nate Silver in the New York Times, he suggests that the relationship between a strong economy and incumbent advantage may have weakened. In Silver’s view, sentiment is indeed turning more positive as Americans put distance between themselves and the inflation that emerged from the pandemic. But here comes the tough part of that equation: Biden’s polling has not improved, and perhaps has gotten just a touch worse. While it may seem unfair, or even irrational, voters perceive Biden in 2024 as having greater difficulty with old age than his opponent. On this point, a far more surprising op-ed was published just last week in which Ezra Klein, who is historically a very risk-averse political writer, jumped aboard the push to get Biden to step aside in favor of a younger candidate. Klein made the point that Biden is not campaigning aggressively, and that the Democratic Party as a whole may now be too inflexible to consider alternatives.

The lesson of 2016 is crucial here. We learned that when the Democrats field an unpopular candidate, regular voting participation from Democrats slumps. For example, Hilary Clinton lost so many votes in just one Michigan County (Genesee) in 2016, compared to Obama’s vote tally there in 2012, that she lost the state. Moreover, the third-party vote soared in 2016, drawing further votes away from Democrats. It’s not that Trump was a strong candidate (he lost the popular vote, twice) but that Clinton was so weak. When Biden challenged Trump in 2020, third-party vote share dropped dramatically, and Democratic voters flocked to the polls.

2024 therefore is shaping up like 2016. Trump is quite unpopular. Accordingly, it’s not his race to win, but rather Biden’s to lose. Michigan in particular is once again concerning, because it has a significant Muslim population that’s unhappy with Biden over the Israel/Hamas conflict. Arizona is also on the radar especially, along with Georgia, because Biden’s margin of victory in those two states was razor thin, last time.

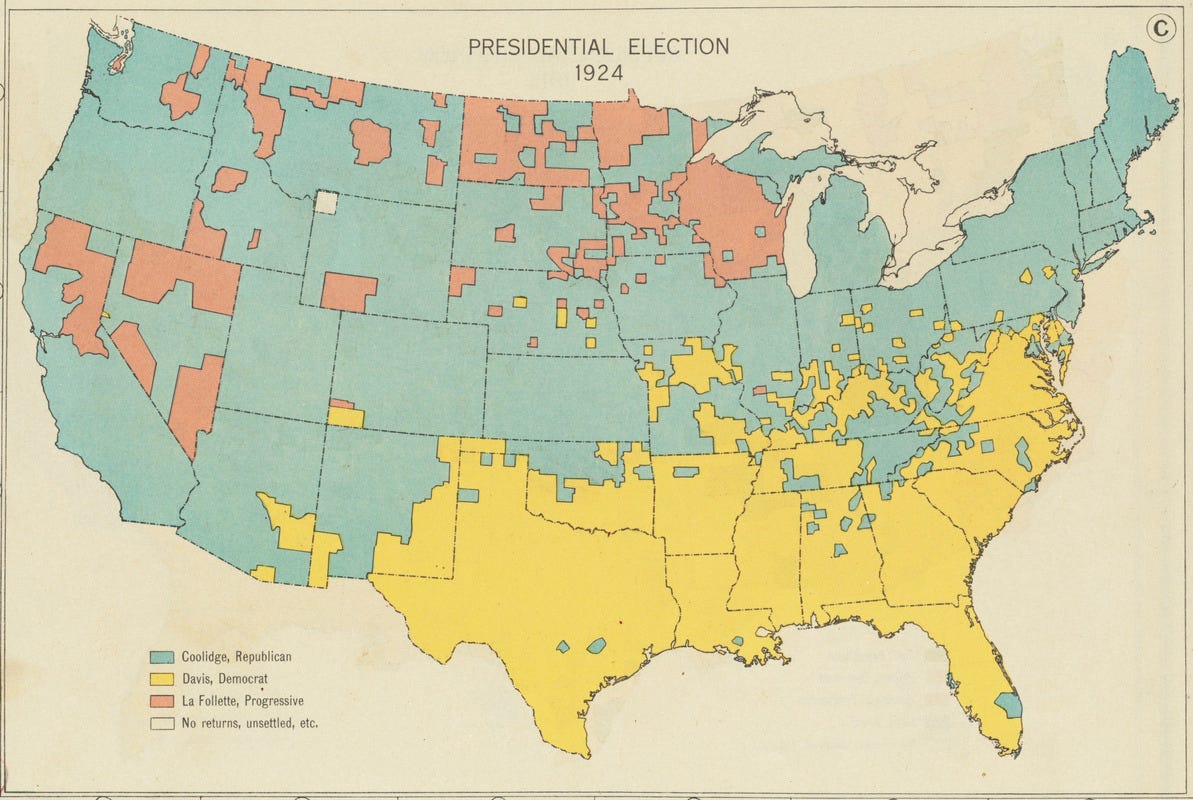

Cold Eye Earth takes the view that Biden, or a different Democrat, is still more likely to win in November than Trump, or a different Republican. That said, to express the renewed uncertainty, we can take Biden’s two, tightest winning-margin states of 2020, Georgia and Arizona, and put them back into the toss-up column. That produces the following result:

As you can see, Biden can afford to lose two states and still stay above 270 electoral votes, but not a third—unless it’s Nevada, with just 6 electoral votes. If Biden were to lose Wisconsin instead of Nevada, for example, his EV count would then fall to 266.

Trump and the Republicans are not in a good spot either. Cold Eye Earth has previously cited the abortion issue in Ohio, which steamrolled Republicans last year when voters came out in droves. This dynamic will be in play again this November. Again, notice the pattern: when Democratic voters are passionate about certain issues they get themselves to the polls and turn expectations upside down. Because the populace is not enthusiastic about either, that makes for an unusually uncertain political landscape, one very difficult to analyze, as we head towards November. In the 11 December issue of Cold Eye Earth, the list of Ten Surprises for this year kicked off with the idea that Trump, when we finally get to election day, would either not be the nominee, or, if he’s on the ballot as the nominee, voters would understand that they’re voting for a different Republican. Now it seems Biden faces that risk too.

• News briefs • Fervo Energy, working on a 400MW geothermal project in Utah, has just produced excellent drilling results. This raises hopes that the economics of geothermal may be better than expected, a boost for this new and emerging energy sources in the US. • Japan’s steady resurrection of its nuclear fleet the past decade has resulted in falling demand for imported LNG. • Heat pump sales in the US once again outpaced sales of gas furnaces. This mirrors the grand upsweep of heat pump sales in Europe, and is a nice example of the free market starting to take control of the natural gas problem. • Nuclear innovation is not dead just yet, even if the US remains one of the worst domains to try and build new nuclear. The NRC has just given the green light to produce a new type of test reactor, one that cools with molten salt. The prototype will be constructed in Oak Ridge Tennessee. • Blackstone, the US private equity group, is moving aggressively into data centers as demand for cloud computing and AI soars. Cold Eye Earth predicts that these data centers will eventually be paired with storage, allowing the facilities to routinely take advantage of pricing arbitrage. •

—Gregor Macdonald