Tech Sparks

Monday 18 October 2021

Grid storage, great and small, is now the central game in energy transition. Because wind and solar are now faster, better, and cheaper than any other power source on the planet, their trajectory is headed towards commodification, a long-timeline buildout that increasingly adheres to classic manufacturing principles and standardization. Value, therefore, will accrue to the storage side of the emerging grid puzzle. And, that’s your signal that technology will increasingly configure global energy. Electricity will be sliced up into tradable bits, transmitted to where it’s needed most, and will be routed algorithmically. Storage is the necessary systemic component, therefore, to enable electricity to become digital. In this way, the world’s energy system won’t depart from the physical world, but will instead be fused with a computational layer—following other sectors like information and finance, along a well worn path. This transformation was forseeen long ago by Robert Metcalfe, an internet pioneer, professor, and co-inventor of the ethernet.

So, what’s happening in storage right now? Tons. First, paired, or “coupled” storage is starting to accelerate as the cost of lithium-ion continues to fall, and especially as such projects qualify for the investment tax credit. According to a Berkeley study, 70-80% of proposed new projects in the US West are coupled with storage, compared to 34% of solar and 6% wind projects last year. As a journalist who covers this space regularly, I regard the 2019 decision by the Oklahoma based Western Farmers Electric Cooperative to make storage a key component of its aggressive sizable wind and solar buildout project as the strong signal that paired storage was about to become routine. Notice the implication of the changing cost structure in this quote by the Cooperative’s CEO: “With the price of wind and solar energy lower than ever, we are now able to pair it with battery storage to make more affordable, renewable energy available,” said Gary Roulet, CEO of Anadarko-based WFEC.

Second, storage growth in the US more generally is starting to meaningfully take off to the upside. The EIA is forecasting that US storage capacity will grow 10X to the year 2023, using 2019 as a baseline. Based on planning data we collect, an additional 10,000 megawatts of large-scale battery storage’s ability to contribute electricity to the grid is likely to be installed between 2021 and 2023 in the United States—10 times the total amount of maximum generation capacity by all systems in 2019, writes the EIA in the above linked report. Well, of course. It’s critical to understand that the severe cost declines in wind and solar make the storage component to new systems increasingly affordable. This is precisely the point being made above by Gary Roulet, of the WFEC. But now comes the cost declines in storage, adding greatly to the positive mix. According to the same EIA report, battery costs fell by 72% between 2015 and 2019, a 27% per year rate of decline.

Now that paired storage with new wind and solar (WSS) is becoming common, everyone will need to grok an emerging fact: WSS is the new and preferred generation solution everywhere. But there is still one hurdle to go: lengthening the 4 hour time block that is the current capability of lithium-ion batteries. And that brings us to the third major development now underway: tech advances in storage. Form Energy, a small energy startup located in Somerville, Massachusetts, recently announced it had made a major breakthrough in long-term grid storage, using iron-air technology. Form claims their batteries will have a discharge cycle that could last as long as 100 hours. The kicker is the projected cost, at a radically low $20 kWh.

Where are lithium-ion costs right now? Mostly hovering around $100 kWh, with a promise to decline to $80 kWh in the next year or two. We know for certain lithium-ion costs will decline. But iron-air, or iron-flow batteries have real promise. The Bill Gates backed ESS Storage, which is a local company here in the Portland metro area, has already struck deals for its own technology that offers not 100 hour storage but 12 hour storage. The global grid system will happily take that tripling of duration from lithium-ion’s 4 hour time block, while we wait to see how and when even longer duration storage works out. ESS has slightly muddied the waters on cost, however, without explicitly stating their cost per kWh. According to their website, the iron-flow battery “has a capex cost similar to Li-ion, with an opex much lower than Li-on, the cost of ownership can be up to 40% less than competing technologies.”

Finally, it’s crucial to consider that downstream of these Very Large Batteries, lies a whole bunch of battery innovation and progress that looks to integrate microchips, computing, and consumer-level capabilities into cars, homes, offices, and local networks. At the moment, my favorite item in this ever expanding list is Ford’s electric truck to be released next year, the F-150 Lighting. The 2022 offering looks to not only build on the best selling vehicle of the past 40 years, but is going to stealthily deliver a mobile power plant every time one rolls out to the street from the showroom. The Lighting will bring European level power capabilities for the first time to the US market, with bi-directional charging. And combined with the Lightning’s battery size, it will be able to run a single family home, as a generator, for 2-3 days. The more routine application in this configuration will be seen in construction, as the trades have increasingly gravitated towards power tools in need of jobsite charging. Most of all, however, is how the Lightning both touches and conquers the cultural third rail in the American carscape by offering a truck that’s electric, but which is going to blow past grumpy resistance to “EV” by overwhelming you with brute power.

