Clean Energy Cascade

Monday 23 September 2019

Daimler intends to shift the bulk of its research and development away from the internal combustion engine, to concentrate on electric vehicles. The announcement came through remarks from Daimler’s head of research in a German auto magazine interview, and was originally mis-reported here in the US as a decision to entirely cease production of ICE. Not exactly. Daimler will continue to produce ICE and offer support, but will no longer fund or explore nextgen iterations of that technology. The strategic shift confirms the tricky timing and operational demands of maintaining a foothold in the existing platform, while ensuring full participation in the only area of growth now available to automakers: the EV drivetrain.

(breakdown of a Mercedes AMG C-63 ICE engine, via Daimler)

Portland, Oregon based utility PacifiCorp is currently studying various plans that could put as many as 17 coal plants, with more than 3,200 MW of capacity, on an accelerated retirement schedule as the economic attractiveness of wind, solar, and storage becomes too persuasive to ignore. The modeling and planning work was reported earlier this month by Benjamin Storrow of E+E News, and is being undertaken before an official announcement on October 18, 2019. Should PacifiCorp choose to replace existing capacity with renewables it will follow other utilities—like NIPSCO of Indiana—in concluding that clean generation is now so cheap it can actually pay for the associated losses of existing-capacity closure, while still delivering all-in savings to customers. Needless to say, this is an existential moment for all remaining coal plants everywhere and not just the United States.

(PacifiCorp’s Jim Bridger coal plant in Point of Rocks, Wyoming)

The PacifiCorp news raises the risk of a cascade effect coming into view, as wind+solar+storage break free from the subsidy regimes of the past decade, and force asset owners to face up to the potential cost-savings of these new technologies. If so, classical corporate decision-making is about to align more regularly with climate goals. Put another way, if you were hoping for the S curve of adoption to start accelerating, your wish may be about to come true.

Note: I recently covered PacifiCorp’s other infrastructure closure project, as it looks to cut itself free of aging dams along the Klamath River. See the story, Take Down That Dam, at the Atlantic’s Route Fifty.

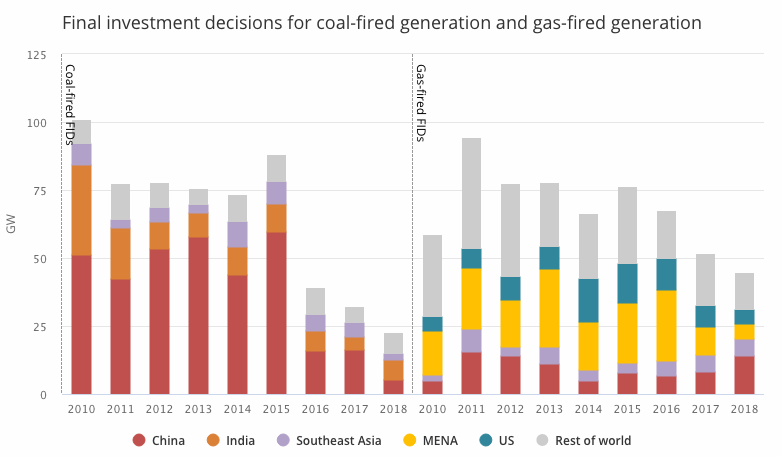

Final investment decisions for new coal and natural gas are declining globally. That’s the finding of the IEA in Paris, showing that plans for new thermal power are dropping rapidly not just in the OECD, but in the domains that really count: China and India.

In my coverage of global coal for Petroleum Economist earlier this summer, I made a special point to highlight the analysis of Tim Buckley of IEEFA in Sydney, Australia. Buckley’s research showed that financing has been steadily drying up for new coal projects in India, because funding sources now understand that new coalbuild is fated to lose money shortly after deployment. In effect, why bother?

The Rocky Mountain Institute released a report showing the brutal economics now bearing down on global coal will soon arrive for natural gas. In a webinar that followed the report, the research team additionally made the point that unit costs of various energy sources now, like natural gas, are no longer as important in determining lifecycle returns on various forms of powergen. Why? Because it’s the infrastructure, operational expenditures, and transportation of those fossil fuel inputs that are now determinative of fossil-gen’s viability. Just to remind: the reason wind and solar are now the cheapest forms of electricity on the planet is that they are little more than energy-capturing devices, paying nothing for energy inputs.

