The Question

Monday 28 November 2022

The US is hurling itself so aggressively into the development of battery production capacity that output may nearly match Europe’s, by 2031. That’s the conclusion of analysts at Cowen, as reported by the Financial Times, in a broad survey of investment activity that’s come in the wake of the Inflation Reduction Act. Along with the Infrastructure Investment and Jobs Act, the US is currently extending energy policy far beyond the simple incentives that historically favored new wind and solar, and consumer purchases of EV. Indeed, the scope of American intentions is very much in the European vein, casting a shadow over everything from high voltage transmission, to hydrogen development in heavy industry, to the entire battery supply chain, starting with mined metals. But in the face of towering demand for batteries not just from the auto industry, but the commercial sector, and the powergrid sector, the question remains: will it be enough? From the FT:

The US is forecast to have around 920 gigawatt hours of annual battery manufacturing capacity by 2031, the year the IRA tax credits are set to expire, according to Cowen. European gigafactories are on track for a total capacity of 1,186 GWh by that time. But China is still set to dominate the space, with 5,153 GWh of capacity.

As discussed in the just released Oil Fall series update, Electric Candyland, the biggest risk to the continued scaling of EV adoption this decade is sufficient battery capacity. The world will have placed nearly 11 million new EV on the road this year, and is on course to double sales to 22 million in 2025. But whether sufficient capacity will exist beyond 2025 is unclear. Each section of Oil Fall contains a What Could Go Wrong chapter, and there’s a valid question as to whether the next doubling won’t be supply constrained. Although the west is clearly undertaking an aggressive buildout strategy, do take notice of the asymmetry as China, in the Cowen analysis, is expected to have greater capacity by 2031 than the US and the EU combined.

The Oil Fall update is now released and offers up three conclusions about our current position in energy transition. First, global oil consumption has now peaked—but any decline is not imminent. Second, there is no going back to the days of oil supply surpluses and ultra low prices, as global oil producers now understand—on a rather deep level—that the end of demand growth means development of the marginal barrel must be far more tethered to actual demand than at any point in history. And finally, if you are still wondering whether a revival is possible for the internal combustion engine in transportation you can stop now: global ICE sales peaked almost six years ago, and the EV drivetrain owns all the growth from this point forward. Yes, all of it.

This year, the Oil Fall series is being sold through Dropbox Shop, a new offering from Dropbox. Payments are easy: credit card, email address, and then an email confirmation request (to make sure you’ve entered the email correctly) gets you to the download. The Oil Fall package contains four PDFs: two full sized, and two compressed versions to fit requirements of e-readers.

All paid subscribers to The Gregor Letter receive free and full access to the updated Oil Fall through a link in The Welcome Letter, that arrives with each new subscription.

You are reading a free post from The Gregor Letter. There are very few of these, throughout the year. Why not become a subscriber? All paid subscribers get a free copy of the Oil Fall update package, and subscription rates are a very reasonable $75 per year, or $7.50 per month. Go on, buy a ticket to the show.

The first big wave of energy transition is now completing, and therefore the focus of The Gregor Letter needs to slightly shift. We are emerging from a decade in which the growth rate and the adoption of wind, solar, EV, and batteries carried meaningful uncertainty. Would combined wind and solar reach 10% of global electricity supply? Would EV be affordable enough to be widely adopted? Would global oil demand finally peak? Could new electricity from clean sources be created more quickly and cheaply than the cost and time to develop the marginal barrel of oil? Would storage, at the domestic and commercial level, develop concurrently alongside grid level storage? Would solar come to be the fastest, cheapest new way to create power, on the planet?

For the past several years, The Gregor Letter has charted the progress of these questions. Now, it’s time to ease back. There is no longer any mystery to unlock about the growth of wind and solar, or the adoption of EV. The ICE platform is done, over. The world will sell fewer and fewer ICE in the years ahead, as ICE steadily decline from their 2017 peak. There is no need to closely track global oil consumption either. Per the Oil Fall outlook, global oil consumption has entered a lengthy plateau, not unlike global coal consumption since 2014. There isn’t going to be a cheaper energy source that will dislodge wind and solar. And storage capacity is going to grow strongly, while falling in price. The decarbonization of global powergrids is a lock. And global transportation is going to be the beneficiary of cheap, clean electricity coming online in massive volumes. Texas, California, the UK, and Europe are all heading towards grids that are 30% composed of some combination of wind and solar.