According to a report from the Rocky Mountain Institute, if half of the current 4.4 million pick-up trucks in Texas were electrified in this way “they would provide the Texas grid with ~460 GWh of battery energy storage capacity and ~38 GW of power discharge capacity.” RMI further observes that in all of 2020 the US grid storage battery market only added “3.5 GWh of energy storage capacity and 1.5 GW of discharge capacity in 2020. Therefore, electrifying even half of Texas pickup trucks would radically scale the storage market by one or two orders of magnitude.”

Technology and in particular software, through the platforms created by batteries great and small, will increasingly govern the US energy system. Homes and businesses will arbitrage their battery capacity, taking surplus power when it’s cheap and selling it back to the grid when power is dear. Industry will deploy hydrogen electrolysis near variable renewable power, running processes at night when wind power and especially offshore wind power creates surpluses. This intertemporal shifting of demand (which the industry calls load shifting), will also become routine. EV users already charge overnight when power prices are lower, especially in domains like Texas where wind power cranks out electricity as everyone sleeps. EV owners in California can already choose and select charging times that are likely to align with surplus solar power, as customers of charging companies that work directly with the grid operator to bid for blocks of power. Your local school district, university, town hall, and other government buildings will also install batteries, and they too will get into this game. Companies like Honeywell, Google, General Electric, and perhaps even Apple, will expand or enter the power management space, bringing engineering and software expertise to the task.

The downside of variable renewable energy is that it’s not as dumb as fossil fuel combustion in power generation. A coal-fired power plant gets up, runs, and keeps running while fed with coal. It has little flexibility, but that is its edge. Coal is a blunt tool, and blunt tools can be effective. But the upside of variable renewable energy is that, when paired with a battery, it can be digitally sliced up and routed to specific markets, users, and transmitted at a chosen time. Fossil fuel powered electricity is reliable, but grossly inefficient losing large sums of its power to waste heat. WSS will create something closer to an internet of energy.

Green steel uses hydrogen made from renewables, instead of coal, and has made its first foray into the automobile sector. The HYBRIT project in Sweden—a collaboration between a mining company, a utility, and a steelmaker—delivered its first green steel in late summer to Volvo. That’s a proof-of-concept breakthrough more than a cost breakthrough, because of course green steel is far more expensive than conventional steel. The cost difference comes mostly through the expense of electrolysis equipment—the electrolyzer—and most analysts don’t foresee electrolyzer costs becoming competitive for at least another four to five years. But that’s not a barrier in some applications, like the auto sector for example, because the cost differential between green and conventional steel as expressed through the car’s sticker price is not all that large. To learn more about decarbonization of the steel, the New Yorker has an excellent piece on the subject published last month.

Adding windpower to oceangoing shipping vessels could dramatically reduce fuel costs and emissions from the sector. While shipping accounts for only 2-3% of total global emissions, growth is expected to carry onward for decades. The idea here is not to entirely drop the drivetrain from oceangoing shipping. But rather, to add a wind component at a cost competitive entry point, that would allow owners to get paid back for such an investment through fuel savings. In a twist, many of these proposed commercial designs appear to be drawing inspiration, and no doubt technical advances, from those seen in the superyacht class over the past decade.

The hyperbole around Bitcoin’s role in the world’s energy system never quits. Earlier this year I pushed back against the shrill and entirely unsupportable view that Bitcoin mining was a world-level environmental disaster. That’s because at best, Bitcoin mining uses one third of one percent of the world’s electricity. Moreover, 100% of Bitcoin mining doesn’t take place in domains with 100% fossil fuel powered electricity, because no such domains exist. At least 10% of global electricity is now derived from wind and solar, with another 26% combined from hydro and nuclear. If we estimate that Bitcoin uses roughly 100 TWh of 26,800 TWh in total global electricity, then at best 65 TWh is mined with fossil fuels.