The EIA showed that as even as US coal deliveries have fallen, transportation costs have remained mostly stable. US coal shipments to the US power sector are down roughly 40% in the past decade, but this has done nothing to lower transportation costs, or operational and maintenance costs. Whether sourcing domestic coal for US consumption, or global coal for transport and importation to heavy users, supply chain costs remain high. The price of coal no longer matters much. It’s the coal system itself that’s become structurally uncompetitive.

Getting out in front of internal pressure from employees, Amazon announced last week a fresh round of climate initiatives. While the broad aspirational goals like zero-emissions by 2040 can be discounted, (usually recommended in these types of announcements) the actions Amazon will take in the short term are important. In particular, the decision to procure 100,000 electric delivery vans from Michigan based Rivian is a signal that the same kind of analysis now persuading utilities to ditch coal and adopt wind and solar is going to push corporate fleets towards EV.

Credit where credit is due: Colin McKerracher of BNEF in London has long held the view that commercial EV adoption could unfold very rapidly—more rapidly than passenger vehicles—first with buses and then delivery vehicles and other business fleets. While individual consumers will surely power the fat part of the S curve, it makes sense that corporations and especially governments, which can often act less pro-cyclically and make bulk purchases, will play a role in putting the big EV adoption numbers on the board. As I mentioned also in the last letter, consumer purchases of EV have finally started to weaken in all key markets as the car market recession drags on, and economies slump.

Disclosure: I was asked by an Amazon employee, key to the ongoing in-house effort to pressure the company, for my ideas on this matter and I offered up a fairly standard set of solutions, some of which Amazon adopted but, and this is important, undoubtedly by coincidence. (Amazon’s not listening to me, not yet at least). I felt strongly that Amazon should get itself a fleet of EV vans, for example. Ok, check. And I also thought the company should post its best estimate of its own carbon footprint and energy consumption. Also, check. Indeed, Amazon’s decision to start an energy expenditure page is a crucial step. By doing so, the company has laid down a marker, against which efforts can be measured.

More broadly, I think there are even richer possibilities to exploit given Amazon’s reach and customer base, and it’s easy to envision Amazon as portal to select clean energy programs in home electricity. Also, now that a clean energy cascade is taking place in power generation, I speculate that Amazon could also get into transition financing.

Coda: Google also announced last week a further procurement of clean energy powergen. While fairly major in scope, it’s also my view that large tech companies covering their own energy use with cleangen has become routine. It’s all good, but, it doesn’t leverage reach. My final recommendation to the good folks at Amazon for example was to build energy storage, lots of energy storage, and to get in the game of energy storage.

In the domains where EV adoption is occurring at the fastest rates—China, California, the EU—the deployment of clean electricity is far outpacing the marginal demand from new on-road EV. I’m placing this snapshot here of the ExxonMobil CEO revealing either bad faith or unfamiliarity with power sector math, because the greatest threat to oil’s monopoly, the internal combustion engine, is of course now coming from electricity. As Oil Fall lays out in detail, while you wouldn’t choose to take all the cars off oil and put them on coal-fired electricity, doing so would still be more efficient because centralizing heat loss in a power plant is better than decentralizing heat loss in millions of separate engines. But this is moot. Global coal consumption peaked in 2013, is in heavy decline in many domains, and the EV uptake is being entirely met at the margin through new generation from wind and solar. One example: China put 1.26 million new EV on the road last year. Very, very generously, this represents 4.41 TWh of new electricity demand. But how much new electricity did China create last year, from wind and solar alone? 130.7 TWh.

For the sake of ExxonMobil shareholders, I do hope the CEO learns some power sector math.

—Gregor Macdonald, editor of The Gregor Letter, and Gregor.us

The Gregor Letter is a companion to TerraJoule Publishing, whose current release is Oil Fall. If you've not had a chance to read the Oil Fall series, the single title just published in December and you are strongly encouraged to read it. Just hit the picture below.