The big questions now point towards hard to abate sectors like steelmaking, aviation, heating in buildings, and the broader need for high heat in a number of industrial processes. Going forward, it will be less compelling to offer up charts of wind+solar progress in Europe, or in states like Texas or Colorado: we already have the answers. Instead, The Gregor Letter needs to focus more on technological advances; policies that take action against legacy petrol consumption (like cars, in cities); and zero-to-one stories, like adoption of new energy technology in developing nations.

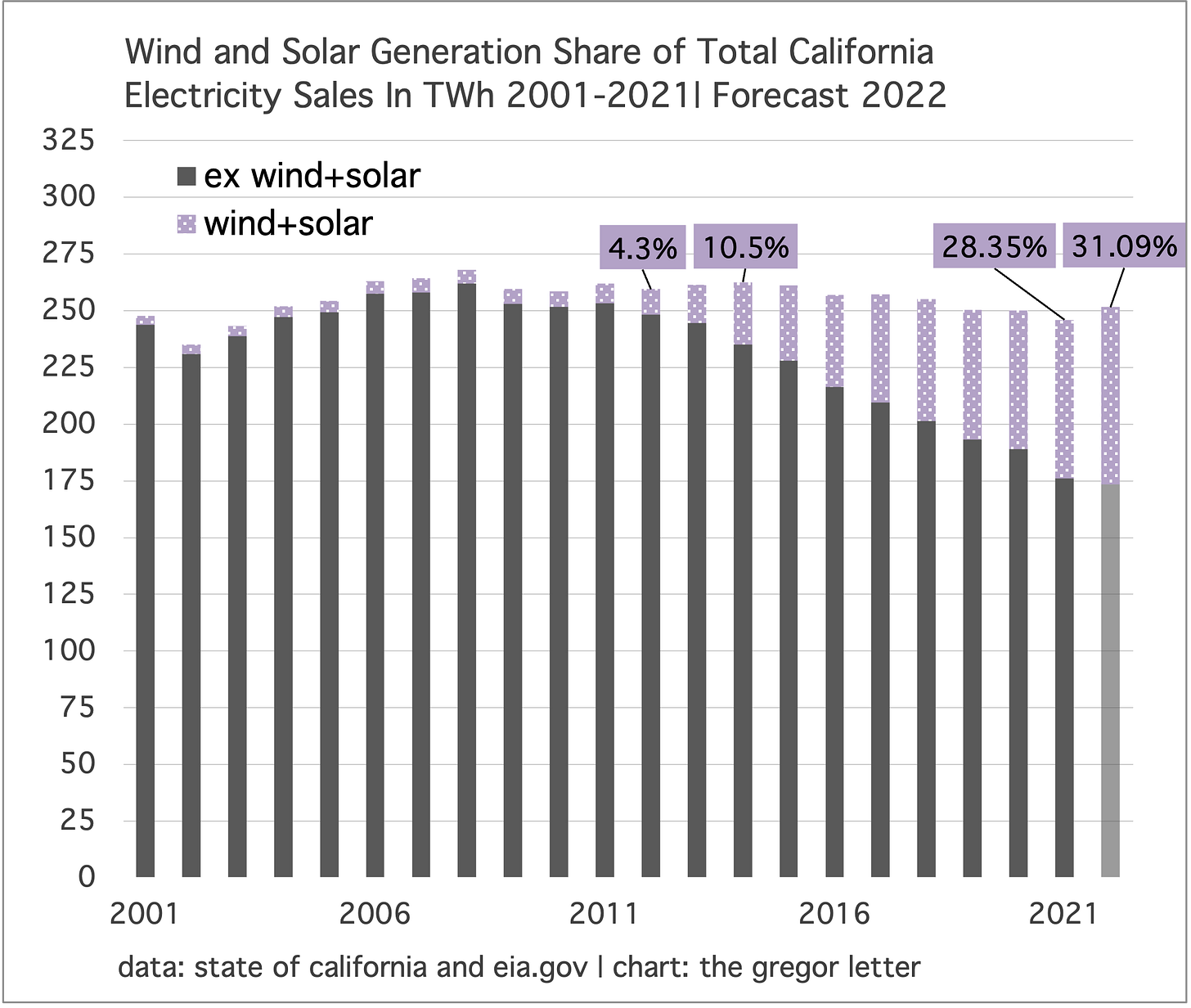

Here’s an example of the kind of chart The Gregor Letter no longer needs to run as frequently: wind and solar share in California, which is now inching above 30%. Relatedly, the Oil Fall series, both in the original 2018 title and now in the 2023 update, addresses not only wind and solar growth in the Golden State but the quantitative effect this has on systemic measures of EV efficiency. Simply put: an EV driving in San Diego is notably more efficient than one driving in Atlanta. And the reason is simple: the amount of combustion (and it’s enormous losses through waste heat) that California is removing from the system.

As EV are now scaling up globally, the following chart—showing that California, like China and Europe, is creating gobs of new power from wind and solar to fuel electric vehicles—is far more relevant. California can develop new electricity from wind and solar quickly, more than overwhelming any new demand for electricity from EV.

Texas and California blackouts in recent years were everywhere and at all times caused by weather extremes, as temperature volatility pushed energy systems outside of historical capability. There is no shortage of electricity in either the Golden State or the Lone Star state. Neither were high penetration levels of wind and solar to blame. It’s nothing more than a uninformed hunch that the variability of renewables played a role: that is the stuff of AM talk radio hokum. As climate kicks regional weather out of long term averages, unleashing either spikes in demand (California air conditioning) or systemic failures (Texas natural gas networks, freezing), one solution would be to overbuild power grids for future spikes, which will no doubt be longer in duration and more severe. But overbuilding requires investment and the US runs a free market energy system, not a state or federal energy system. Who is going to take on the commercial risk of overbuilding power capacity?