So, it stands to reason therefore that on the other side of the argument, claims that Bitcoin Mining Is Reshaping the Energy Sector are entirely false. The scale here is just not proportional to the task. Is that not obvious? The valid claim, however, is that Bitcoin mining can indeed be harnessed as a time-shifting demand load, to better utilize surplus power in local domains. In this way, Bitcoin mining can be useful but only at the micro level, like a fleet of smart-enable water heaters in a local network. Pro-tip: if you are going to argue that Bitcoin’s emissions are too tiny to matter, it’s best not to pivot and argue that Bitcoin mining can transform the energy sector. You can almost hear Charlie Brown whispering good grief.

China’s wind and solar buildout has gone supernova, as it starts construction on a singularly colossal 100 GW wind and solar project. To build 100 GW of wind and solar from scratch is simply more proof that these two energy technologies are indeed becoming commodified. This will likely be an overbuild, a characteristic seen increasingly in wind and solar, as cost declines shift the economics to maximizing output during high sunshine or high wind-supply times of day. And just to remind: we do not need to wait for a technological breakthrough in solar, because solar itself is the breakthrough technology. Rather, the breakthroughs to come will be in how we harness cheap, clean energy.

High voltage direct current transmission technology will grow, as large renewable output in rural areas will need access to dense markets of high demand. A current project that highlights these twin factors is taking place between Iowa and Chicago, that will unsurprisingly begin to route enormous and expanding wind output to city populations. HVDC is also proposed here in Oregon, as a more efficient way to deliver wind power from the eastern Columbia region to Portland. Cascade Renewable Transmission also has a good explainers, to help you understand better how HVDC will actually work.

Once upon a time, in a previous era before digital media, magazine covers could be relied upon to indicate extremes of sentiment. The Economist’s famous Drowning in Oil cover in 1999 was pretty close to the price low in crude, even if it took another couple years for the bull market to get going. In the digital era however it is hard to both create or track sentiment extremes, because information is absorbed far more quickly and pivots also to new thinking are more frequent. However. It’s tantalizing that The Economist is back at it, running two distinct stories the past few weeks that arrive as the storyline blows up to front pages everywhere. Was the intensity level of these two stories just realized?

Upper level concepts require fine writing, sufficient to elucidate the nuance and complexity of such ideas. Over the past decade the International Energy Agency (IEA) in Paris has found itself locked in a kind of conundrum, as its projections of future energy consumption were consistently interpreted as forecasts, rather than contingent what-if models should certain policies either become, or fail to become, enacted. As a result, the IEA’s forecasts fell into a doom loop, in which the agency pleaded to be understood better, while its audience saw persistently low projections of renewables growth as an outright prediction. But how to explain that dynamic? In an exceptionally fine piece this week on the release of IEA’s latest World Energy Outlook (WEO), Kate Mackenzie found a way to describe this coalition of misunderstanding. Here are some key passages:

The new WEO possibly marks the resolution of a tension that has plagued the IEA for years: Does it simply show possible futures, or does it also define those futures? …The agency has always rejected criticisms that its scenarios delay the shift away from fossil fuels. In response, it insists that the WEO does not contain forecasts, but rather illustrations of possible futures. ...IEA seems to have conceded that the rest of the world will never see the WEO in the same way that its authors intend. Birol and his colleagues seem to have assumed they were a creating a thoughtful but entirely hypothetical set of numbers and charts each years. Policymakers, industry and investors saw instead a rationale for their decisions, and worse, a justification for their biases—particularly the ones that lock in fossil fuels.

