Transition Stories

Monday 27 July 2020

Slow growth can sometimes accelerate the share gains of clean energy, and no better example is shaping up right now than in the US electricity system. The pandemic-induced economic slowdown arrives at a time when coal has entered its collapse phase, and a broader slump in energy demand now accentuating coal’s misfortune. Through the first five month of 2020, combined wind+solar generated an astonishing 195.466 TWh of power in the US, while coal generated 258.891 TWh. If such a trend were sustained, coal would lose its position to combined wind+solar far more quickly than even recent projections anticipate. Indeed, at this year’s rate of coal decline and wind+solar growth, the crossover would occur as early as next year.

The surprising data also informs us that total year-over-year power demand has fallen 4.8% compared to the same five month period last year. While many workers now operate from home—unsurprisingly lifting demand within the household sector—it’s not enough of a shift to compensate for the major decline in the industrial sector. And coal, which is now increasingly inefficient compared to new natural gas, and wind+solar, is the singular loser in the year-over-year comparison—with the exception of hydro, which also slumped. For a side-by-side look at the two strongest growers in US electricity, power generated by natural gas grew by 7.9%, and combined wind+solar grew by 14.3% in the same period.

Fast economic growth can oftentimes mask inefficient players, as capacity is called upon urgently to meet demand. But slow growth can have the opposite effect, highlighting poor performers. And there’s no worse performer than coal for generating not only electricity, but economic returns. My own coverage of this supertrend last year showed a domino effect beginning to take place, as the future expected losses from continuing to run existing coal plants was motivating US utilities to accelerate coal retirements.

While we can’t rely on slow growth to always give a leg up to clean energy, to the extent new energy technologies are better, faster, and cheaper, we can indeed forecast that slow growth will amplify their advantage. A plausible outcome now emerging in the US, for example, is that combined wind and solar now head towards 520 TWh of generation next year as coal slumps further—falling less aggressively than this year—but roughly towards the same level, around 520 TWh. Accordingly the crossover, which seemed very far away just two years ago is now likely to arrive as early as 2022. Indeed, the latest 12 month look-ahead capacity map, also from the EIA in the recent data release, reveals the extent to which wind+solar are now dominating marginal growth in the US system.

Global warming has shifted the climate classification of New York City, which will now be placed within the humid subtropical climate zone. That’s according to new findings from the National Climate Assessment. In a summary piece published this week in The New York Times (Sultry Nights and Magnolia Trees: New York is Now Subtropical), the city has long met the requirement that summers average above 72F. What’s changed are the winters. New York, for the past five years, has seen winter months average above 27F, with recent averages heading even higher.

Energy crises tend to spur innovation, as they typically arise when the dominant energy source becomes broadly unaffordable. My own view, for what it’s worth, is that the oil shock which took place between 2005 and 2008 was very much the catalyst that kicked off our current energy transition, as the price of oil and other fossil fuels took energy expenditures, both on the individual level and as a portion of GDP, well past economically sustainable thresholds. Those pain points were quickly followed by a massive global recession, fusing the ugly experience to our collective memory.

While energy transitions are complicated and messy affairs, they pick up momentum at the inflection point when the legacy energy source is shown to be less competitive just as new sources finally gain a foothold within the infrastructure landscape. You might enjoy, therefore, this concise summary of pre-industrial Britain’s over-dependency on wood from Davis Kedrosky in the Berkeley Economic Review. Indeed, Britain’s painful transition to coal—a far more powerful energy source with at least two times the energy density of wood—is a seminal lesson in energy history. While coal was of course always available in the pre-industrial era, the infrastructure landscape was not set up to utilize it, or exploit it. Unsurprisingly, therefore, wood had to reach a pain point not only in price, but as a scarcity-crises and a broader environmental threat to Britain’s forests, to finally open up a pathway for coal.