Americans love the idea of a free market in energy, until, say, petrol prices spike and then it seems Americans want a system more like Saudi Arabia—where petrol prices are subsidized by the state. The same holds true for power systems. If you don’t like how the free market handles blackouts and brownouts, then perhaps you should vote for the federal government’s ability to overbuild redundant, back-up power generation in states like Texas and California. Because it’s not the type of energy source that’s the issue here. Rather, it’s how your system is designed. The Texas energy crisis of 2021 wasn’t the result of an intrinsic flaw with natural gas. No. The failure of the natural gas pipeline and delivery system to be properly designed for extreme weather was the cause. Do you want the free-market to fix that? Because the free-market, actually, doesn’t want to fix that.

Nuclear power has long faced a social hurdle, one that translates into extreme cost overruns and thus poor economics. But small modular reactors (SMR) could potentially solve some of those problems, mainly through standardization and faster deployment timelines. Now comes Ontario Power Generation with a plan to utilize the GE-Hitachi BWRX-300, targeting completion before the end of the decade. Yes, that’s still a slow walk to deployment. But it beats the painful and costly 12-16 year timeframes seen in other western nuclear projects.

Just to remind, The Gregor Letter remains an advocate of building some new nuclear. The main reason: to better leverage and maximize the fast buildout already taking place in wind and solar. In this framing, nuclear would play a supportive but subordinate role, ceding the leadership position to wind, solar, and storage. What’s not true: that the only way to decarbonize the world is with nuclear, and, with nuclear as a spearhead. Those who assert such things often say “it’s just math.” Nope. The math, in fact, doesn’t get you there. What is true: without nuclear, powergrid growth of wind, solar, and storage is going to be shared with natural gas. And a further dependency on natural gas, already growing globally, will embed itself even further. Global generation of nuclear power has not grown in 20 years, having flatlined through that entire period as new capacity is neutralized through retirements. That’s a ton of potential clean electricity the world has left on the table. Let’s stop doing that. Let’s build some new nuclear.