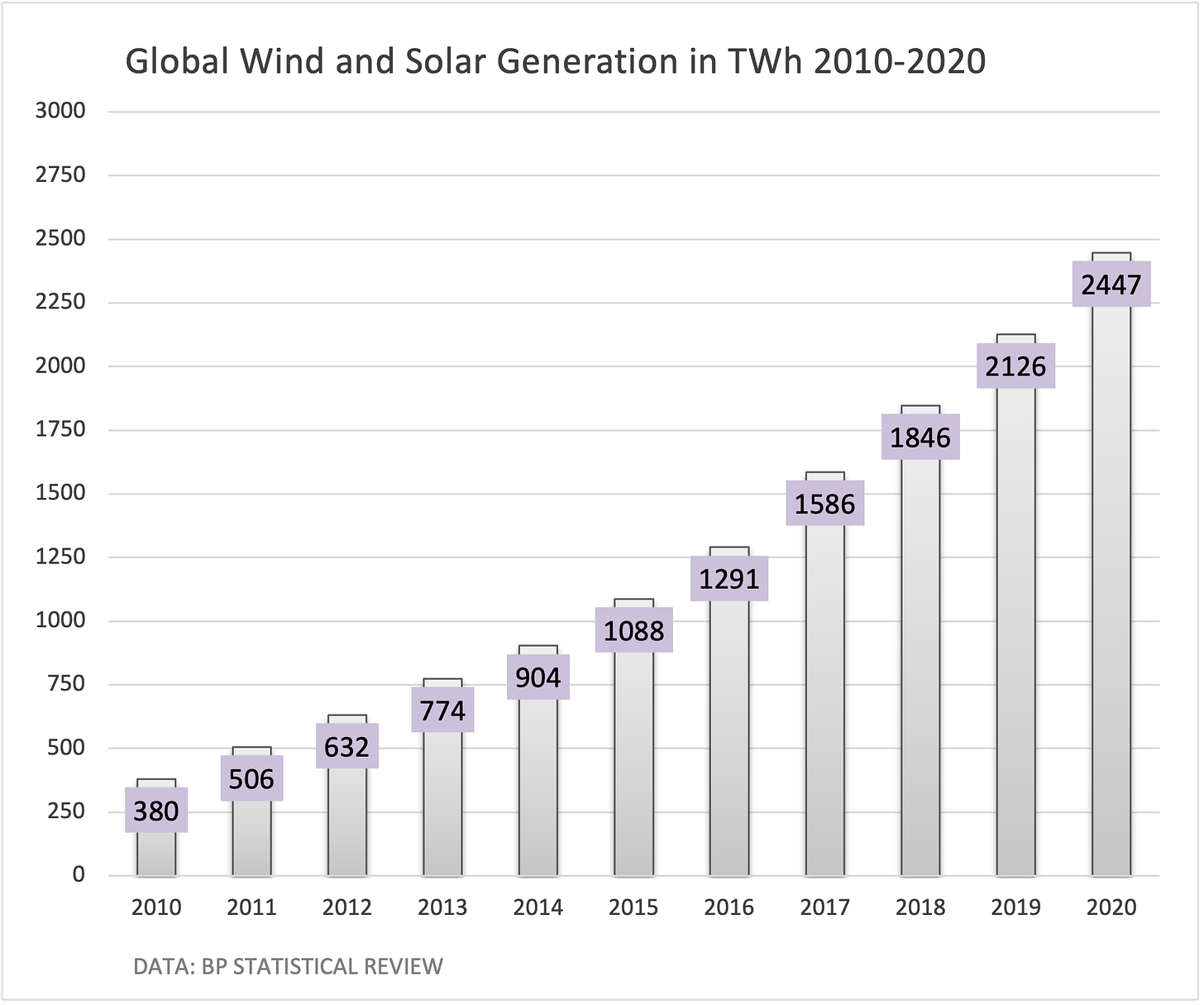

Now that the IEA has created a new approach to forecasts, their wind and solar projection is far more aligned with the probable pathway forward. Since 2010, electricity generation globally from wind and solar has grown from 380 TWh to 2447 TWh. To put that in context, in 2010 global wind and solar generated enough power to meet all the electricity needs of the United Kingdom. By 2020, global wind and solar generated enough power to meet nearly half (47%) of the electricity needs of North America. Wind and solar are a very big deal! Here is their progress up through last year:

What might we expect therefore as a reasonable forecast in the years ahead? Well, generation from the two technologies has roughly advanced at an 18% compound annual growth rate in the ten years from 2010 to 2020. If wind and solar generation maintained that rate through 2030, the world would wind up with roughly 12,800 TWh. Now, that rate probably can’t be sustained in the next ten years, because growth rates always slow as systems get larger. That said, at least the figure of 12,000 TWh appears in one of IEA’s scenarios, below. See here: for a direct link to the IEA’s chart.

The Gregor Letter has been in the news this past week, mainly from a twitter thread I composed revealing China’s explosive EV growth. Ian McGugan at Toronto’s Globe and Mail gave a very fair reading of my views, incorporating my twitter thread but also recent newsletter discussions into his piece. The bottom line: the oil market is tight right now, but OPEC has tremendous spare capacity. Meanwhile, at Brussels based Energy Monitor, journalist Justin Gerdes delved deep into the recent double freepost, and noticed that the US decision last decade to unlock natural gas for export is now pushing natgas prices higher, which will accelerate renewables growth. Finally, I was interviewed by the Financial Times of London, for a piece likely to emerge shortly. All in all, it was a great week for The Gregor Letter, with many new subscribers.

A very warm welcome to all new readers.

—Gregor Macdonald

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, just hit the picture below.