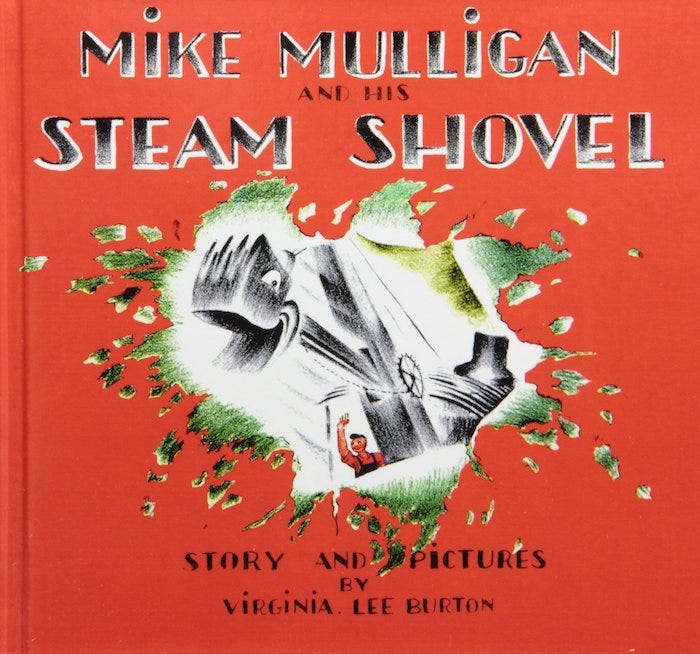

The early days of oil in the 20th century are not dissimilar. Coal, long the dominant energy source during the 19th century, ran into trouble during the Great Depression. Oil, plentiful and cheap, finally found its vehicle through the internal combustion engine. And oil more broadly began to displace coal as the industrial fuel of choice. While lighthearted, I continue to point to the 1939 children’s book Mike Mulligan and His Steam Shovel as one of the best portraits of that particular energy transition.

Legacy coal and nuclear power have become so transparently uneconomic that an absurd, fraud-driven piece of legislation was required to “save” them last year, in the state of Ohio. Unlike neighboring Indiana and many other states where coal retirements are increasing and utilities have successfully proposed to change-up their portfolios in favor of wind+solar+storage, the Republican-controlled state legislature in Ohio tried to halt progress last year with a crazy-expensive bill to bail out First Energy. One problem. The legislation, known as House Bill 6, required a criminal conspiracy to pass. Last week, the FBI raided the home of Ohio’s Speaker of the House, amidst a slew of other arrests in the scheme. Ohio’s Governor, Mike DeWine, who signed the bill into law last year, has now signaled he supports its repeal.

The latest blockbuster procurement for utility scale solar was announced just Sunday, the 26th of July, in the United Arab Emirates. The Emirates Water and Electricity Company (EWEC) will build a 2GW solar plant with partners EDF and JinkoPower. The headline news item however has to be the price: 1.35 USD cents per kWh. Better, faster, and cheaper just got… even cheaper.

Global electricity demand is rising faster than population. The observation further confirms we have entered a new era, one that calls less upon liquid fossil fuels for growth. The trend will only intensify as global transportation migrates at a faster rate towards battery-powered platforms. If the 20th century was marked by each new unit of global GDP largely backed by oil, the 21st century will see growth driven by the powergrid. EIA Washington has the blog post.

An electrified world is of course the supertrend EV makers are now chasing. I had a chance to further explain my views on Tesla (from the last newsletter) with Greg Lindsay on the CoMotion podcast. You can listen for free at Soundcloud.

Work-From-Home could have a major impact on transportation demand and commercial real estate, even if the practice only survives at the margin of the labor market. Christopher Mims has one part of the story at the Wall Street Journal (probably behind a paywall, unfortunately) indicating that millions of Americans never want to go back to the office, and, many of their employers “say that’s fine.” One wonders that the modern workplace largely developed as an artifact of the factory, and without realizing it, commuting to a distant office only to sit down in front of a computer has now become redundant. Meanwhile, the New York Times has a great piece on the new stagnation taking place in Manhattan’s Midtown—a district largely dependent on commuters. The pandemic appears to have drawn back the curtain on a number of practices that seemed vital, but were only vestigial.

The Gregor Letter base case for economic recovery remains unchanged, because the bounce-back in the US economy has now stalled out, extending the real recovery to a further point in time. Schools will not reopen normally this Fall, furloughed workers will become permanently separated from their employers, consensus SP500 earnings for 2021 are not going to come true, and the bond market continues to strongly signal that deflation is now the dominant risk. Without the US as an engine of growth, the global economy is going to stumble further. And, to make matters worse, the next aid package is bogged down in Congress due entirely to Republican dithering. | see: the latest update on consumer spending from Opportunity Insights.

Just to remind: previous letters have laid out in some detail all the good things which will eventually unfold for the US, and the better policy to come, once the country is back under adult supervision. That particular outcome is looking quite inevitable now, as Trump collapses even further in the polls. But let’s be sober. The hole in the economy is not being repaired. While worker’s payment checks—what might be called maintenance money—are preventing the onset of a liquidation phase in asset prices, the duration of the pandemic’s grip and the way it steadily erodes economic relationships will become its own problem. If one was looking for upside risk to The Gregor Letter base case, you might argue that cultural sentiment will change so quickly next year— after a new President is sworn in—that a broad recovery may take hold much faster than expected. I hope that happens. But what we’ve learned from previous crises and recessions is that a strong deflationary undertow can persist, even after “recovery” starts to gain traction.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

Photos: 1. Looking North from the 1st Street Bridge to the Santa Monica and San Gabriel Mountains, Los Angeles, June 2018, Gregor Macdonald.

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.