Technology that could produce high heat without relying on metallurgical coal would represent a major breakthrough in an otherwise tough area for decarbonization. Coolbrook, a Finland based start-up, is experimenting with the use of electricity to not just spin a turbine, but to do so by combining acceleration/deceleration as a method to produce kinetic heat. If successful, the critically high temperatures not normally achievable with electricity could be unleashed without coal. And that means primary energy inputs to creating such heat could be derived from clean sources: everything from hydropower to nuclear, and wind and solar. From the Financial Times:

In essence, Coolbrook’s technology reverses conventional turbine theory. For more than a century, coal and other fossil fuels have been burnt to create the heat and kinetic power used to turn turbine-driven generators and power electricity grids. But the start-up’s rotodynamic heaters and reactors turn that process on its head. They use electricity to rotate turbines, which, by forcing a rapid acceleration and deceleration of air or other gases, create violent levels of kinetic energy. This energy can supply the extreme temperatures required by many heavy industrial processes, which cannot normally be achieved by conventional electrification through resistive heaters, because these struggle to exceed a threshold of 500C.

One of the constraints that gets missed in all the enthusiasm over hydrogen— targeted as metallurgical coal and natural gas replacement—is that hydrogen production and distribution remain a challenge. While the prospects for making hydrogen with clean sources through electrolysis are promising, hydrogen is entirely lacking in any kind of global or even regional distribution network. This means that early iterations of hydrogen utilization will require that production and consumption are co-located. And these first steps will need to concentrate on big, heavy users because the investment cost in electrolysis is steep. Such hurdles are likely to be overcome at the small scale. But broad and wide utilization of hydrogen is not so promising, in the near term.

How fast is energy transition taking place, and will it matter? I was delighted to have a chance to answer these and other questions recently as a guest on The Compound and Friends podcast, with hosts Josh Brown and Michael Batnick. On a very sincere level, Josh Brown during the interview voiced what is perhaps the most common uncertainty people have about the trillions being spent to build clean energy: will it make a dent in emissions, enough to stave off the worst effects of rising temperatures and seal level rise. The simple answer is that the world is doing extremely well, advancing quickly even, in deploying new clean energy technology. And we’ve made enough progress so that energy consumption of fossil fuels has really slowed down, and flattened even, compared with the growth of renewables. The problem is that we have an inventory of emissions that started with the industrial revolution, about which we can do very little. The past, is the past. And equally, we are not currently on a trajectory to sufficiently force the consumption of fossil fuels into outright decline, at least not by 2030, to hit commonly agreed upon targets.

In thinking about our relative position in the overall effort to kill combustion, I was reminded of this graphic that comes from the artificial intelligence community. Notice how on the intelligence timeline, our local world makes sense and the gaps between a chimp and Albert Einstein make sense—that is, until AI shows up and entirely changes our understanding of what’s possible. Indeed, in the face of AI, each human, whether high IQ or low IQ, is just another mammal:

We can make an analogous graph comparing our current rate of progress in global decarbonization, to where we need to be. This is not quantified, but indicative:

Now let’s get more quantified. In the chart below, growth of energy consumption outside of wind, solar, hydro, and nuclear has not made any progress since 2018. Before you can force fossil fuel combustion into decline, you must first stop its growth. The flattening since 2018 is neither anomalous, nor surprising. Marginal growth in global energy consumption has indeed been swinging, finally, towards clean sources. It took about a decade of heavy lifting, but here we are.

The bottom line is that we are going far faster than the skeptics believed was possible, or, that the clueless can even appreciate. And it’s still not enough. But the sober truth of our situation is not a reason to give up. Momentum too has arrived. And while it probably won’t be quite enough for the world to hit its 2030 targets, all efforts made right now to go even faster will show up as rewards between 2030 and 2040.

The Compound and Friends: YouTube version, and the Apple audio/podcast version. The podcast is available at most podcast platforms, from Spotify to Google.

—Gregor Macdonald

Correction: The legend in the following chart was mistakenly reversed, and has now been corrected—Annual Growth of Electricity in California from Wind and Solar vs Annual New Demand from On-Road EV in TWh.

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the 2018 single title is newly packaged and now arrives with a final installment: the 2023 update, Electric Candyland. Just hit the picture below to be taken to Dropbox Shop.